Value Chart Surging Sparks: Decoding the Volatility and its Implications

Associated Articles: Value Chart Surging Sparks: Decoding the Volatility and its Implications

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Value Chart Surging Sparks: Decoding the Volatility and its Implications. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Value Chart Surging Sparks: Decoding the Volatility and its Implications

The latest surge in varied worth charts throughout various markets – from cryptocurrencies and equities to commodities and actual property – has ignited a wave of hypothesis, anxiousness, and intense debate amongst traders and analysts. This volatility, characterised by speedy and vital worth will increase, calls for a cautious examination of the underlying elements, potential penalties, and strategic responses for navigating this turbulent panorama. Whereas the specifics differ relying on the asset class, a number of widespread threads weave via these surging worth charts, providing useful insights into the present financial and market dynamics.

Understanding the Surge: A Multifaceted Phenomenon

The present worth surges should not a monolithic occasion however somewhat a confluence of a number of interconnected elements:

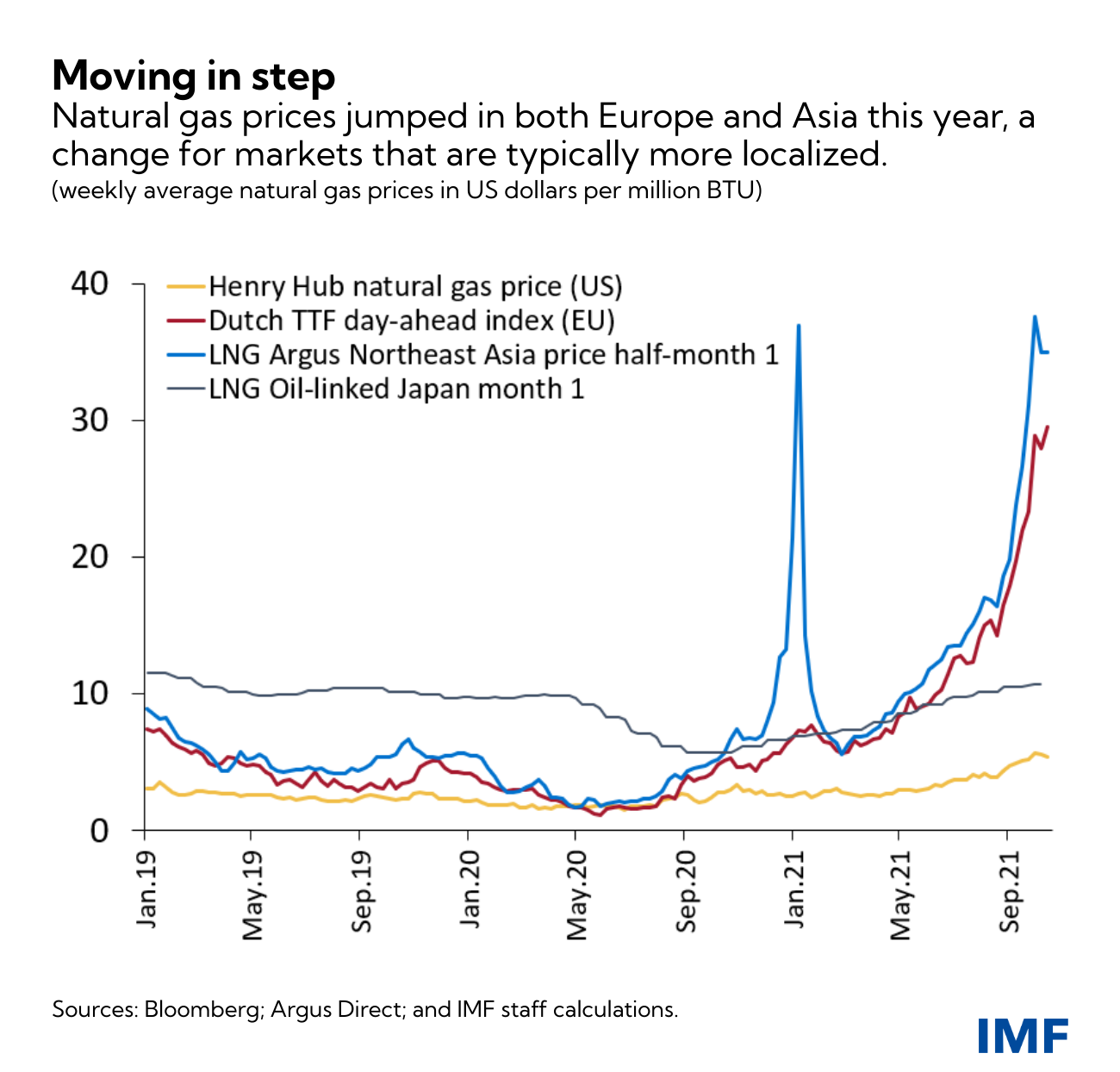

1. Inflationary Pressures and Financial Coverage: The lingering results of inflation, pushed by provide chain disruptions, geopolitical instability, and elevated power prices, have performed a major position. Central banks globally have responded with rate of interest hikes to curb inflation, however these actions have had combined outcomes. Larger rates of interest, whereas aiming to chill down the financial system, may create uncertainty and doubtlessly set off a flight to belongings perceived as secure havens, inadvertently pushing up costs in sure sectors. The timing and effectiveness of those financial coverage changes stay a key determinant of future worth actions.

