Reaching New Heights: A Deep Dive into File-Breaking S&P 500 and Dow Jones Industrial Common Charts

Associated Articles: Reaching New Heights: A Deep Dive into File-Breaking S&P 500 and Dow Jones Industrial Common Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Reaching New Heights: A Deep Dive into File-Breaking S&P 500 and Dow Jones Industrial Common Charts. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Reaching New Heights: A Deep Dive into File-Breaking S&P 500 and Dow Jones Industrial Common Charts

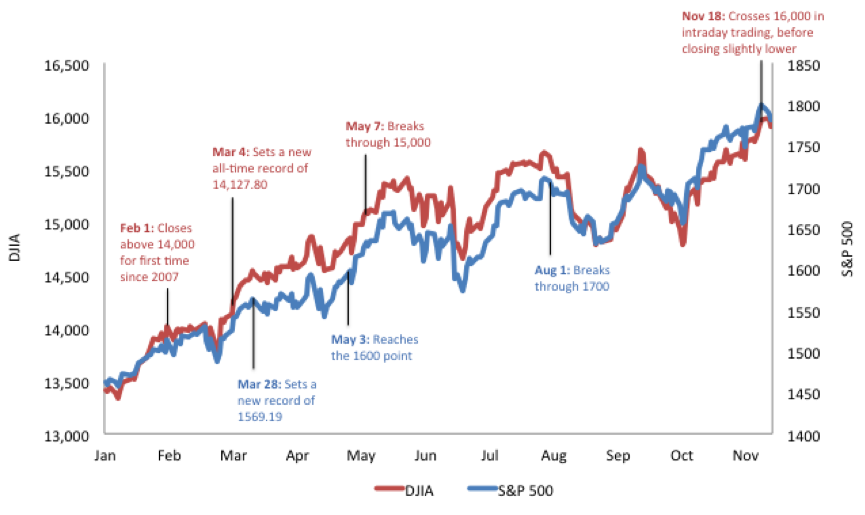

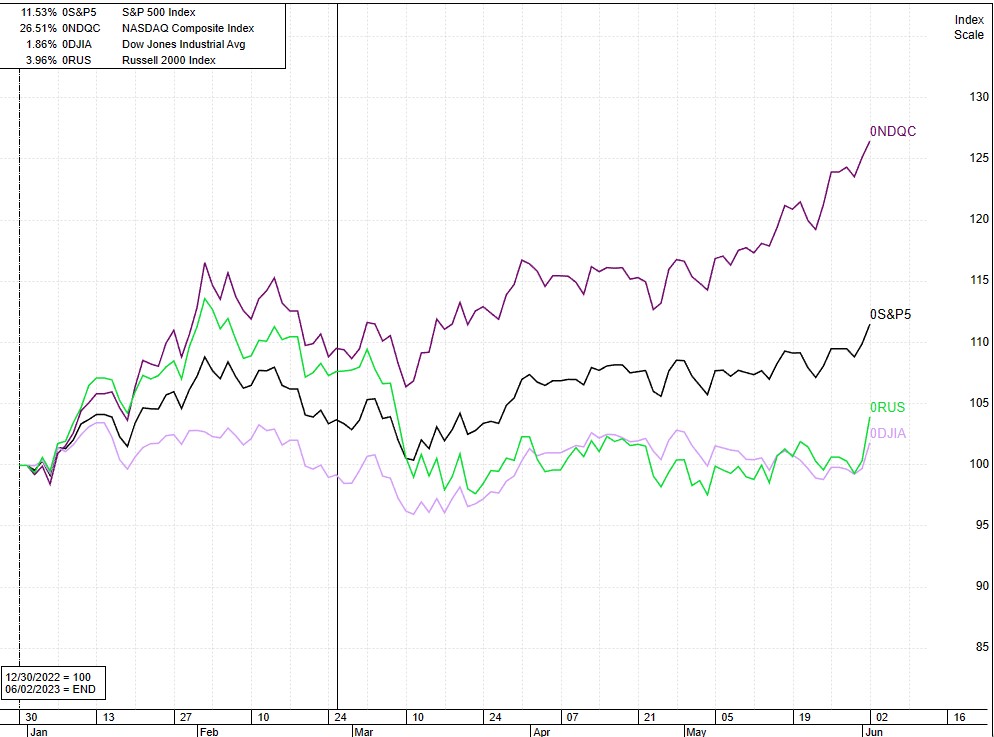

The S&P 500 and the Dow Jones Industrial Common (DJIA) are two of essentially the most carefully watched inventory market indices globally. Their efficiency serves as a barometer of the general well being of the US economic system and displays investor sentiment concerning the long run. Through the years, each indices have scaled unprecedented heights, hitting report highs quite a few occasions, every milestone marking a big chapter within the historical past of the American monetary market. Analyzing these record-breaking charts reveals essential insights into market developments, financial cycles, and the forces driving funding selections.

This text delves into the historic efficiency of the S&P 500 and the Dow, specializing in their report highs, the elements contributing to those achievements, and the implications for buyers. We’ll discover the charts, inspecting the intervals of sustained development, the abrupt corrections, and the long-term developments which have formed these iconic indices.

The Dow Jones Industrial Common: A Century of Milestones

The DJIA, first calculated in 1896, represents 30 massive, publicly-owned corporations actively traded on the New York Inventory Change (NYSE) and Nasdaq. Its historical past is a captivating narrative of commercial development, technological developments, and financial fluctuations. Monitoring its report highs offers a compelling image of the evolution of the American economic system.

