Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

Associated Articles: Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

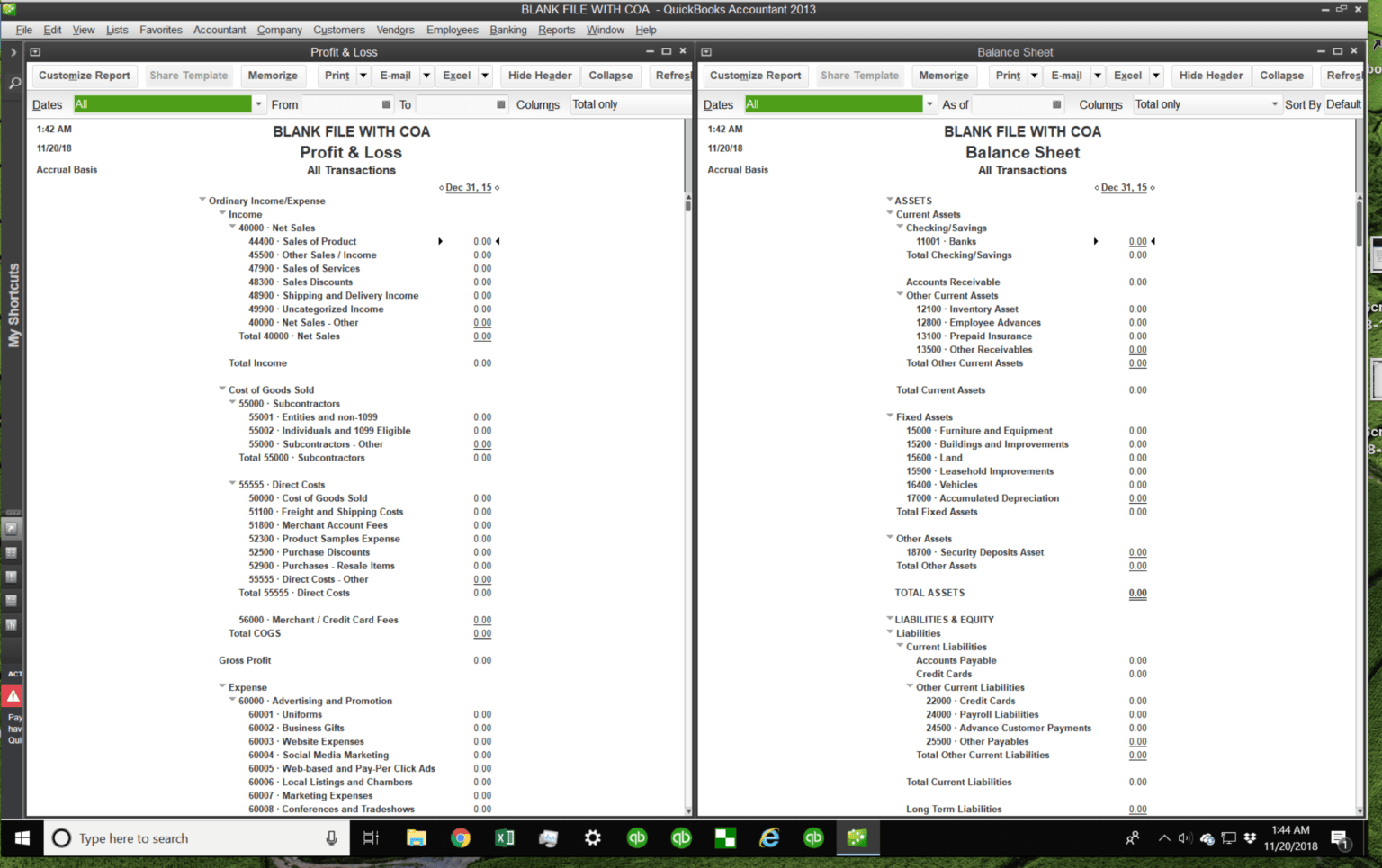

QuickBooks, a number one accounting software program, depends closely on its Chart of Accounts (COA) to prepare and handle monetary information. The COA acts because the spine of your monetary record-keeping, classifying each transaction and offering a structured overview of your corporation’s monetary well being. Whereas QuickBooks provides a default COA, tailoring it with an appropriate template is essential for optimum effectivity and correct reporting. This text will discover the significance of a well-structured Chart of Accounts, delve into the various kinds of QuickBooks COA templates, and information you thru the method of choosing and implementing the most effective one to your particular enterprise wants.

