Navigating the Chart of Accounts: Understanding Credit score Card Transactions

Associated Articles: Navigating the Chart of Accounts: Understanding Credit score Card Transactions

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Navigating the Chart of Accounts: Understanding Credit score Card Transactions. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Navigating the Chart of Accounts: Understanding Credit score Card Transactions

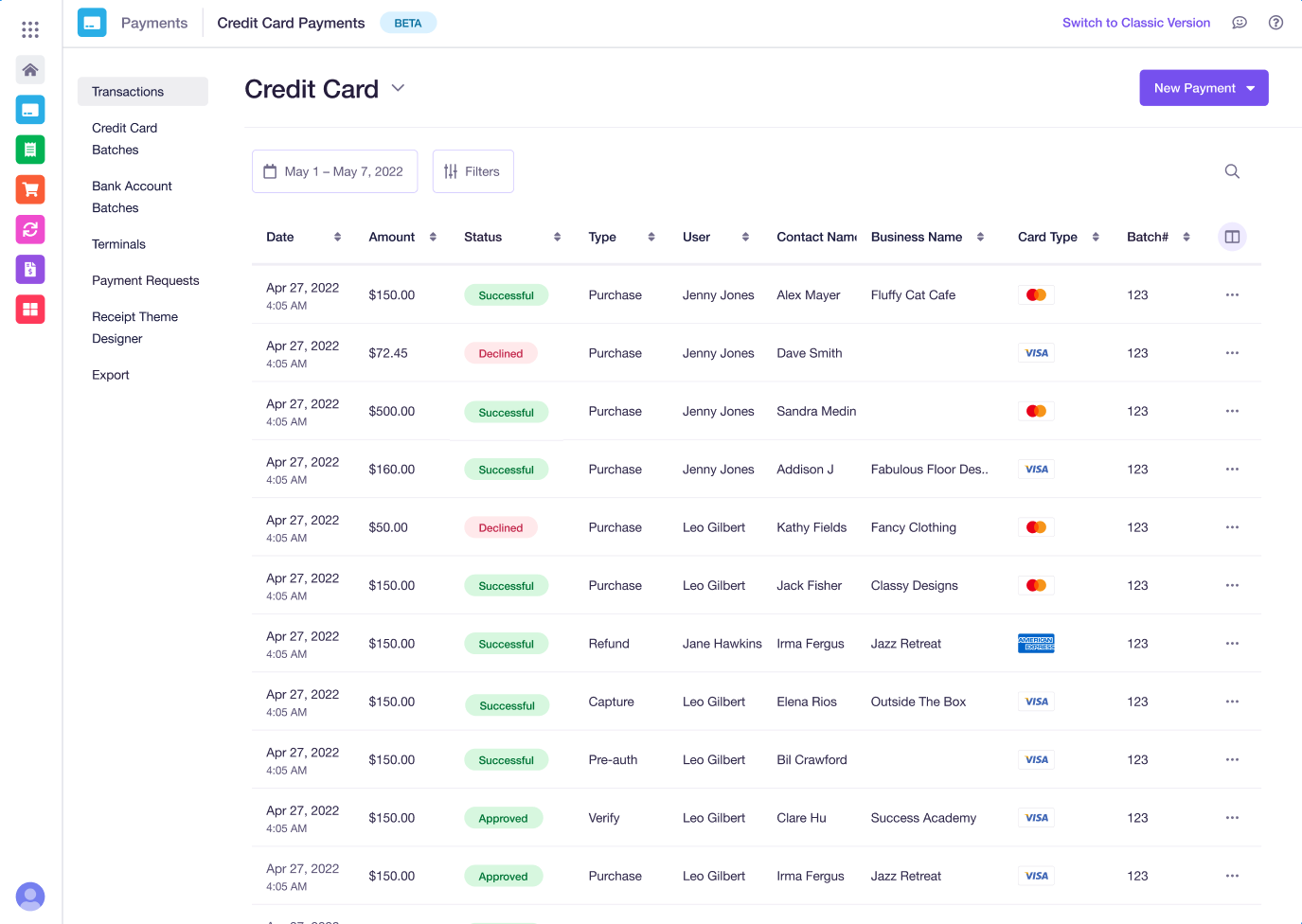

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured record of all of the accounts used to report monetary transactions, appearing as an in depth roadmap for monitoring revenue, bills, property, liabilities, and fairness. In relation to bank card transactions, understanding how they combine with the COA is essential for correct monetary statements and efficient enterprise administration. This text delves into the complexities of bank card accounting inside the COA, exploring finest practices, potential pitfalls, and techniques for sustaining management.

The Function of the Chart of Accounts in Credit score Card Administration

Bank card transactions, encompassing each enterprise bills and buyer funds, require meticulous recording inside the COA. The particular accounts used rely upon the character of the transaction. As an example, a purchase order of workplace provides utilizing an organization bank card would necessitate debiting the "Workplace Provides" expense account and crediting the "Credit score Card Payable" legal responsibility account. Conversely, a buyer cost obtained by way of bank card would debit the "Accounts Receivable" account and credit score the "Credit score Card Gross sales" or an identical income account.

