Navigating the SAP Chart of Accounts: T-Codes, Performance, and Finest Practices

Associated Articles: Navigating the SAP Chart of Accounts: T-Codes, Performance, and Finest Practices

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Navigating the SAP Chart of Accounts: T-Codes, Performance, and Finest Practices. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Navigating the SAP Chart of Accounts: T-Codes, Performance, and Finest Practices

The Chart of Accounts (CoA) is the spine of any monetary system, offering a structured framework for recording and reporting monetary transactions. Within the SAP ecosystem, the CoA performs an important function in organizing monetary information, making certain accuracy, and facilitating complete monetary reporting. Understanding the assorted SAP t-codes associated to the CoA and their performance is crucial for any finance skilled working inside an SAP atmosphere. This text delves deep into the world of SAP Chart of Accounts t-codes, exploring their functionalities, sensible purposes, and finest practices for efficient administration.

Understanding the SAP Chart of Accounts

Earlier than diving into the t-codes, let’s briefly revisit the elemental idea of the Chart of Accounts in SAP. It is a hierarchical construction that categorizes all common ledger accounts utilized by a corporation. These accounts are used to file monetary transactions, comparable to revenues, bills, belongings, liabilities, and fairness. A well-defined CoA is important for:

- Correct Monetary Reporting: Offers a constant and arranged option to categorize transactions, enabling correct monetary statements.

- Compliance: Ensures adherence to accounting requirements and regulatory necessities.

- Knowledge Evaluation: Facilitates environment friendly evaluation of economic information for decision-making.

- Auditing: Simplifies the auditing course of by offering a transparent and clear file of economic transactions.

SAP permits for a number of CoAs to be outlined inside a single system, catering to totally different organizational buildings, authorized entities, or reporting necessities. This flexibility is essential for multinational companies or organizations with various enterprise items.

Key SAP T-Codes for Chart of Accounts Administration

A number of SAP t-codes are instrumental in managing the Chart of Accounts. Probably the most generally used ones are:

-

KS01 (Create Chart of Accounts): This t-code is used to create a brand new Chart of Accounts. It permits customers to outline the construction, account numbers, account descriptions, and different related attributes. This course of includes defining the account hierarchy, setting account varieties (e.g., asset, legal responsibility, income), and specifying account traits. Cautious planning and consideration of future necessities are essential throughout this part.

-

KS02 (Change Chart of Accounts): Used to switch an present Chart of Accounts. This might contain altering account descriptions, including new accounts, or modifying the account construction. Adjustments made right here have important implications for your entire monetary system, so meticulous consideration to element is crucial. Thorough testing and authorization processes are important to forestall information inconsistencies.

-

KS03 (Show Chart of Accounts): This t-code permits customers to view the small print of a particular Chart of Accounts. It offers a complete overview of the account construction, together with account numbers, descriptions, and related attributes. It is a useful instrument for understanding the prevailing CoA and verifying account data.