The early many years noticed comparatively modest development, punctuated by intervals of stagnation and even decline throughout financial downturns. The post-World Warfare II period witnessed a interval of sustained enlargement, fueled by a booming economic system and widespread prosperity. The Eighties and Nineteen Nineties have been marked by vital technological developments, notably within the computing and communications sectors, which propelled the Dow to new heights. The dot-com increase of the late Nineteen Nineties, nevertheless, was adopted by a pointy correction, highlighting the inherent volatility of the market.

The twenty first century has witnessed intervals of each distinctive development and vital setbacks. The 2008 monetary disaster led to a dramatic plunge within the Dow, underscoring the interconnectedness of the worldwide monetary system. The following restoration, nevertheless, has been outstanding, with the index reaching new report highs repeatedly, pushed by elements comparable to quantitative easing, low rates of interest, and the expansion of the expertise sector. Analyzing the chart reveals clear correlations between financial development, technological innovation, and investor confidence in driving these report highs. Learning the intervals of consolidation and correction following these highs offers precious insights into threat administration and market timing.

The S&P 500: A Broader Perspective

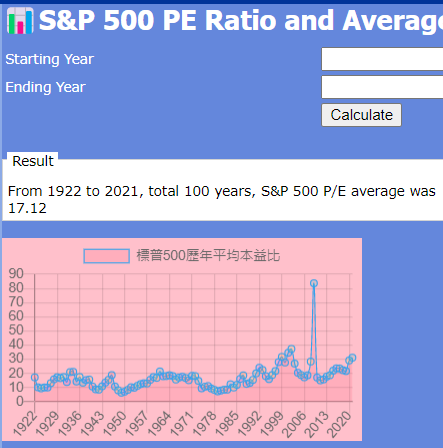

The S&P 500, representing 500 large-cap corporations listed on US inventory exchanges, offers a broader perspective on the US fairness market than the Dow. Its composition, encompassing a wider vary of sectors, makes it a extra complete indicator of general market efficiency. The S&P 500’s historical past additionally displays the evolution of the American economic system, however with a better emphasis on the diversification of the market.

Much like the Dow, the S&P 500’s report highs replicate intervals of sustained financial enlargement, technological innovation, and investor confidence. Nevertheless, the S&P 500’s broader illustration gives a extra nuanced image of market efficiency, capturing the expansion of assorted sectors past the 30 corporations represented within the Dow. The chart reveals the impression of main financial occasions, comparable to recessions and geopolitical instability, on the general market. Moreover, analyzing the relative efficiency of various sectors inside the S&P 500 in periods main as much as report highs offers precious insights into market dynamics and sector rotation.

Components Driving File Highs: A Multifaceted Evaluation

A number of interconnected elements contribute to the record-breaking efficiency of each the S&P 500 and the Dow. These embody:

-

Financial Development: Sturdy financial development, characterised by low unemployment, rising client spending, and strong company income, is a main driver of inventory market beneficial properties. Durations of sustained financial enlargement usually coincide with report highs in each indices.

-

Technological Innovation: Technological breakthroughs have constantly fueled market development. The rise of the web, the cell revolution, and the continued developments in synthetic intelligence have created vital alternatives for corporations and buyers alike, resulting in substantial beneficial properties within the inventory market.

-

Financial Coverage: Central financial institution insurance policies, notably rate of interest selections, play an important position in shaping market sentiment and driving funding flows. Low rates of interest typically stimulate borrowing and funding, contributing to increased inventory costs. Conversely, rate of interest hikes can dampen market enthusiasm.

-

Investor Sentiment: Investor confidence and expectations concerning future financial development are highly effective determinants of inventory costs. Durations of optimism and bullish sentiment are inclined to push the market to new highs.

-

Geopolitical Occasions: World political and financial occasions can considerably impression market efficiency. Durations of geopolitical stability are inclined to help market development, whereas uncertainty and instability can result in market corrections.

Decoding the Charts: Implications for Buyers

Analyzing the historic charts of the S&P 500 and the Dow is essential for buyers to grasp market cycles, establish developments, and make knowledgeable funding selections. Whereas previous efficiency just isn’t indicative of future outcomes, learning these charts offers precious context for assessing present market circumstances and anticipating potential future actions.

Buyers ought to be conscious that market highs are sometimes adopted by intervals of correction and even decline. Understanding the cyclical nature of the market is important for managing threat and growing a long-term funding technique. Diversification, strategic asset allocation, and a disciplined strategy to investing are essential for navigating the inherent volatility of the market.

Conclusion:

The report highs achieved by the S&P 500 and the Dow Jones Industrial Common signify vital milestones within the historical past of the US inventory market. Analyzing these charts, factoring within the interaction of financial development, technological innovation, financial coverage, investor sentiment, and geopolitical occasions, offers a complete understanding of the forces shaping market efficiency. Whereas predicting the long run is inconceivable, learning these historic developments equips buyers with the information and perspective wanted to navigate the complexities of the market and make knowledgeable funding selections, aiming to profit from future report highs whereas managing potential dangers. The journey to new heights continues, and understanding the previous is essential to navigating the way forward for these iconic indices.

:max_bytes(150000):strip_icc()/GettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg)

Closure

Thus, we hope this text has supplied precious insights into Reaching New Heights: A Deep Dive into File-Breaking S&P 500 and Dow Jones Industrial Common Charts. We hope you discover this text informative and useful. See you in our subsequent article!