Understanding the Significance of a Effectively-Structured Chart of Accounts

Your Chart of Accounts is greater than only a record of accounts; it is a meticulously organized system that categorizes each monetary transaction your corporation undertakes. A well-structured COA provides quite a few advantages:

-

Correct Monetary Reporting: A correctly designed COA ensures that each one transactions are categorized appropriately, resulting in correct monetary statements (revenue assertion, stability sheet, money move assertion). This accuracy is important for making knowledgeable enterprise selections.

-

Improved Monetary Evaluation: An in depth COA facilitates in-depth monetary evaluation. By categorizing transactions into particular accounts, you may simply monitor profitability, establish value facilities, and analyze traits over time.

-

Streamlined Bookkeeping: A logical COA simplifies the bookkeeping course of. With a transparent construction, transactions are simply assigned to the right accounts, minimizing errors and saving time.

-

Higher Tax Preparation: A well-organized COA makes tax preparation considerably simpler. It permits for environment friendly categorization of deductible bills and simplifies the method of producing tax studies.

-

Enhanced Budgeting and Forecasting: An in depth COA is important for creating correct budgets and monetary forecasts. By monitoring bills and revenues in particular classes, you may higher predict future monetary efficiency.

-

Improved Collaboration: A standardized COA facilitates collaboration amongst totally different departments and stakeholders. Everybody makes use of the identical system, guaranteeing consistency and understanding of monetary information.

Varieties of QuickBooks Chart of Accounts Templates

QuickBooks provides a fundamental default Chart of Accounts, however this is probably not ample for all companies. The complexity of your COA ought to replicate the scale and nature of your corporation. A number of templates could be tailored or created:

-

Service-Primarily based Enterprise Template: This template is right for companies that primarily present companies, akin to consulting, freelance work, or skilled companies. It emphasizes revenue accounts associated to service charges and expense accounts associated to working prices like advertising, journey, {and professional} charges.

-

Retail Enterprise Template: Fitted to companies that promote items, this template consists of accounts for stock, value of products bought (COGS), gross sales income, and accounts receivable. It additionally incorporates accounts for managing returns and allowances.

-

Manufacturing Enterprise Template: This template is tailor-made for companies concerned in manufacturing processes. It consists of accounts for uncooked supplies, work-in-progress (WIP), completed items, and manufacturing overhead. It is extra complicated than different templates because of the intricate nature of producing accounting.

-

Non-profit Group Template: This template caters to the particular wants of non-profit organizations. It consists of accounts for grants, donations, fundraising occasions, and program bills. It additionally incorporates accounts for monitoring restricted funds and complying with non-profit accounting requirements.

-

Actual Property Template: This template is designed for companies concerned in actual property transactions. It consists of accounts for property administration, rental revenue, mortgage funds, property taxes, and capital enhancements.

-

Customized Template: For companies with distinctive necessities, a customized template is the best choice. This enables for tailoring the COA to particular wants, guaranteeing that each one accounts are related and precisely replicate the enterprise’s operations. Making a customized template requires an intensive understanding of your corporation’s monetary actions and accounting rules.

Selecting the Proper QuickBooks Chart of Accounts Template

Deciding on the correct COA template is essential for the graceful operation of your corporation. Contemplate these components when making your selection:

-

Trade: Your trade considerably influences the construction of your COA. A service-based enterprise could have a distinct COA than a producing enterprise.

-

Enterprise Dimension: Bigger companies usually require extra detailed COAs than smaller companies. As your corporation grows, you would possibly have to broaden your COA to accommodate new accounts.

-

Accounting Methodology: The accounting methodology you employ (money or accrual) will even affect your COA. Accrual accounting requires extra complicated accounts to trace accounts receivable and accounts payable.

-

Reporting Necessities: Contemplate the forms of studies it is advisable to generate. Your COA needs to be structured to facilitate the era of those studies effectively.

