Navigating the Shifting Sands: A Deep Dive into Present 30-Yr Mortgage Curiosity Charges and Their Implications

Associated Articles: Navigating the Shifting Sands: A Deep Dive into Present 30-Yr Mortgage Curiosity Charges and Their Implications

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the Shifting Sands: A Deep Dive into Present 30-Yr Mortgage Curiosity Charges and Their Implications. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Navigating the Shifting Sands: A Deep Dive into Present 30-Yr Mortgage Curiosity Charges and Their Implications

The 30-year fixed-rate mortgage is the cornerstone of the American dream of homeownership. For many years, it has supplied a predictable and manageable path to proudly owning a house, offering debtors with long-term stability and monetary planning certainty. Nonetheless, the rate of interest connected to this mortgage is a dynamic entity, continually fluctuating primarily based on a posh interaction of financial components. Understanding these fluctuations and their affect is essential for anybody contemplating buying a house within the present market. This text supplies an in depth evaluation of present 30-year mortgage rates of interest, exploring their historic context, the components influencing them, and their implications for potential homebuyers. Whereas we can’t present a real-time, reside chart (as rates of interest change continually), we’ll analyze present tendencies and supply a framework for understanding the information you may discover from respected sources like Freddie Mac, Bankrate, and others.

The Present Panorama: A Snapshot of 30-Yr Mortgage Charges

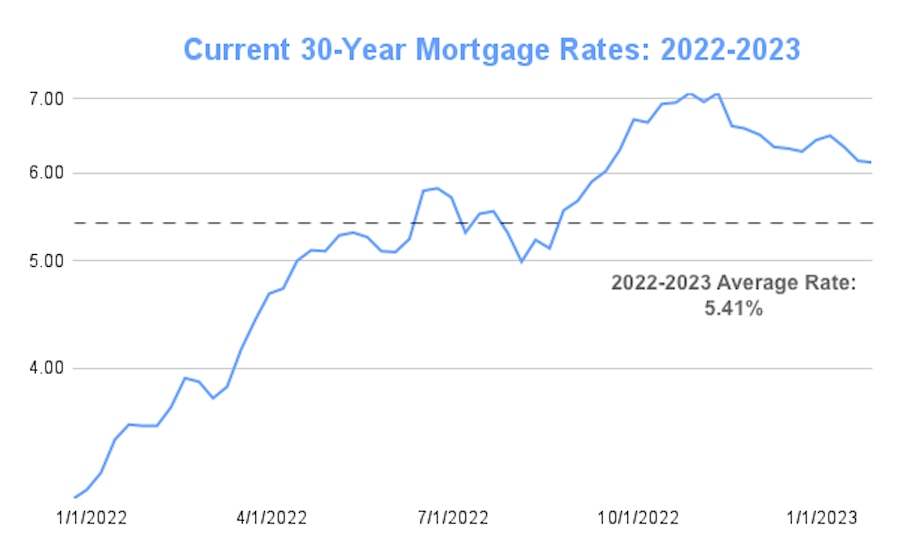

