Navigating the Depreciation Maze: A Complete Information to the Revenue Tax Depreciation Chart (FY 2023-24)

Associated Articles: Navigating the Depreciation Maze: A Complete Information to the Revenue Tax Depreciation Chart (FY 2023-24)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the Depreciation Maze: A Complete Information to the Revenue Tax Depreciation Chart (FY 2023-24). Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the Depreciation Maze: A Complete Information to the Revenue Tax Depreciation Chart (FY 2023-24)

The depreciation chart, a vital part of revenue tax rules, dictates how companies can account for the wear and tear and tear of their property over time. Understanding this chart is important for correct tax filings and maximizing tax advantages. Whereas particular charges and rules can change yearly, this text supplies a complete overview of the depreciation chart relevant to the monetary 12 months 2023-24 (FY 2023-24) in India, aiming to make clear the complexities and empower taxpayers to navigate this important side of tax compliance. Be aware that this info is for normal understanding and shouldn’t be thought-about skilled tax recommendation. At all times seek the advice of with a certified tax skilled for customized steering.

Understanding Depreciation and its Significance:

Depreciation is the systematic allocation of the price of a tangible asset over its helpful life. It displays the gradual decline within the asset’s worth attributable to elements like put on and tear, obsolescence, and technological developments. From an accounting perspective, depreciation ensures that the price of an asset is unfold throughout its productive years, offering a extra correct illustration of an organization’s monetary efficiency. From a tax perspective, depreciation permits companies to say a deduction on their taxable revenue, thereby lowering their total tax legal responsibility. This deduction is essential for sustaining monetary well being and inspiring capital funding.

The Revenue Tax Act, 1961 and Depreciation:

The Revenue Tax Act, 1961, governs the foundations and rules surrounding depreciation in India. The Act outlines totally different strategies of calculating depreciation and specifies charges for varied asset lessons. The depreciation charges are prescribed primarily based on the character and anticipated lifespan of the asset. The depreciation chart, due to this fact, acts as a vital reference level for figuring out the allowable depreciation deduction for a given monetary 12 months.

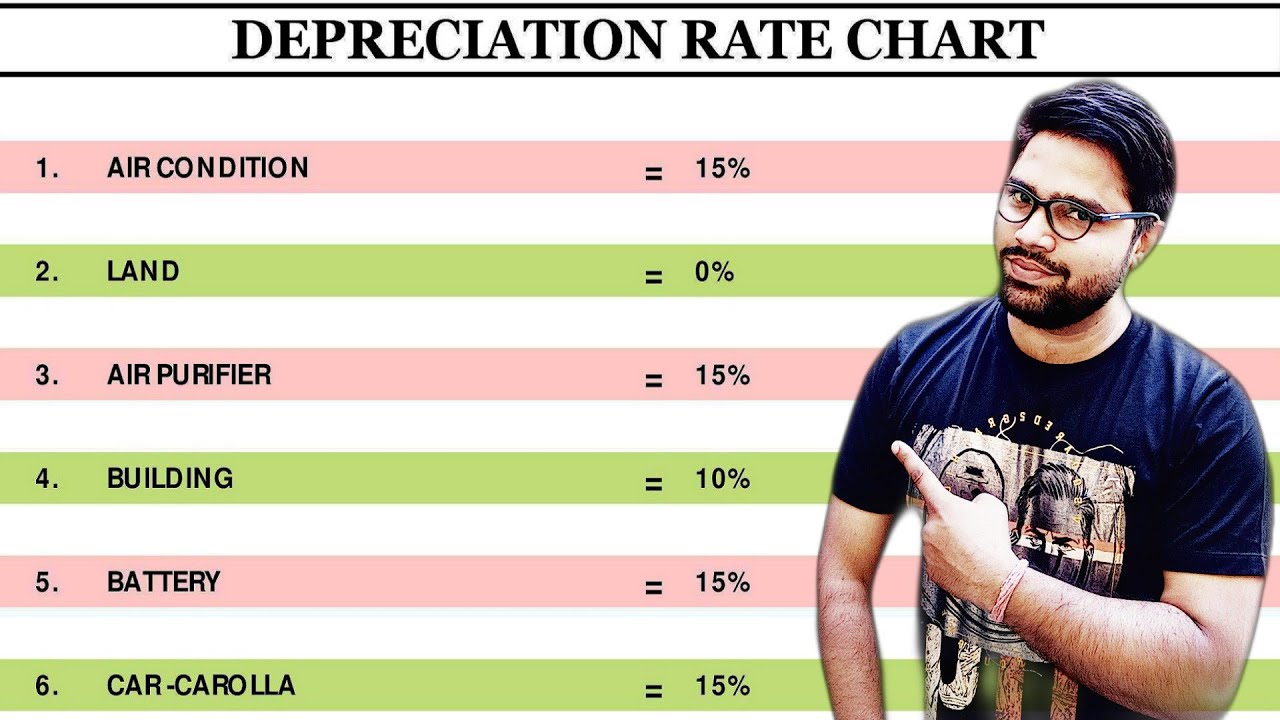

Key Elements of the FY 2023-24 Depreciation Chart:

The depreciation chart for FY 2023-24, whereas not introduced as a single, available desk, is derived from the Revenue Tax Act, 1961, and associated notifications. Key facets embody:

-

Asset Classification: Belongings are categorized into varied lessons primarily based on their nature and use. This classification is essential as totally different charges of depreciation apply to totally different asset lessons. Examples embody plant and equipment, buildings, furnishings, computer systems, and automobiles.

