Platinum: A Historic Value Chart and Evaluation

Associated Articles: Platinum: A Historic Value Chart and Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Platinum: A Historic Value Chart and Evaluation. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Platinum: A Historic Value Chart and Evaluation

Platinum, a lustrous, silvery-white metallic, has captivated humanity for hundreds of years, prized not just for its magnificence but in addition for its distinctive properties. In contrast to gold and silver, which have a protracted and wealthy historical past primarily tied to financial use, platinum’s journey is intertwined with industrial purposes, making its value trajectory an enchanting reflection of each financial developments and technological developments. Analyzing a historic value chart of platinum reveals a narrative of booms and busts, influenced by provide constraints, industrial demand, funding sentiment, and world financial occasions.

Early Historical past and Restricted Information:

Monitoring platinum’s value earlier than the Twentieth century is difficult as a consequence of restricted buying and selling and inconsistent reporting. Whereas platinum was identified to pre-Columbian civilizations, its widespread use and buying and selling started a lot later. Early data primarily mirror sporadic transactions and localized costs, making it troublesome to assemble a complete historic value chart extending again centuries. Nevertheless, we will glean some insights from historic accounts. Platinum’s inherent rarity and issue in refining contributed to its initially larger worth relative to gold and silver. Its use in jewellery and specialised purposes, notably in early scientific devices, additional influenced its restricted market and pricing.

Twentieth Century and the Rise of Industrial Demand:

The Twentieth century marks a turning level in platinum’s historical past. Advances in refining methods made it extra accessible, and its distinctive properties – excessive melting level, resistance to corrosion, and catalytic talents – fueled rising industrial demand. This era noticed platinum’s value start to fluctuate extra considerably, reflecting the rising interaction between its industrial and funding markets. The automotive catalytic converter, launched within the Seventies, grew to become a serious driver of platinum demand, considerably impacting its value. Environmental laws mandating catalytic converters in autos worldwide created a considerable and sustained improve in platinum consumption.

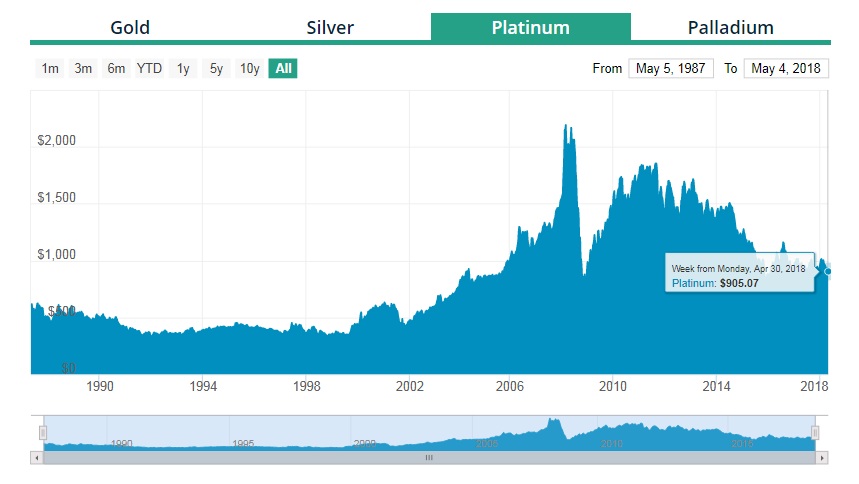

A Glimpse on the Value Chart (Illustrative):

Whereas an in depth numerical chart is past the scope of this textual content, we will describe the final developments noticed in a historic platinum value chart:

- Early to Mid-Twentieth Century: Comparatively steady and low costs, with occasional spikes reflecting localized provide points or elevated industrial use.

- Seventies-Nineteen Eighties: A big upward development pushed by the surge in automotive catalytic converter demand. Value volatility elevated alongside this development.

- Nineteen Nineties: A interval of relative stability, with costs fluctuating round a sure degree, although influenced by broader financial cycles and shifts in industrial demand.

- 2000s: A dramatic value surge pushed by a mixture of things, together with elevated funding demand, industrial development in rising economies, and provide disruptions in main producing international locations like South Africa. This era witnessed important volatility, with sharp value will increase adopted by corrections.

- 2010s: A extra risky decade, influenced by world financial uncertainty, fluctuations in industrial demand (notably from the automotive sector), and the impression of speculative funding.

- 2020s: The COVID-19 pandemic initially triggered a value drop, however a subsequent restoration displays the metallic’s continued significance in varied industries and its perceived worth as a safe-haven asset throughout instances of financial instability. Provide chain points and geopolitical components have additionally performed a task.

Components Influencing Platinum Costs:

A number of key components work together to find out platinum’s value:

- Industrial Demand: The automotive trade stays the most important shopper of platinum, primarily for catalytic converters. Adjustments in car manufacturing, emission laws, and the adoption of different applied sciences considerably impression demand. Different industrial purposes, together with jewellery, electronics, and chemical processes, additionally contribute to general demand.

- Provide: South Africa is the world’s largest producer of platinum, with important manufacturing additionally coming from Russia and Zimbabwe. Mining manufacturing is influenced by components like geological situations, labor prices, political stability, and technological developments in extraction strategies. Provide disruptions, whether or not as a consequence of strikes, political instability, or pure disasters, can considerably impression costs.

- Funding Demand: Platinum is taken into account a treasured metallic and a safe-haven asset, attracting funding throughout instances of financial uncertainty. Funding flows into platinum ETFs (Change Traded Funds) and bodily platinum holdings can affect costs. Speculative buying and selling may also contribute to cost volatility.

- Foreign money Fluctuations: Platinum is priced in US {dollars}, so fluctuations within the worth of the greenback towards different currencies can have an effect on the value for consumers in several international locations.

- Financial Progress: World financial development usually correlates with elevated industrial demand for platinum, pushing costs larger. Recessions or financial slowdowns have a tendency to cut back demand and stress costs downward.

- Technological Developments: The event of different applied sciences, equivalent to electrical autos, might probably cut back platinum demand in the long run, though the impression is advanced and is dependent upon the speed of adoption.

Platinum vs. Different Treasured Metals:

Evaluating platinum’s value chart to these of gold and silver reveals distinct patterns. Whereas all three are influenced by funding sentiment and financial situations, platinum’s value is extra strongly linked to industrial demand than gold, which is extra closely influenced by funding flows and its function as a safe-haven asset. Silver, whereas having some industrial purposes, additionally displays important funding demand. The correlation between platinum and the opposite treasured metals can range over time, reflecting the shifting interaction of provide, demand, and investor sentiment throughout these markets.

Conclusion:

The historic value chart of platinum displays a fancy interaction of commercial demand, provide constraints, funding developments, and world financial occasions. Whereas its value has skilled important volatility, its long-term trajectory has been upward, reflecting its enduring significance in varied industries and its rising attraction as a treasured metallic funding. Understanding the components influencing platinum’s value is essential for traders, industrial customers, and anybody on this fascinating and invaluable metallic. Future value actions will seemingly proceed to be formed by developments in know-how, geopolitical components, and the evolving world financial panorama. Analyzing the historic value chart supplies invaluable context for navigating the complexities of this dynamic market.

Closure

Thus, we hope this text has offered invaluable insights into Platinum: A Historic Value Chart and Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!