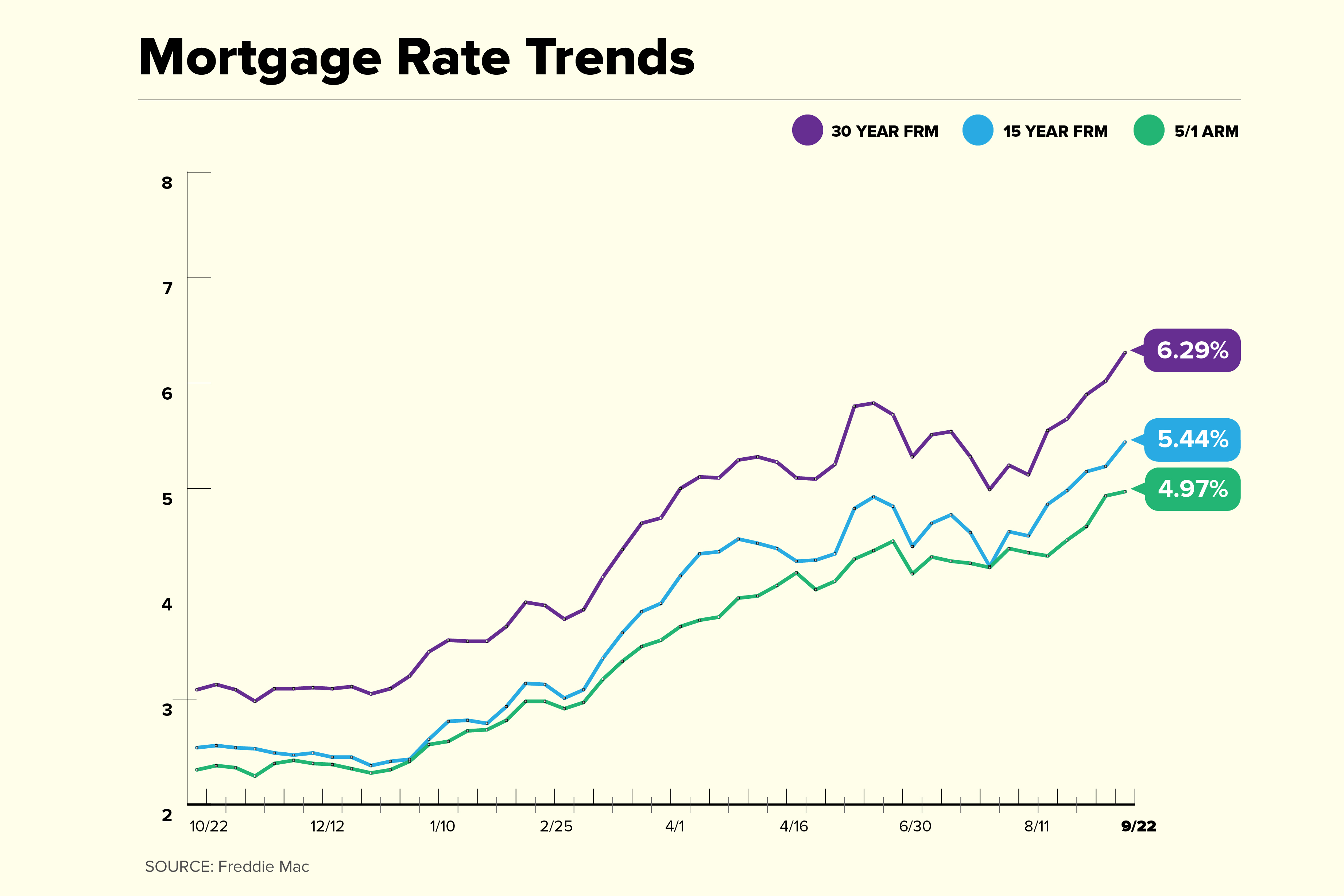

As of [Insert Today’s Date], the typical 30-year fixed-rate mortgage rate of interest is hovering round [Insert Current Average Rate – Source Required, e.g., "4.5% according to Freddie Mac’s Primary Mortgage Market Survey"]. This determine, nevertheless, represents a mean throughout varied lenders and should not replicate the speed you personally qualify for. Components like your credit score rating, down cost, loan-to-value ratio (LTV), and the kind of mortgage (e.g., conforming vs. non-conforming) considerably affect the ultimate charge you obtain.

It is essential to do not forget that these charges should not static. Each day, even hourly, fluctuations are widespread, influenced by financial information, market sentiment, and the actions of the Federal Reserve. Due to this fact, counting on a single information level is inadequate. Potential debtors ought to actively monitor charge tendencies over a time period, consulting a number of sources to achieve a complete understanding of the market.

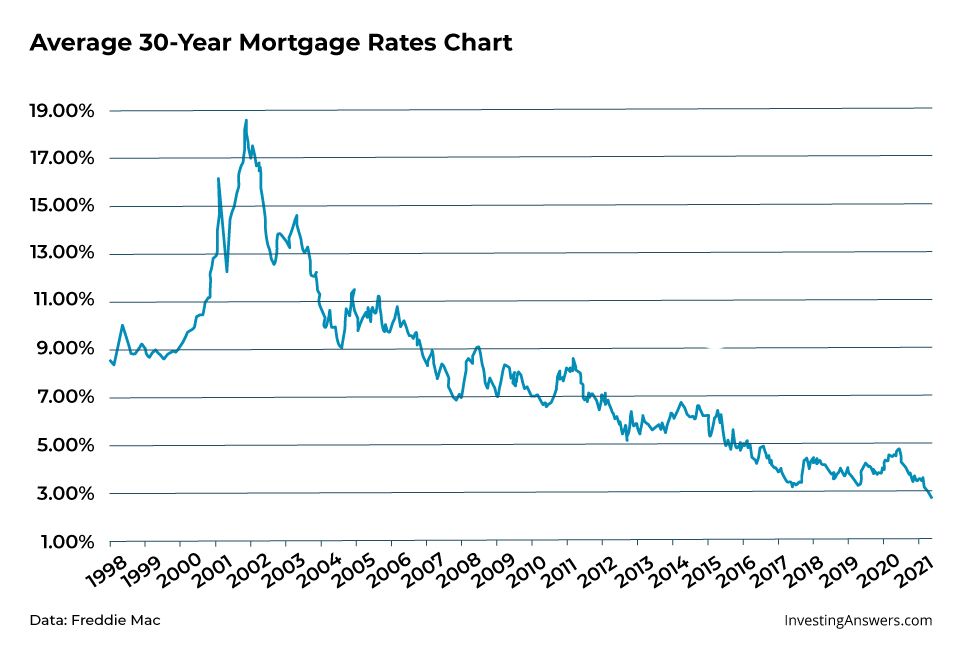

Historic Context: Understanding the Rollercoaster Experience

To understand the present charge setting, it is important to look at the historic trajectory of 30-year mortgage rates of interest. Over the previous few a long time, these charges have skilled appreciable volatility. The early 2000s noticed comparatively low charges, adopted by a interval of serious enhance main as much as the 2008 monetary disaster. The disaster itself triggered a dramatic drop in charges, reaching traditionally low ranges within the years following. Extra lately, charges have been on an upward development, influenced by components mentioned beneath.