-

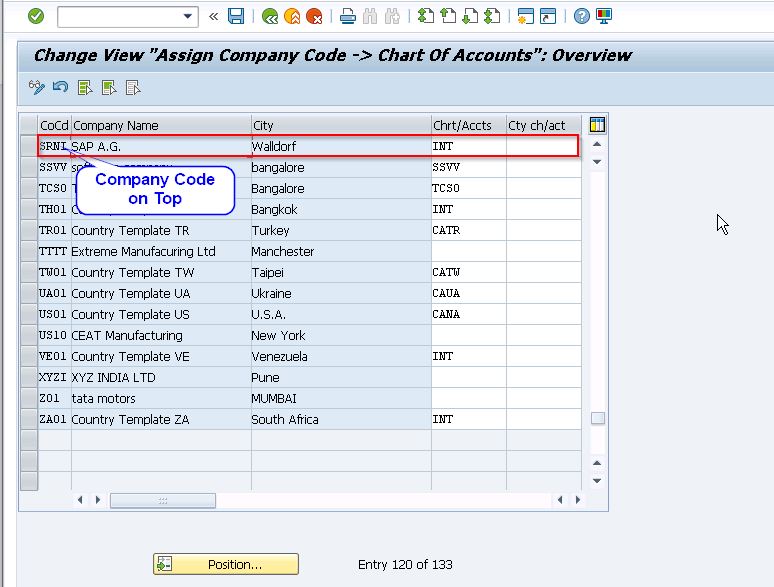

OBY6 (Assign Chart of Accounts to Firm Code): This t-code is essential for linking a Chart of Accounts to a particular firm code. Every firm code in SAP requires a chosen Chart of Accounts to file its monetary transactions. This project is a basic step in organising the monetary accounting module. Incorrect project can result in important reporting errors.

-

OBY7 (Preserve Quantity Ranges for G/L Accounts): This t-code is used to outline and handle the quantity ranges for common ledger accounts inside a particular Chart of Accounts. It ensures that account numbers are distinctive and sequentially assigned, stopping conflicts and sustaining information integrity. Correct quantity vary administration is crucial for environment friendly account creation and avoids potential errors.

-

OB52 (Outline Account Willpower): This t-code is used to configure the automated account dedication course of. It permits the system to routinely assign common ledger accounts primarily based on predefined guidelines and standards. This automation saves time and reduces guide effort, however requires cautious configuration to make sure correct account assignments.

-

FS00 (Show Common Ledger Account): Whereas not solely a CoA t-code, FS00 is essential for viewing the small print of particular person common ledger accounts inside a particular CoA. It offers insights under consideration balances, transaction historical past, and different related data. This t-code is ceaselessly used for account reconciliation and evaluation.

-

S_ALR_87012060 (Common Ledger Account Stability): This t-code offers a regular SAP report that shows the balances of common ledger accounts. It is a highly effective instrument for analyzing account balances and producing monetary reviews. Varied choice standards can be utilized to filter the information and generate custom-made reviews.

Finest Practices for Chart of Accounts Administration in SAP

Efficient administration of the Chart of Accounts in SAP requires cautious planning and adherence to finest practices:

-

Complete Planning: Earlier than creating or modifying a Chart of Accounts, thorough planning is crucial. Contemplate the group’s construction, reporting necessities, and future progress. Contain key stakeholders from finance and different related departments.

-

Constant Numbering System: Make use of a constant and logical numbering system for common ledger accounts. This ensures readability and facilitates straightforward navigation and evaluation. Think about using a hierarchical numbering system to replicate the account construction.

-

Common Evaluate and Upkeep: Periodically assessment and replace the Chart of Accounts to make sure it stays related and correct. Adjustments in enterprise operations, accounting requirements, or reporting necessities could necessitate changes.

-

Correct Authorization: Implement strong authorization controls to limit entry to delicate CoA information and stop unauthorized modifications. This safeguards information integrity and ensures compliance with inside controls.

-

Documentation: Preserve complete documentation of the Chart of Accounts, together with account descriptions, account varieties, and any related guidelines or pointers. This documentation is essential for coaching, troubleshooting, and auditing functions.

-

Testing: Totally check any adjustments made to the Chart of Accounts earlier than deploying them to the manufacturing atmosphere. This helps stop errors and ensures that the adjustments perform as supposed.

Conclusion

The Chart of Accounts in SAP is a essential part of the monetary accounting system. Understanding the assorted t-codes associated to CoA administration and following finest practices are important for sustaining correct monetary information, facilitating environment friendly reporting, and making certain compliance with accounting requirements. By leveraging the functionalities supplied by these t-codes and adopting a proactive strategy to CoA administration, organizations can optimize their monetary processes and achieve useful insights into their monetary efficiency. Keep in mind that steady monitoring and adaptation of the CoA are essential for sustained accuracy and relevance inside a always evolving enterprise atmosphere. This requires a collaborative effort between finance professionals, IT specialists, and enterprise customers to make sure the graceful operation and effectiveness of the SAP monetary system.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has supplied useful insights into Navigating the SAP Chart of Accounts: T-Codes, Performance, and Finest Practices. We hope you discover this text informative and helpful. See you in our subsequent article!