Silver’s Recessionary Dance: A Chart-Pushed Evaluation of Value Efficiency

Associated Articles: Silver’s Recessionary Dance: A Chart-Pushed Evaluation of Value Efficiency

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Silver’s Recessionary Dance: A Chart-Pushed Evaluation of Value Efficiency. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Silver’s Recessionary Dance: A Chart-Pushed Evaluation of Value Efficiency

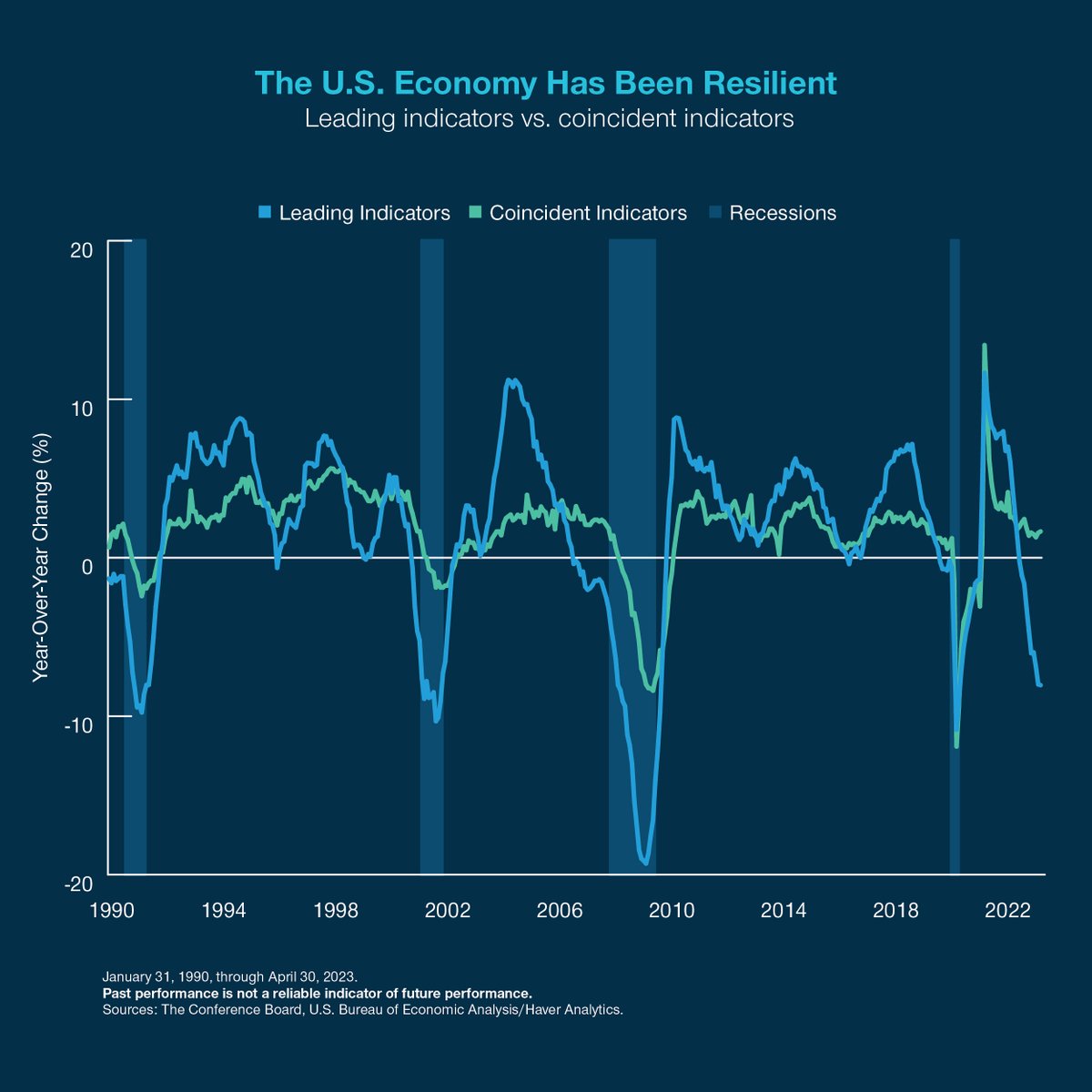

The shimmering attract of silver, a valuable steel prized for its industrial and funding purposes, has lengthy captivated traders. Its value, nevertheless, is way from predictable, usually exhibiting risky swings influenced by a posh interaction of financial elements, industrial demand, and speculative buying and selling. One significantly compelling space of examine is the connection between silver costs and financial recessions. Does silver act as a secure haven throughout financial downturns, mirroring gold’s efficiency, or does its industrial sensitivity outweigh its safe-haven enchantment, main to cost declines throughout recessions? This text delves into this query, analyzing historic knowledge and charting silver’s efficiency towards the backdrop of previous recessions to uncover potential correlations and predictive energy.

Understanding the Twin Nature of Silver:

Not like gold, which primarily serves as a retailer of worth and inflation hedge, silver possesses a twin nature. A good portion of silver demand stems from its industrial purposes, together with electronics, photo voltaic panels, pictures, and jewellery. This industrial demand element makes silver extra vulnerable to cyclical financial fluctuations. Throughout financial expansions, sturdy industrial exercise fuels increased silver demand, pushing costs upward. Conversely, throughout recessions, lowered industrial manufacturing and weakened client spending can result in a decline in silver demand, doubtlessly miserable costs.

