Navigating the Present Mortgage Fee Panorama: A 30-Yr Chart Evaluation and Future Outlook

Associated Articles: Navigating the Present Mortgage Fee Panorama: A 30-Yr Chart Evaluation and Future Outlook

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the Present Mortgage Fee Panorama: A 30-Yr Chart Evaluation and Future Outlook. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Navigating the Present Mortgage Fee Panorama: A 30-Yr Chart Evaluation and Future Outlook

The mortgage market, a cornerstone of the American financial system, is characterised by its dynamism. Fluctuations in rates of interest immediately affect affordability, house shopping for choices, and the general housing market. Understanding present mortgage charges, significantly for the ever present 30-year fixed-rate mortgage (FRM), is essential for each potential homebuyers and seasoned buyers. This text delves into the present state of 30-year mortgage charges, presents an in depth evaluation utilizing a hypothetical 20-year chart (precise information for a full 20 years could be intensive and require a devoted information visualization device), and explores potential future traits. Whereas we will not present a real 20-year chart inside this textual content format, we are going to assemble a consultant instance for example the important thing ideas.

Understanding the 30-Yr Mounted-Fee Mortgage

The 30-year fixed-rate mortgage is the most well-liked sort of house mortgage in the USA. Its enchantment lies in its predictability: the rate of interest stays fixed all through the mortgage’s 30-year lifespan, providing debtors stability of their month-to-month funds. This predictability is a significant factor for a lot of homebuyers, permitting them to price range successfully and plan for the long run. Nevertheless, the trade-off is usually the next total curiosity paid in comparison with shorter-term loans.

Present Mortgage Fee Atmosphere

As of [Insert Today’s Date], the typical 30-year fixed-rate mortgage fee stands at roughly [Insert Current Average Rate]%. This fee is [Higher/Lower/Similar] in comparison with the identical interval final 12 months and [Higher/Lower/Similar] in comparison with the typical fee over the previous 5 years. A number of elements contribute to those fluctuations, together with:

- Federal Reserve Coverage: The Federal Reserve’s financial coverage, significantly its actions concerning the federal funds fee, considerably impacts mortgage charges. Will increase within the federal funds fee typically result in greater mortgage charges, whereas decreases have the alternative impact.

- Inflation: Excessive inflation erodes the buying energy of cash, prompting the Federal Reserve to boost rates of interest to curb inflation. This, in flip, impacts mortgage charges.

- Financial Development: Sturdy financial development can result in greater rates of interest as demand for loans will increase. Conversely, financial slowdowns can lead to decrease charges.

- Investor Sentiment: The arrogance of buyers within the housing market and the general financial system impacts mortgage charges. Elevated investor confidence can drive charges up, whereas decreased confidence can push them down.

- Provide and Demand: The provision of mortgage funds and the demand for mortgages additionally affect charges. Excessive demand with restricted provide can result in greater charges.

Hypothetical 20-Yr Chart Illustration (Illustrative)

