nasdaq vs qqq chart

Associated Articles: nasdaq vs qqq chart

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to nasdaq vs qqq chart. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Nasdaq vs. QQQ: Deciphering the Variations and Charting the Course

The Nasdaq Composite and the Invesco QQQ Belief (QQQ) are sometimes mentioned in the identical breath, main many buyers to consider they’re interchangeable. Whereas intently associated, vital variations exist between these two entities, impacting their value actions, danger profiles, and suitability for various funding methods. Understanding these distinctions is essential for making knowledgeable funding selections. This text delves into the nuances of the Nasdaq Composite and QQQ, evaluating their composition, efficiency, and charting traits to supply a complete understanding of their relationship and particular person strengths.

Understanding the Nasdaq Composite

The Nasdaq Composite is a market-capitalization-weighted index that tracks the efficiency of over 3,300 widespread equities listed on the Nasdaq Inventory Market. It is thought-about a benchmark for the expertise sector, though it consists of firms from numerous different sectors, albeit with a heavy expertise weighting. Its composition is dynamic, with firms added and eliminated based mostly on components like market capitalization and itemizing necessities. This broad illustration makes it a barometer of the general US expertise panorama and, to a lesser extent, the broader US economic system.

The Key Traits of the Nasdaq Composite:

- Broader Illustration: Encompasses a wider vary of firms than QQQ, together with smaller-cap expertise companies and firms from non-technology sectors.

- Market-Capitalization Weighted: Bigger firms exert a larger affect on the index’s general efficiency.

- Excessive Volatility: Identified for its larger volatility in comparison with broader market indices just like the S&P 500 attributable to its focus in growth-oriented expertise firms.

- Progress-Oriented Bias: Closely weighted in direction of progress shares, making it vulnerable to intervals of market corrections when investor sentiment shifts in direction of worth shares.

- Troublesome to Immediately Make investments In: Traders can not straight spend money on the Nasdaq Composite itself. They should use ETFs or mutual funds that observe the index.

Understanding the Invesco QQQ Belief (QQQ)

The Invesco QQQ Belief is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. The Nasdaq-100 is a subset of the Nasdaq Composite, consisting of the 100 largest non-financial firms listed on the Nasdaq Inventory Market. This focus on large-cap expertise giants considerably differentiates it from the broader Nasdaq Composite.

Key Traits of QQQ:

- Giant-Cap Focus: Targeting the 100 largest non-financial firms listed on the Nasdaq, primarily tech giants.

- Market-Capitalization Weighted: Much like the Nasdaq Composite, bigger firms maintain extra weight.

- Excessive Progress Potential: Publicity to a few of the world’s most revolutionary and quickly rising firms.

- Larger Volatility than S&P 500, however probably lower than Nasdaq Composite: Whereas nonetheless risky, the focus on large-cap, established firms can present a point of stability in comparison with the broader Nasdaq Composite.

- Direct Funding Automobile: Traders can straight purchase and promote shares of QQQ on exchanges.

Charting the Variations: Nasdaq Composite vs. QQQ

When evaluating charts of the Nasdaq Composite and QQQ, a number of observations turn out to be obvious:

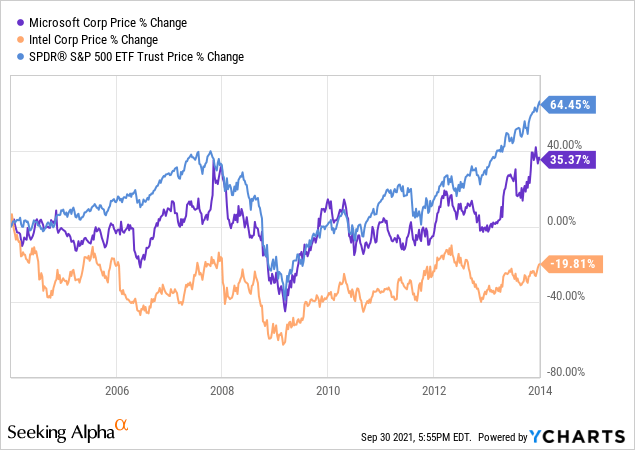

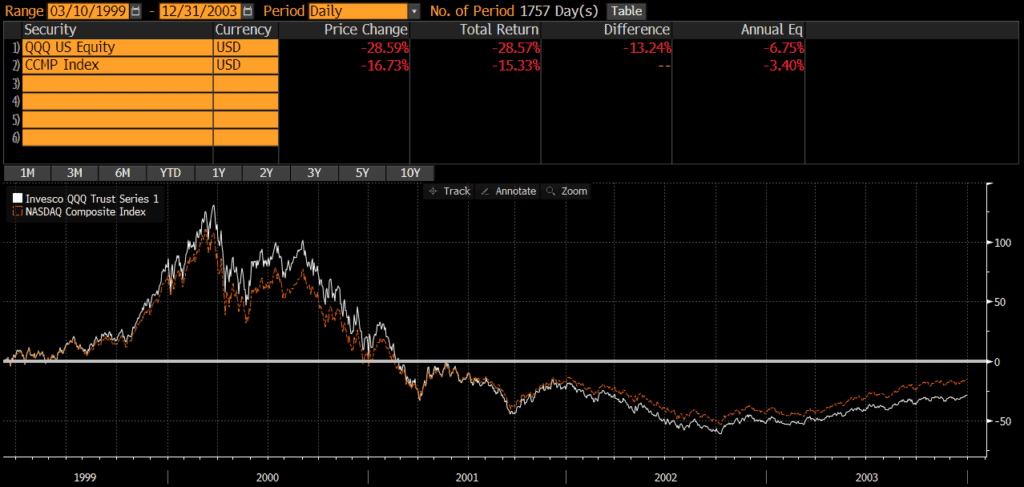

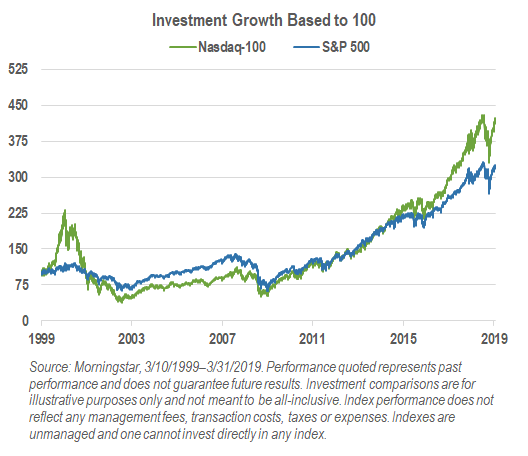

- Comparable Traits, Totally different Magnitude: Each indices typically observe comparable tendencies, reflecting the general efficiency of the expertise sector. Nevertheless, QQQ’s value actions are sometimes much less risky than the broader Nasdaq Composite, attributable to its focus on large-cap firms. Which means whereas each might transfer up or down collectively, the magnitude of the motion can differ.

- Divergence Throughout Market Corrections: Throughout market corrections or sector-specific downturns, the Nasdaq Composite might expertise a extra vital decline than QQQ. It’s because the Nasdaq Composite consists of smaller, extra risky firms which might be extra vulnerable to market sentiment shifts. QQQ, with its deal with established giants, tends to exhibit larger resilience.

- Impression of Particular person Inventory Efficiency: A major transfer in a large-cap firm inside the Nasdaq-100 could have a extra pronounced impact on QQQ’s value than on the Nasdaq Composite, the place the impression is diluted throughout a a lot bigger variety of firms. Conversely, a big transfer in a smaller firm listed on the Nasdaq could have a a lot larger impression on the Nasdaq Composite than on QQQ.

Analyzing Chart Patterns:

Whereas each charts will present comparable general tendencies, analyzing chart patterns individually is essential. Technical evaluation instruments like transferring averages, RSI, and MACD may be utilized to each charts, however the interpretations may differ barely because of the various volatility and composition. For instance, a breakout above a resistance degree on the QQQ chart may counsel a stronger bullish sign than an identical breakout on the Nasdaq Composite chart attributable to QQQ’s decrease volatility and focus on established firms.

