Navigating the Share Market: A Complete Flowchart and Information

Associated Articles: Navigating the Share Market: A Complete Flowchart and Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the Share Market: A Complete Flowchart and Information. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Navigating the Share Market: A Complete Flowchart and Information

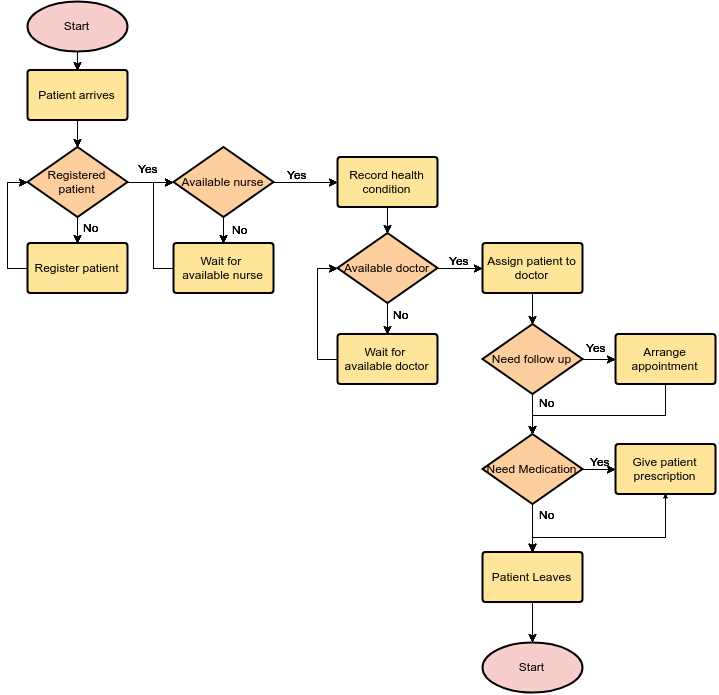

The share market, a fancy ecosystem of shopping for and promoting publicly traded firm shares, can appear formidable to newcomers. Understanding its intricacies is essential for profitable funding. This text gives a complete flowchart visualizing the important thing steps concerned in collaborating within the share market, adopted by an in depth rationalization of every stage, clarifying the processes and concerns concerned.

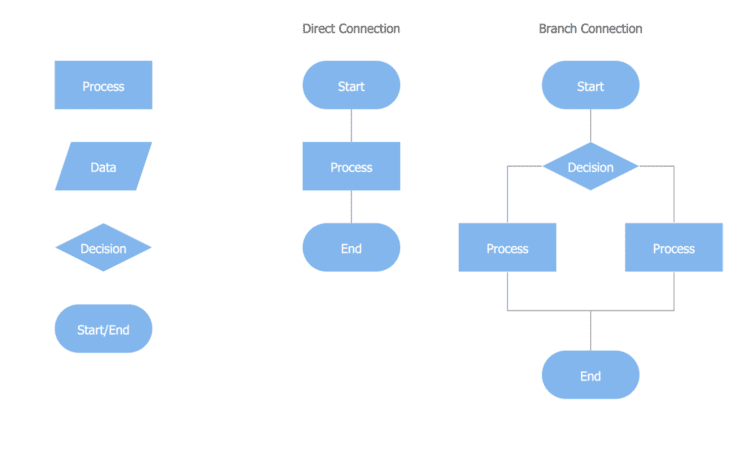

I. The Share Market Flowchart:

This flowchart outlines the overall course of, from preliminary analysis to eventual revenue or loss. Word that particular steps and timelines could fluctuate relying on the person investor, brokerage, and market circumstances.

[Start] --> [Research & Planning] --> [Account Opening & Funding] --> [Order Placement & Execution] --> [Monitoring & Portfolio Management] --> [Selling & Profit/Loss Realization] --> [Tax Implications] --> [End]

|

V

[Research & Planning]:

|-----> [Identify Investment Goals]

|-----> [Analyze Market Trends]

|-----> [Select Brokerage Firm]

|-----> [Understand Risk Tolerance]

|-----> [Research Potential Investments]

[Monitoring & Portfolio Management]:

|-----> [Track Stock Performance]

|-----> [Rebalance Portfolio]

|-----> [Adjust Strategy as Needed]

|-----> [Dividend Reinvestment/Withdrawal]

II. Detailed Rationalization of Every Stage:

A. Analysis & Planning: This significant preliminary section lays the groundwork for profitable funding.

-

Determine Funding Objectives: Earlier than investing a single greenback, outline your aims. Are you aiming for long-term progress, short-term features, or earnings technology via dividends? Understanding your objectives helps decide your funding technique and danger tolerance. Examples embody retirement planning, buying a home, or funding training.

-

Analyze Market Traits: The share market is dynamic, influenced by financial indicators, geopolitical occasions, and company-specific information. Analyzing market developments – utilizing elementary and technical evaluation – helps predict potential value actions and establish promising funding alternatives. Basic evaluation focuses on an organization’s monetary well being, whereas technical evaluation research value charts and buying and selling quantity to establish patterns.