-

Future Development: Select a template that may accommodate future progress and enlargement. A versatile COA can adapt to adjustments in your corporation operations.

Implementing and Sustaining Your QuickBooks Chart of Accounts

As soon as you have chosen a template, the implementation course of entails:

-

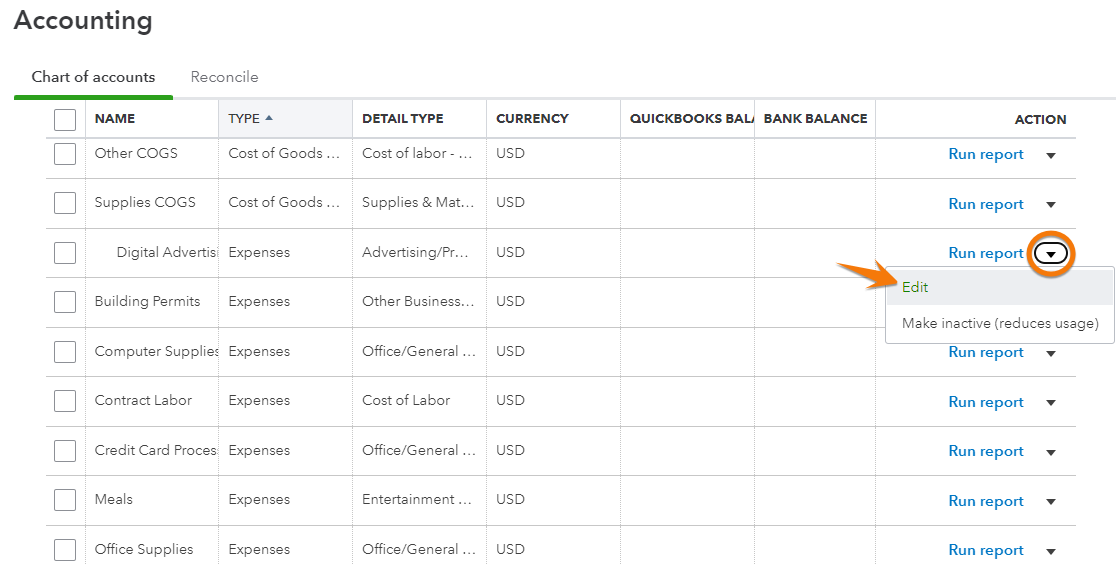

Import or Create the Template: QuickBooks permits importing COA templates or creating them manually. Guarantee accuracy when getting into account names and numbers.

-

Assessment and Customise: After importing or creating the template, evaluation it totally to make sure it aligns with your corporation’s particular wants. Make vital customizations and additions.

-

Coaching: Prepare your workers on utilizing the brand new COA to make sure constant and correct information entry.

-

Common Assessment and Updates: Periodically evaluation your COA to make sure it stays related and correct. Make changes as your corporation grows and evolves.

Widespread Errors to Keep away from When Utilizing QuickBooks Chart of Accounts Templates

-

Utilizing the Default Template With out Customization: The default template won’t be appropriate to your particular enterprise wants. All the time customise it to replicate your operations precisely.

-

Inconsistent Account Naming: Utilizing inconsistent account names can result in confusion and errors in reporting. Preserve a standardized naming conference.

-

Lack of Account Element: Utilizing overly broad account classes can hinder detailed monetary evaluation. Break down accounts into extra particular sub-accounts as wanted.

-

Ignoring Chart of Accounts Updates: As your corporation evolves, your COA must adapt. Repeatedly evaluation and replace your COA to replicate adjustments in your operations.

Conclusion:

A well-structured Chart of Accounts is prime to efficient monetary administration in QuickBooks. Selecting the best template and sustaining it diligently ensures correct reporting, streamlined bookkeeping, and knowledgeable decision-making. By rigorously contemplating your corporation’s particular wants and following the rules outlined on this article, you may leverage the facility of QuickBooks’ COA templates to optimize your monetary processes and obtain larger success. Keep in mind, a well-maintained COA is an funding within the long-term well being and prosperity of your corporation.

Closure

Thus, we hope this text has offered beneficial insights into Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates. We hope you discover this text informative and useful. See you in our subsequent article!