2. Geopolitical Uncertainty and Provide Chain Disruptions: The continued struggle in Ukraine, coupled with escalating tensions in different areas, continues to disrupt international provide chains and gasoline uncertainty. This uncertainty results in elevated volatility as traders react to evolving geopolitical dangers. Particular commodities, like power and sure metals, are instantly impacted by these disruptions, resulting in vital worth will increase. The ripple impact extends past these instantly affected sectors, influencing broader market sentiment and investor habits.

3. Technological Developments and Innovation: Technological breakthroughs, notably in areas like synthetic intelligence (AI) and renewable power, have sparked vital investor curiosity. Corporations main the cost in these sectors are experiencing substantial valuation will increase, driving up their inventory costs. This surge displays a rising perception within the transformative potential of those applied sciences and their means to reshape varied industries. Nevertheless, it additionally carries the danger of a speculative bubble if valuations outpace the precise technological progress.

4. Shifting Investor Sentiment and Speculative Bubbles: Investor psychology performs an important position in driving worth surges. Durations of optimism and FOMO (concern of lacking out) can result in a speedy inflow of capital into particular belongings, pushing costs past their elementary worth. This speculative habits can create bubbles, characterised by unsustainable worth will increase that finally burst, leading to vital market corrections. Figuring out the indicators of speculative bubbles is essential for mitigating potential losses.

5. Fiscal Stimulus and Authorities Spending: Authorities spending packages, designed to stimulate financial progress and deal with particular challenges, may contribute to cost will increase. These packages can inject vital quantities of capital into the financial system, growing demand and doubtlessly driving up costs for items and companies. The effectiveness and sustainability of those fiscal measures are important elements in figuring out the long-term affect on worth stability.

Sector-Particular Analyses: Divergent Developments

Whereas the elements talked about above contribute to total market volatility, the specifics of worth surges differ significantly throughout completely different sectors:

-

Cryptocurrencies: The cryptocurrency market stays extremely risky, pushed by speculative buying and selling, regulatory uncertainty, and technological developments. Value surges are sometimes fueled by hype cycles and social media developments, highlighting the numerous affect of sentiment and hypothesis on this asset class.

-

Equities: The fairness market has witnessed a combined efficiency, with sure sectors experiencing vital positive aspects whereas others stay comparatively stagnant. Development shares, notably these in expertise and AI, have seen substantial worth will increase, reflecting investor optimism about future progress prospects. Worth shares, however, have exhibited extra average progress.

-

Commodities: Commodities, together with power, metals, and agricultural merchandise, have skilled vital worth fluctuations resulting from provide chain disruptions, geopolitical occasions, and altering international demand. The value of oil, for example, has been extremely risky as a result of struggle in Ukraine and OPEC+ manufacturing choices.

-

Actual Property: The actual property market has seen various developments relying on location and property sort. Rate of interest hikes have dampened demand in some areas, main to cost stabilization and even declines. Nevertheless, in sure markets with restricted provide and powerful demand, costs proceed to rise.

Navigating the Volatility: Methods for Traders

The present market atmosphere calls for a cautious and strategic method from traders. Listed here are some key issues:

-

Diversification: Diversifying investments throughout completely different asset lessons and sectors is essential to mitigate threat and scale back the affect of volatility in any single market.

-

Danger Administration: Implementing sturdy threat administration methods, together with setting stop-loss orders and defining acceptable ranges of threat, is crucial to guard capital during times of excessive volatility.

-

Elementary Evaluation: Specializing in elementary evaluation, which includes assessing the intrinsic worth of an asset based mostly on its underlying monetary efficiency, can assist traders establish undervalued belongings and keep away from speculative bubbles.

-

Lengthy-Time period Perspective: Sustaining a long-term funding horizon is essential to weathering short-term market fluctuations. Specializing in long-term progress potential somewhat than short-term worth actions can assist traders make knowledgeable choices.

-

Skilled Recommendation: In search of recommendation from certified monetary advisors can present useful insights and steerage in navigating the complexities of the present market atmosphere.

Conclusion: A Time for Prudence and Strategic Planning

The surging worth charts throughout varied markets replicate a posh interaction of financial, geopolitical, and technological elements. Whereas these surges can current alternatives for traders, in addition they carry vital dangers. Navigating this risky panorama requires a cautious method, a concentrate on diversification and threat administration, and a transparent understanding of the underlying drivers of worth actions. By adopting a long-term perspective and in search of skilled recommendation when obligatory, traders can place themselves to climate the present volatility and capitalize on future alternatives. The important thing takeaway is that prudence and strategic planning are paramount on this dynamic and unsure market atmosphere. The longer term stays unpredictable, however by understanding the forces at play, traders can enhance their possibilities of success.

:max_bytes(150000):strip_icc()/OptionPrice-VolatilityRelationship_AvoidingNegativeSurprises2-7c29ee4470f64718b957ff917e9380c1.png)

Closure

Thus, we hope this text has supplied useful insights into Value Chart Surging Sparks: Decoding the Volatility and its Implications. We admire your consideration to our article. See you in our subsequent article!