-

Choose Brokerage Agency: A brokerage agency acts as an middleman, facilitating the shopping for and promoting of shares. Selecting the best brokerage is significant. Contemplate elements like charges, buying and selling platforms, analysis instruments, customer support, and safety measures. On-line brokers usually provide decrease charges than conventional full-service brokers.

-

Perceive Danger Tolerance: Investing within the share market inherently includes danger. Understanding your danger tolerance – your skill to resist potential losses – is essential. Conservative traders want lower-risk investments, whereas aggressive traders are snug with greater danger for doubtlessly greater returns. This influences your portfolio diversification and funding selections.

-

Analysis Potential Investments: Thorough analysis is paramount. Analyze firm financials (steadiness sheets, earnings statements, money circulation statements), perceive their enterprise mannequin, aggressive panorama, and future progress prospects. Contemplate elements like business developments, administration high quality, and debt ranges. Diversification throughout totally different sectors and asset courses reduces total portfolio danger.

B. Account Opening & Funding: This includes organising a brokerage account and depositing funds.

-

Account Software: Full the appliance course of along with your chosen brokerage, offering mandatory identification and monetary info. This usually includes verifying your identification and tackle.

-

Account Funding: Deposit funds into your brokerage account utilizing varied strategies, akin to financial institution transfers, wire transfers, or checks. The minimal deposit requirement varies relying on the brokerage.

-

Account Verification: The brokerage could require further verification steps to make sure safety and compliance with regulatory necessities.

C. Order Placement & Execution: That is the place you really purchase or promote shares.

-

Order Sort Choice: Select the kind of order you need to place. Widespread order varieties embody market orders (executed on the present market value), restrict orders (executed solely at a specified value or higher), and stop-loss orders (triggered when the value falls under a sure stage).

-

Order Placement: Submit your order via your brokerage’s buying and selling platform, specifying the inventory image, amount, and order sort.

-

Order Execution: The brokerage executes your order, matching it with a vendor (for purchase orders) or a purchaser (for promote orders) out there. The execution value could fluctuate barely from the anticipated value, relying on market circumstances and order sort.

-

Affirmation: You obtain a affirmation of your order execution, detailing the transaction value, amount, and charges.

D. Monitoring & Portfolio Administration: This ongoing course of includes monitoring your investments and making changes as wanted.

-

Monitor Inventory Efficiency: Usually monitor the efficiency of your investments, monitoring value actions, dividends, and total portfolio worth. Use your brokerage’s platform or different monetary instruments to trace your investments.

-

Rebalance Portfolio: Periodically rebalance your portfolio to keep up your required asset allocation. This includes promoting some property which have carried out properly and shopping for others which have underperformed, bringing your portfolio again to your goal allocation.

-

Alter Technique as Wanted: Market circumstances change, and your funding technique may have changes based mostly in your objectives, danger tolerance, and market efficiency. This may occasionally contain promoting some investments and shopping for others, or altering your funding method.

-

Dividend Reinvestment/Withdrawal: Resolve whether or not to reinvest dividends (mechanically shopping for extra shares) or withdraw them as money. Reinvesting dividends can speed up long-term progress.

E. Promoting & Revenue/Loss Realization: That is the ultimate stage, the place you promote your shares and decide your revenue or loss.

-

Place Promote Order: Submit a promote order via your brokerage, specifying the amount and order sort.

-

Order Execution: The brokerage executes your promote order, matching it with a purchaser.

-

Revenue/Loss Calculation: Calculate your revenue or loss by subtracting your preliminary funding value (together with commissions and charges) from the proceeds from the sale.

-

Settlement: The proceeds from the sale, much less commissions and charges, are deposited into your brokerage account.

F. Tax Implications: Investing within the share market has tax implications.

-

Capital Positive aspects Tax: Earnings from promoting shares are topic to capital features tax, which varies relying in your jurisdiction and holding interval.

-

Dividend Tax: Dividends acquired might also be topic to tax.

-

Tax Reporting: Precisely report your funding earnings and capital features in your tax return. Seek the advice of a tax skilled for personalised recommendation.

III. Conclusion:

This flowchart and accompanying rationalization present a structured overview of navigating the share market. Keep in mind that investing includes danger, and previous efficiency will not be indicative of future outcomes. Thorough analysis, cautious planning, and disciplined execution are essential for profitable investing. Contemplate searching for skilled monetary recommendation earlier than making any funding choices. This text serves as a information, however particular person circumstances and market dynamics require personalised methods. Steady studying and adaptation are important for long-term success within the share market.

Closure

Thus, we hope this text has supplied worthwhile insights into Navigating the Share Market: A Complete Flowchart and Information. We respect your consideration to our article. See you in our subsequent article!