The Adam and Eve Chart Sample: A Detailed Evaluation of a Highly effective Reversal Sign

Associated Articles: The Adam and Eve Chart Sample: A Detailed Evaluation of a Highly effective Reversal Sign

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Adam and Eve Chart Sample: A Detailed Evaluation of a Highly effective Reversal Sign. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

The Adam and Eve Chart Sample: A Detailed Evaluation of a Highly effective Reversal Sign

The Adam and Eve chart sample, a uncommon and highly effective reversal formation, holds vital weight in technical evaluation. In contrast to extra frequent patterns like head and shoulders or double tops/bottoms, its distinct traits and fewer frequent look make it a compelling sign for astute merchants. This text will delve into the intricacies of the Adam and Eve sample, exploring its formation, identification, affirmation methods, and potential pitfalls. We’ll additionally analyze real-world examples and focus on the best way to incorporate this highly effective software right into a complete buying and selling technique.

Understanding the Formation:

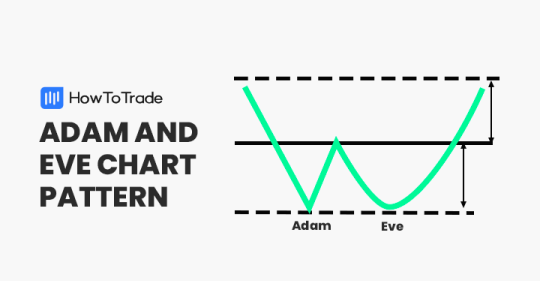

The Adam and Eve sample is a double backside formation, however with an important distinction: the 2 bottoms will not be similar. As an alternative, it resembles two distinct troughs, with the second "Eve" backside considerably decrease than the primary "Adam" backside. This asymmetry is essential to its predictive energy. Let’s break down the parts:

-

Adam (First Backside): That is the preliminary trough within the worth motion. It signifies a big decline within the asset’s worth, typically preceded by a downward pattern. The Adam backside usually types after a interval of bearish momentum, representing a possible exhaustion of promoting strain. It is characterised by a comparatively rounded backside, not a pointy V-shaped reversal.

-

The Rising Neckline: After the Adam backside, the value begins to rebound, forming a rising neckline. This neckline is a vital factor of the sample. It is a connecting line drawn between the highs fashioned through the worth restoration after the Adam backside and the following decline. The neckline acts as a assist stage through the formation and later as a resistance stage as soon as the sample is full.

-

Eve (Second Backside): Following the rise, the value experiences one other decline, forming the second backside, "Eve." This backside is usually decrease than the Adam backside, creating the asymmetry that distinguishes this sample. The depth of the Eve backside is a key consider figuring out the potential magnitude of the following worth enhance.

-

The Breakout: The essential second arrives when the value decisively breaks above the rising neckline. This breakout confirms the Adam and Eve sample and alerts a possible bullish reversal. The energy of the breakout, measured by the quantity and worth momentum, reinforces the sign’s reliability.

Figuring out the Adam and Eve Sample:

Figuring out the Adam and Eve sample requires cautious statement and understanding of worth motion. Listed here are some key traits to search for:

- Asymmetry: An important function is the asymmetry between the Adam and Eve bottoms. Eve ought to be considerably decrease than Adam.

- Rounded Bottoms: Each Adam and Eve bottoms ought to have comparatively rounded shapes, indicating a gradual change in momentum. Sharp V-shaped bottoms are much less indicative of this sample.

- Clear Neckline: A well-defined rising neckline is important. The road ought to join the highs fashioned through the worth restoration after Adam and the following decline earlier than Eve.

- Quantity Affirmation: Elevated quantity through the breakout above the neckline confirms the sample’s validity and strengthens the bullish sign. Conversely, low quantity breakouts ought to be handled with warning.

- Timeframe: The sample can kind on numerous timeframes, from short-term (e.g., hourly) to long-term (e.g., month-to-month) charts. The timeframe influences the potential length and magnitude of the following worth motion.

Affirmation Methods:

Whereas the breakout above the neckline is the first affirmation, merchants ought to make use of extra affirmation methods to scale back threat:

- Transferring Averages: A bullish crossover of short-term and long-term shifting averages after the breakout strengthens the bullish sign.