A comparability of historic charges with the present charge supplies useful context. As an illustration, evaluating the present charge to the typical charge in the course of the housing increase of the mid-2000s or the traditionally low charges of the post-2008 interval highlights the present market’s place inside the broader historic context. This historic perspective helps mood expectations and supplies a practical understanding of the speed’s potential future actions.

Key Components Influencing 30-Yr Mortgage Charges:

A number of intertwined components affect the ebb and circulation of 30-year mortgage charges:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a pivotal position via its financial coverage. By adjusting the federal funds charge (the goal charge banks cost one another for in a single day loans), the Fed influences borrowing prices throughout the financial system, together with mortgage charges. Will increase within the federal funds charge usually result in increased mortgage charges, whereas decreases have the other impact. The Fed’s actions are sometimes guided by its inflation targets, aiming to take care of value stability.

-

Inflation: Excessive inflation erodes buying energy and prompts the Fed to lift rates of interest to chill down the financial system. This, in flip, results in increased mortgage charges. Conversely, low inflation might permit the Fed to take care of or decrease rates of interest, doubtlessly leading to decrease mortgage charges.

-

Financial Progress: Robust financial progress can result in elevated demand for loans, doubtlessly pushing mortgage charges increased. Conversely, weak financial progress might suppress demand, resulting in decrease charges.

-

Authorities Bond Yields: Mortgage charges are sometimes correlated with the yields on authorities bonds, notably 10-year Treasury notes. Modifications in these yields replicate investor sentiment and expectations about future inflation and financial progress. Larger bond yields usually result in increased mortgage charges.

-

Provide and Demand within the Mortgage Market: The general provide and demand dynamics inside the mortgage market itself additionally affect charges. Excessive demand for mortgages, maybe pushed by robust homebuyer sentiment, can push charges upward, whereas decrease demand can have the other impact.

-

International Financial Circumstances: International financial occasions, equivalent to geopolitical instability or worldwide monetary crises, can ripple via the worldwide monetary markets and affect mortgage charges within the US.

Implications for Potential Homebuyers:

Understanding present 30-year mortgage charges and the components driving them is essential for potential homebuyers. Larger charges imply increased month-to-month mortgage funds, doubtlessly decreasing affordability and limiting the buying energy of homebuyers. This could result in decreased demand within the housing market and doubtlessly average value will increase.

Conversely, decrease charges can increase affordability, stimulating demand and doubtlessly resulting in elevated competitors and better residence costs. Homebuyers must fastidiously assess their monetary scenario, contemplating not solely the rate of interest but in addition the general value of homeownership, together with property taxes, insurance coverage, and potential upkeep bills.

Methods for Navigating the Present Market:

Given the dynamic nature of mortgage charges, potential homebuyers ought to undertake a proactive method:

-

Monitor Fee Developments: Usually test respected sources for updates on mortgage charges. This lets you determine potential alternatives and make knowledgeable choices.

-

Enhance Credit score Rating: A better credit score rating can qualify you for decrease rates of interest. Work on enhancing your creditworthiness earlier than making use of for a mortgage.

-

Store Round: Examine charges from a number of lenders to safe the absolute best deal. Do not accept the primary give you obtain.

-

Contemplate Totally different Mortgage Sorts: Discover varied mortgage choices, equivalent to adjustable-rate mortgages (ARMs) or fixed-rate mortgages with totally different phrases, to search out the very best match in your monetary scenario and threat tolerance. Perceive the implications of every sort totally earlier than committing.

-

Safe Pre-Approval: Getting pre-approved for a mortgage demonstrates your monetary readiness to sellers and offers you a clearer image of your borrowing capability.

Conclusion:

The present panorama of 30-year mortgage rates of interest is a posh interaction of financial components. Understanding these components and their affect is crucial for anybody contemplating shopping for a house. By actively monitoring charge tendencies, enhancing credit score scores, procuring round for the very best charges, and understanding totally different mortgage varieties, potential homebuyers can navigate the present market successfully and make knowledgeable choices that align with their monetary targets and long-term aspirations. Keep in mind to seek the advice of with monetary advisors and mortgage professionals for personalised steerage tailor-made to your distinctive circumstances. The data offered on this article is for academic functions solely and shouldn’t be thought-about monetary recommendation.

Closure

Thus, we hope this text has offered useful insights into Navigating the Shifting Sands: A Deep Dive into Present 30-Yr Mortgage Curiosity Charges and Their Implications. We hope you discover this text informative and useful. See you in our subsequent article!