Nonetheless, silver additionally reveals safe-haven traits. In periods of financial uncertainty and market turmoil, traders usually search refuge in valuable metals, together with silver, perceiving them as a retailer of worth that may retain its buying energy even throughout financial downturns. This safe-haven demand can act as a counterbalance to the detrimental influence of lowered industrial demand.

Charting the Course: Silver Costs and Recessions (2000-Current):

For example the connection between silver costs and recessions, let’s analyze the interval from 2000 to the current. This timeframe encompasses a number of important financial downturns, offering ample knowledge for evaluation. We’ll think about the next recessions:

- The Dot-com Bubble Burst (2001): This recession was characterised by a pointy decline in expertise shares and a slowdown in funding.

- The Nice Recession (2008-2009): This was a extreme international monetary disaster triggered by the subprime mortgage disaster.

- The COVID-19 Recession (2020): A novel recession brought on by a worldwide pandemic, characterised by unprecedented financial shutdowns and provide chain disruptions.

(Insert a chart right here exhibiting silver costs (e.g., month-to-month common) overlaid with shaded recessionary durations. The chart ought to clearly mark the beginning and finish dates of every recession. Knowledge sources ought to be cited, e.g., London Bullion Market Affiliation (LBMA), Buying and selling Economics.)

Analyzing the Chart:

A visible inspection of the chart reveals a blended relationship between silver costs and recessions. Whereas the chart could not present a constant sample of value will increase throughout each recession, a number of key observations will be made:

-

The Dot-com Bubble Burst (2001): Silver costs skilled a reasonable decline throughout this recession, reflecting the weakened industrial demand within the expertise sector. Nonetheless, the decline was much less pronounced in comparison with the broader market downturn, hinting at some safe-haven demand.

-

The Nice Recession (2008-2009): This recession noticed a major drop in silver costs, mirroring the general market crash. The extreme contraction in industrial exercise and investor panic overshadowed any safe-haven demand for silver. Nonetheless, it is essential to notice that the restoration in silver costs was comparatively swift in comparison with different asset lessons.

-

The COVID-19 Recession (2020): Initially, silver costs skilled a pointy decline alongside different commodities as a result of financial uncertainty and lockdowns. Nonetheless, the next restoration was remarkably robust, fueled by each elevated safe-haven demand and a restoration in industrial exercise (albeit uneven) as economies reopened. This means a extra pronounced safe-haven impact in comparison with the 2008 disaster.

Components Influencing Silver’s Efficiency Throughout Recessions:

A number of elements past the easy recessionary setting affect silver’s value efficiency:

-

Industrial Demand: The power and resilience of commercial sectors consuming silver play a vital function. Throughout recessions, industries with excessive silver utilization (electronics, photo voltaic) can expertise various levels of influence, affecting demand.

-

Inflationary Pressures: Recessions can typically be accompanied by inflationary pressures, particularly if governments implement expansionary financial insurance policies. Silver, like gold, can act as a hedge towards inflation, driving up its value.

-

Investor Sentiment: Investor confidence and danger urge for food considerably influence silver costs. Throughout occasions of financial uncertainty, traders could flock to safe-haven belongings like silver, boosting its value. Conversely, detrimental sentiment can result in sell-offs.

-

Financial Coverage: Central financial institution actions, corresponding to rate of interest adjustments and quantitative easing, can affect silver costs not directly by affecting the general financial setting and the relative attractiveness of varied asset lessons.

-

Geopolitical Components: International political instability and provide chain disruptions may also affect silver costs, typically no matter the prevailing financial situations.

Predictive Energy and Funding Implications:

Whereas the connection between silver costs and recessions is not completely linear, analyzing historic knowledge offers precious insights. The chart evaluation means that silver’s efficiency throughout recessions is influenced by the interaction of commercial demand, inflation, investor sentiment, and financial coverage. Due to this fact, merely utilizing previous recessionary patterns to foretell future silver value actions is unreliable.

Nonetheless, understanding the elements influencing silver’s value might help traders make extra knowledgeable selections. Throughout a recession, traders may think about the next:

-

Diversification: Together with silver in a diversified portfolio can doubtlessly cut back general portfolio danger, as its value actions could not completely correlate with different asset lessons.

-

Danger Tolerance: Traders with the next danger tolerance may think about rising their silver allocation throughout a recession, anticipating a possible restoration in value.

-

Lengthy-Time period Perspective: Investing in silver requires a long-term perspective, as short-term value volatility will be important.

Conclusion:

The connection between silver costs and recessions is complicated and multifaceted. Whereas silver reveals each industrial and safe-haven traits, its value efficiency throughout recessions is not persistently predictable. The interaction of varied financial and geopolitical elements determines its value trajectory. An intensive understanding of those elements, coupled with a diversified funding technique and a long-term perspective, is essential for traders navigating the risky world of valuable metals throughout financial downturns. Additional analysis, incorporating extra refined econometric fashions and contemplating different macroeconomic indicators, may present a extra nuanced understanding of this intricate relationship. Nonetheless, the historic knowledge introduced right here gives a precious start line for traders in search of to know silver’s function of their portfolios throughout occasions of financial uncertainty.

Closure

Thus, we hope this text has supplied precious insights into Silver’s Recessionary Dance: A Chart-Pushed Evaluation of Value Efficiency. We admire your consideration to our article. See you in our subsequent article!