-

Depreciation Strategies: The Revenue Tax Act permits for various strategies of calculating depreciation, together with:

- Written Down Worth (WDV) Methodology: That is probably the most generally used methodology. Depreciation is calculated on the lowering steadiness of the asset’s worth every year. This implies the depreciation quantity decreases every year because the asset’s worth depreciates.

- Straight-Line Methodology: This methodology calculates depreciation as a hard and fast proportion of the asset’s authentic value every year. The depreciation quantity stays fixed all through the asset’s life.

-

Depreciation Charges: The depreciation charges range relying on the asset class and the strategy used. The charges are usually expressed as a proportion of the asset’s written down worth (WDV) or authentic value. These charges are prescribed by the Revenue Tax Division and might be topic to alter. For FY 2023-24, the charges can be these specified within the related Revenue Tax guidelines and notifications for that 12 months. These charges usually differ for brand new and second-hand property.

-

Particular Provisions: The Revenue Tax Act consists of particular provisions for sure property and conditions. These would possibly embody:

- Further depreciation: Sure industries or property might qualify for added depreciation allowances, offering additional tax advantages.

- Depreciation on intangible property: Whereas the main focus is totally on tangible property, the Act additionally addresses depreciation for sure intangible property.

- Remedy of losses: The Act specifies how depreciation impacts the calculation of losses and their carryforward.

-

Documentation: Sustaining correct data of asset acquisition, depreciation calculations, and associated documentation is essential for tax compliance. These data ought to be available for audit functions.

Understanding the Affect of Modifications in Depreciation Charges:

Modifications in depreciation charges, even seemingly small ones, can considerably impression an organization’s tax legal responsibility. Greater depreciation charges result in greater deductions, leading to decrease taxable revenue and due to this fact decrease tax funds. Conversely, decrease charges result in greater tax funds. Companies should fastidiously monitor these modifications and regulate their tax planning accordingly. The implications lengthen past fast tax financial savings, influencing funding selections, money movement projections, and total monetary planning.

Sensible Software and Examples:

Let’s take into account a simplified instance for instance the applying of the depreciation chart. Suppose a enterprise bought equipment price ₹10,00,000 in FY 2023-24. Assume the depreciation fee for this equipment class is 15% below the WDV methodology.

- 12 months 1 (FY 2023-24): Depreciation = 15% of ₹10,00,000 = ₹1,50,000. WDV on the finish of 12 months 1 = ₹10,00,000 – ₹1,50,000 = ₹8,50,000.

- 12 months 2 (FY 2024-25): Depreciation = 15% of ₹8,50,000 = ₹1,27,500. WDV on the finish of 12 months 2 = ₹8,50,000 – ₹1,27,500 = ₹7,22,500.

This straightforward instance demonstrates the lowering steadiness nature of the WDV methodology. The precise depreciation charges and strategies would depend upon the particular asset class and the provisions of the Revenue Tax Act for FY 2023-24.

Looking for Skilled Recommendation:

The complexities of the depreciation chart and its software necessitate in search of skilled recommendation. Tax legal guidelines are topic to alter, and particular person circumstances might require specialised interpretation. A certified chartered accountant or tax advisor can present customized steering, making certain correct depreciation calculations and optimum tax planning. They can assist companies navigate the intricacies of the Revenue Tax Act, maximizing tax advantages whereas making certain compliance with all related rules. This proactive strategy minimizes the chance of penalties and ensures monetary stability.

Conclusion:

The depreciation chart is a important factor of the Indian revenue tax system. Understanding its intricacies is important for companies to precisely calculate their tax liabilities and optimize their tax planning. Whereas this text supplies a normal overview of the important thing facets of the depreciation chart relevant to FY 2023-24, it is essential to keep in mind that particular charges and rules can change. Consulting with a tax skilled is very really useful to make sure correct calculations and compliance with the ever-evolving tax panorama. Proactive tax planning, knowledgeable by professional steering, is essential for the long-term monetary well being and success of any enterprise.

Closure

Thus, we hope this text has offered useful insights into Navigating the Depreciation Maze: A Complete Information to the Revenue Tax Depreciation Chart (FY 2023-24). We thanks for taking the time to learn this text. See you in our subsequent article!