The accuracy of this course of instantly impacts the reliability of economic studies. Incorrect categorization can result in misstated bills, inflated income, or inaccurate legal responsibility figures, in the end hindering knowledgeable decision-making. A strong COA, designed with bank card transactions in thoughts, is crucial for mitigating these dangers.

Key Accounts Concerned in Credit score Card Transactions:

A number of key accounts inside the COA work together instantly with bank card transactions. These embody:

-

Credit score Card Payable: This legal responsibility account tracks the excellent stability owed on the corporate’s bank cards. It is credited when purchases are made and debited when funds are made.

-

Credit score Card Gross sales (or related income accounts): This income account information gross sales made utilizing bank cards. It is credited when a sale is processed and the funds are anticipated to be obtained. The particular account title could range relying on the corporate’s accounting construction. For instance, some corporations may use separate accounts for various bank card processors.

-

Accounts Receivable: If the enterprise makes use of a bank card processor that instantly deposits funds, this account won’t be used. Nonetheless, if there is a delay in receiving funds (e.g., on account of processing charges or disputes), this account tracks the quantity owed to the enterprise by the bank card processor.

-

Varied Expense Accounts: These accounts mirror the character of the acquisition made utilizing the bank card. Examples embody "Workplace Provides," "Journey Bills," "Advertising and marketing Bills," "Hire," and plenty of extra. These accounts are debited when bills are incurred.

-

Credit score Card Charges Expense: This account tracks the charges charged by the bank card processor, corresponding to transaction charges, annual charges, or late cost charges. It is debited when these charges are incurred.

-

Money: This asset account is debited when funds are made to the bank card firm to cut back the "Credit score Card Payable" stability.

Reconciliation: A Essential Step in Credit score Card Administration

Common reconciliation between the corporate’s bank card statements and the accounting information is paramount. This course of entails evaluating the transactions listed on the bank card assertion with the corresponding entries within the COA. Discrepancies have to be investigated and resolved promptly to make sure accuracy. Reconciliation helps determine:

- Lacking entries: Transactions recorded on the bank card assertion however not within the COA.

- Incorrect entries: Transactions recorded with incorrect quantities or within the incorrect accounts.

- Fraudulent transactions: Unauthorized or suspicious expenses.

The reconciliation course of must be carried out not less than month-to-month, ideally by a distinct particular person than the one who manages the bank card. This gives an extra layer of safety and reduces the chance of errors or fraud going undetected.

Greatest Practices for Managing Credit score Card Transactions inside the COA:

- Set up clear insurance policies: Outline procedures for utilizing firm bank cards, together with licensed customers, acceptable bills, and reporting necessities.

- Implement sturdy inside controls: Segregate duties to stop fraud and errors. Completely different people must be liable for making purchases, reconciling statements, and approving bills.

- Make the most of accounting software program: Accounting software program automates many elements of bank card administration, together with transaction recording, reconciliation, and reporting.

- Often overview the COA: Make sure the COA is up-to-date and precisely displays the corporate’s bills and income streams. That is particularly necessary because the enterprise grows and evolves.

- Prepare workers: Present enough coaching to workers on the correct use of firm bank cards and the significance of correct record-keeping.

- Implement a robust approval course of: Set up clear tips for expense approvals, making certain that each one transactions are licensed earlier than being processed.

- Often monitor bank card balances: Maintain observe of excellent balances to keep away from late cost charges and keep good credit score standing.

Potential Pitfalls and Easy methods to Keep away from Them:

- Inconsistent coding: Utilizing totally different account codes for related transactions can result in inaccurate monetary studies. Set up a constant coding system and cling to it strictly.

- Delayed reconciliation: Suspending reconciliation will increase the chance of errors going undetected and changing into tough to appropriate.

- Lack of correct authorization: Permitting unauthorized people to make use of firm bank cards exposes the enterprise to fraud and monetary losses.

- Ignoring bank card charges: Failing to account for bank card charges can result in underestimation of bills and inaccurate revenue calculations.

- Poor record-keeping: Inadequate documentation of bank card transactions makes it tough to trace bills and reconcile statements.

Superior Concerns:

- International forex transactions: Transactions in foreign exchange require extra concerns, together with forex conversion and potential change fee fluctuations. Particular accounts could be wanted to trace change fee positive aspects or losses.

- Chargebacks: Companies have to have a course of in place to deal with chargebacks and disputes, which may affect income and require changes to the COA.

- Integration with different methods: The COA must be built-in with different enterprise methods, corresponding to stock administration and buyer relationship administration (CRM) methods, to make sure knowledge consistency and accuracy.

Conclusion:

Successfully managing bank card transactions inside the chart of accounts is essential for sustaining correct monetary information and making knowledgeable enterprise selections. By implementing finest practices, establishing clear insurance policies, and performing common reconciliations, companies can mitigate dangers, enhance monetary management, and make sure the reliability of their monetary statements. A well-structured COA, tailor-made to the precise wants of the group, is the inspiration for this success. Ignoring the intricacies of bank card accounting inside the COA can result in important monetary implications, highlighting the significance of cautious planning and diligent execution. Investing time and assets in creating and sustaining a strong bank card administration system inside the COA framework is an funding within the long-term monetary well being and stability of the enterprise.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered priceless insights into Navigating the Chart of Accounts: Understanding Credit score Card Transactions. We thanks for taking the time to learn this text. See you in our subsequent article!