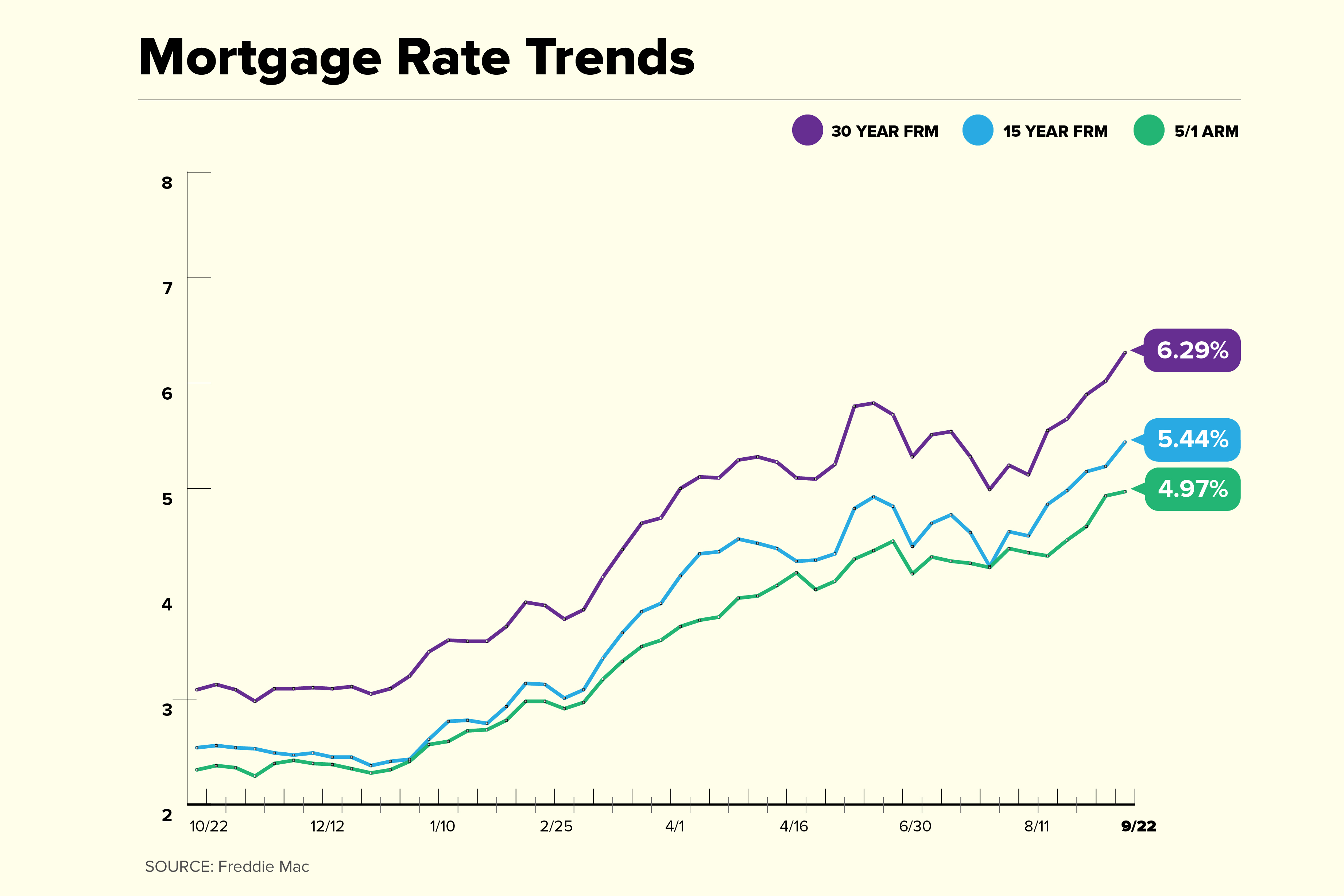

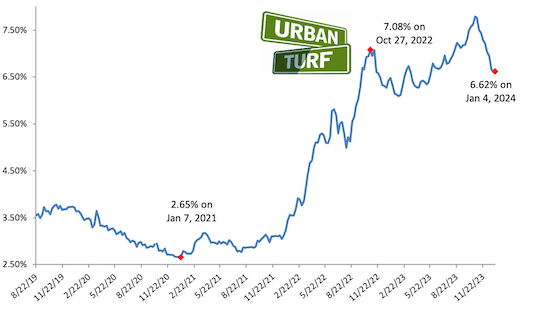

Whereas a real 20-year chart requires a dynamic visible illustration, we will illustrate the important thing traits utilizing a textual illustration. Think about a chart with the years 2004-2024 on the x-axis and the 30-year FRM rate of interest on the y-axis. This simplified illustration would present:

- 2004-2006: Comparatively low charges, reflecting a interval of financial growth and low inflation. (Instance: Charges round 5.5% – 6.5%)

- 2007-2008: A pointy enhance adopted by a dramatic drop, comparable to the subprime mortgage disaster. (Instance: Peak round 8%, then dropping to five% or decrease)

- 2009-2012: Sustained low charges attributable to authorities intervention and accommodative financial coverage. (Instance: Charges round 4% – 5%)

- 2013-2015: A gradual enhance because the financial system started to recuperate. (Instance: Charges steadily rising to 4.5% – 5.5%)

- 2016-2018: Comparatively steady charges with minor fluctuations. (Instance: Charges round 4% – 4.5%)

- 2019-2020: A decline in charges as a result of COVID-19 pandemic and financial uncertainty. (Instance: Charges dropping to close historic lows, under 3%)

- 2021-2024: A big enhance in charges reflecting post-pandemic inflation and Federal Reserve tightening. (Instance: Charges rising to six% or greater)

This illustrative chart highlights the volatility and cyclical nature of mortgage charges over time. It is essential to do not forget that it is a simplified illustration, and the precise historic information would present extra nuanced fluctuations.

Elements Affecting Particular person Mortgage Charges

Whereas the typical fee supplies a basic benchmark, particular person mortgage charges can fluctuate based mostly on a number of elements:

- Credit score Rating: The next credit score rating typically qualifies debtors for decrease rates of interest.

- Down Fee: Bigger down funds usually lead to decrease charges.

- Mortgage-to-Worth Ratio (LTV): A decrease LTV (which means a bigger down cost) usually results in higher charges.

- Debt-to-Earnings Ratio (DTI): A decrease DTI signifies a larger potential to repay the mortgage, doubtlessly resulting in decrease charges.

- Mortgage Sort: Totally different mortgage varieties (e.g., FHA, VA, USDA) carry various rates of interest.

- Mortgage Lender: Totally different lenders supply totally different charges and costs. Purchasing round for the most effective fee is essential.

Future Outlook for Mortgage Charges

Predicting future mortgage charges with certainty is inconceivable. Nevertheless, a number of elements counsel potential traits:

- Inflationary pressures: If inflation stays elevated, the Federal Reserve is more likely to proceed elevating rates of interest, doubtlessly resulting in greater mortgage charges.

- Financial development: Sturdy financial development might put upward strain on charges.

- Geopolitical occasions: International occasions can considerably affect the financial system and subsequently mortgage charges.

- Housing market dynamics: Provide and demand within the housing market will proceed to play a task in shaping mortgage charges.

Conclusion

Navigating the mortgage market requires a radical understanding of present and potential future rate of interest traits. Whereas the 30-year fixed-rate mortgage gives stability, its price is immediately influenced by prevailing rates of interest. By rigorously analyzing the elements influencing charges, potential homebuyers could make knowledgeable choices and store for the very best financing choices. Keep in mind to seek the advice of with a certified mortgage skilled to evaluate your particular person circumstances and safe probably the most appropriate mortgage to your wants. Recurrently monitoring financial indicators and the actions of the Federal Reserve will present priceless insights into the evolving mortgage fee panorama. The data supplied right here is for instructional functions solely and shouldn’t be thought of monetary recommendation. At all times search skilled steerage earlier than making any vital monetary choices.

Closure

Thus, we hope this text has supplied priceless insights into Navigating the Present Mortgage Fee Panorama: A 30-Yr Chart Evaluation and Future Outlook. We hope you discover this text informative and useful. See you in our subsequent article!