- RSI (Relative Energy Index): An RSI studying above 50 after the breakout suggests rising bullish momentum.

- MACD (Transferring Common Convergence Divergence): A bullish MACD crossover after the breakout reinforces the bullish sign.

- Assist Ranges: The neckline itself ought to act as assist after the breakout. A retest and bounce off this stage additional confirms the sample’s validity.

Potential Pitfalls and Concerns:

Whereas the Adam and Eve sample is a strong indicator, it isn’t foolproof. Merchants ought to pay attention to potential pitfalls:

- False Breakouts: The worth may break above the neckline solely to reverse shortly afterward. This can be a false breakout, and merchants ought to use stop-loss orders to mitigate losses.

- Lack of Quantity Affirmation: A breakout with low quantity weakens the sign’s reliability.

- Subjectivity in Identification: Drawing the neckline could be subjective, resulting in totally different interpretations of the sample.

- Market Context: The sample’s effectiveness depends upon the broader market context. A bearish market may negate the bullish sign.

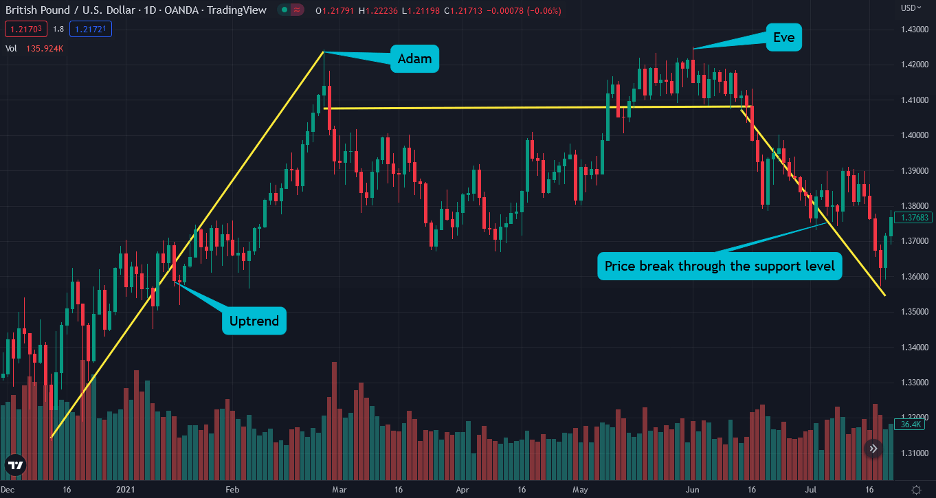

Actual-World Examples:

Analyzing historic charts of varied belongings will reveal situations of the Adam and Eve sample. Nonetheless, it is essential to do not forget that previous efficiency shouldn’t be indicative of future outcomes. Detailed evaluation of particular examples, together with quantity knowledge and different technical indicators, is important for correct interpretation.

Incorporating right into a Buying and selling Technique:

The Adam and Eve sample ought to be built-in right into a complete buying and selling technique, not utilized in isolation. Merchants ought to mix this sample with different technical indicators, basic evaluation, and threat administration methods. A well-defined threat administration plan, together with stop-loss orders and place sizing, is essential to mitigate potential losses.

Conclusion:

The Adam and Eve chart sample is a strong reversal sign, nevertheless it requires cautious statement, affirmation, and a sound buying and selling technique. Its rarity and the necessity for exact identification make it a software greatest fitted to skilled merchants. By understanding its formation, affirmation methods, and potential pitfalls, merchants can leverage this sample to boost their buying and selling selections and doubtlessly capitalize on vital worth actions. Keep in mind at all times to follow accountable threat administration and mix the Adam and Eve sample with different types of evaluation for a extra complete buying and selling method. Diligent analysis and follow are key to mastering this complicated but rewarding chart sample.

Closure

Thus, we hope this text has offered invaluable insights into The Adam and Eve Chart Sample: A Detailed Evaluation of a Highly effective Reversal Sign. We thanks for taking the time to learn this text. See you in our subsequent article!