Funding Implications:

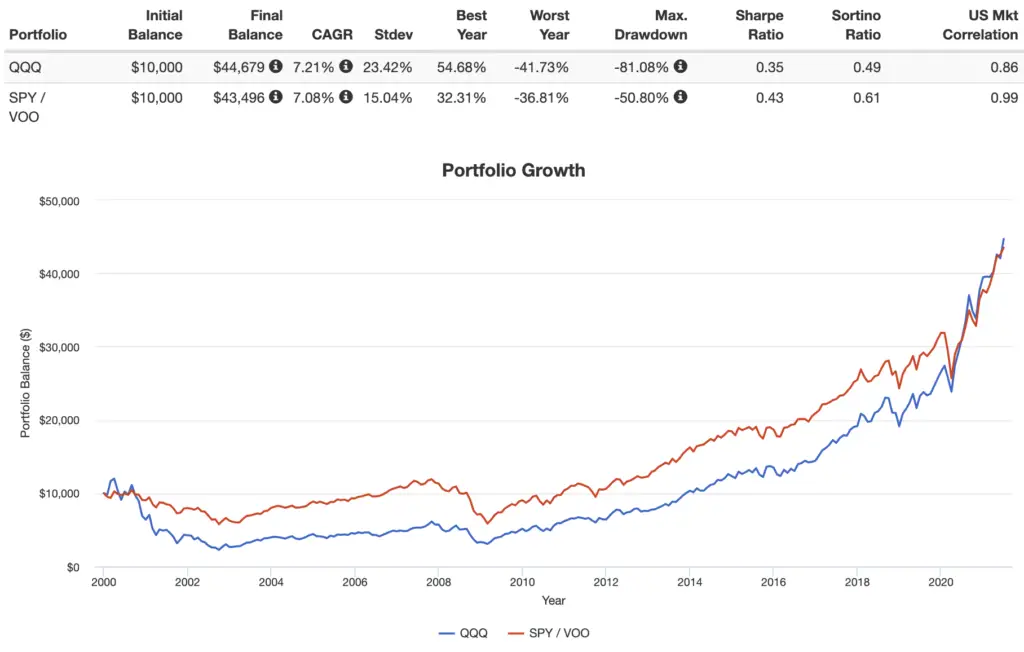

The selection between investing within the Nasdaq Composite (by way of ETFs or mutual funds) or QQQ depends upon particular person danger tolerance and funding objectives.

- QQQ for Decrease Threat, Targeted Progress: Traders in search of publicity to large-cap tech giants with a probably decrease volatility profile in comparison with the broader Nasdaq Composite may want QQQ. It gives a concentrated wager on the main expertise firms.

- Nasdaq Composite for Diversification and Potential Larger Returns (Larger Threat): Traders in search of broader diversification inside the expertise sector and probably larger returns (with larger danger) may want the Nasdaq Composite. This permits for publicity to smaller, probably higher-growth firms, but additionally entails larger volatility.

Conclusion:

The Nasdaq Composite and QQQ are usually not interchangeable. Whereas each supply publicity to the expertise sector, their composition, volatility, and funding implications differ considerably. The Nasdaq Composite supplies broader diversification inside the expertise sector and past, whereas QQQ gives concentrated publicity to the biggest non-financial firms on the Nasdaq. Traders ought to fastidiously think about their danger tolerance, funding horizon, and funding objectives when selecting between these two choices. Analyzing each charts alongside one another supplies a extra complete understanding of the expertise sector’s general efficiency and permits for a extra knowledgeable funding technique. Keep in mind that previous efficiency just isn’t indicative of future outcomes, and thorough due diligence is at all times really helpful earlier than making any funding selections. Consulting with a professional monetary advisor may help decide probably the most acceptable funding technique based mostly on particular person circumstances.

Closure

Thus, we hope this text has supplied beneficial insights into nasdaq vs qqq chart. We hope you discover this text informative and useful. See you in our subsequent article!