The Apple Inventory Chart of 2000: A Case Research in Pre-iPhone Volatility

Associated Articles: The Apple Inventory Chart of 2000: A Case Research in Pre-iPhone Volatility

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Apple Inventory Chart of 2000: A Case Research in Pre-iPhone Volatility. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

The Apple Inventory Chart of 2000: A Case Research in Pre-iPhone Volatility

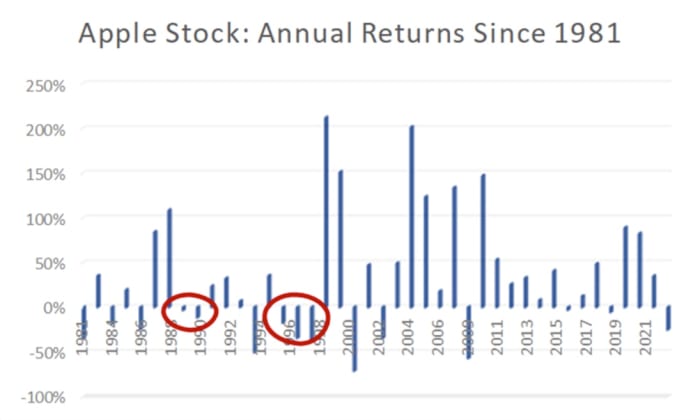

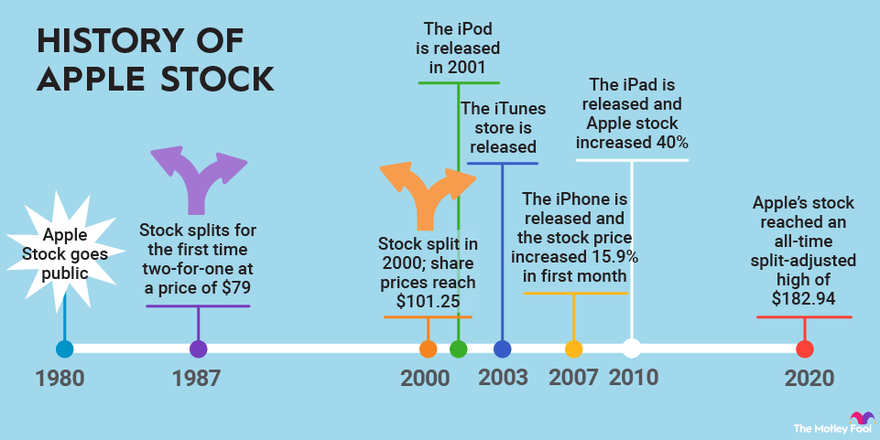

The 12 months 2000 stands as a pivotal second within the historical past of Apple Pc, Inc. (AAPL), a 12 months etched within the reminiscence of buyers as one in all important volatility and uncertainty. Analyzing the Apple inventory market chart for 2000 reveals a narrative of battle, pre-existing anxieties, and the seeds of future triumph, all set in opposition to the backdrop of the dot-com bubble burst. Understanding this era requires not solely analyzing the inventory’s value actions but additionally contextualizing them inside the broader technological and financial panorama of the time.

The Pre-2000 Panorama: A Firm on the Brink

Earlier than diving into the 2000 chart, it is essential to grasp the precarious place Apple occupied. Whereas the corporate had achieved iconic standing with merchandise just like the Macintosh, it was removed from the dominant pressure it’s right now. The late Nineties noticed a sequence of missteps and inside struggles. Competitors from Home windows-based PCs was fierce, and Apple’s market share was dwindling. The corporate was tormented by inside disagreements, a scarcity of clear product technique, and a struggling monetary efficiency. Steve Jobs, who had been ousted in 1985, returned to the corporate in 1997, initiating a turnaround that might finally rewrite Apple’s historical past, however in 2000, this turnaround was nonetheless in its early, unsure phases.

The 2000 Chart: A Rollercoaster Experience

The Apple inventory chart for 2000 displays this precarious state of affairs. The 12 months started with the inventory buying and selling at a comparatively low value, reflecting the corporate’s general struggles. The preliminary months confirmed a level of stability, with the worth fluctuating inside a comparatively slim vary. Nonetheless, this obvious calm was misleading. The underlying points inside Apple, coupled with the broader financial anxieties surrounding the dot-com bubble, created a unstable atmosphere.

The dot-com bubble, characterised by inflated valuations of internet-based corporations, reached its peak in early 2000. The following burst had a ripple impact throughout the complete tech sector, impacting even corporations that weren’t straight concerned within the web growth. Apple, regardless of its efforts to reposition itself, wasn’t resistant to this detrimental sentiment.

Because the 12 months progressed, the Apple inventory chart reveals a sequence of dramatic swings. Durations of slight development have been punctuated by sharp declines, reflecting investor uncertainty and the general market turmoil. Information cycles performed a big position in shaping these fluctuations. Optimistic bulletins about new merchandise or strategic partnerships might briefly enhance the inventory value, however these positive aspects have been usually short-lived, as detrimental information or broader market anxieties rapidly eroded investor confidence.

The shortage of a really groundbreaking product in 2000 additional exacerbated the state of affairs. Whereas Apple launched incremental updates to current product strains, it lacked the sort of transformative product that might dramatically shift market notion and investor sentiment. This contrasted sharply with the explosive development skilled by a few of its rivals, fueling additional considerations about Apple’s future.

Key Elements Influencing the 2000 Chart:

A number of elements contributed to the volatility depicted within the Apple inventory chart of 2000:

- The Dot-Com Bubble Burst: The bursting of the dot-com bubble created a local weather of worry and uncertainty within the expertise sector, resulting in widespread sell-offs. Apple, as a expertise firm, was straight impacted by this broader market development.

- Lack of a Defining Product: Whereas Apple was making progress underneath Steve Jobs’ management, it lacked a really revolutionary product in 2000 that might drive important development and investor confidence. The iMac, whereas profitable, wasn’t sufficient to totally alleviate considerations.

- Competitors: The aggressive panorama remained difficult. Microsoft continued to dominate the working system market, whereas different PC producers provided more and more aggressive merchandise.

- Monetary Efficiency: Apple’s monetary efficiency remained fragile all year long, additional fueling investor anxieties. The corporate was nonetheless struggling to attain profitability and sustainable development.

- Investor Sentiment: Investor sentiment was extremely unstable, reflecting the general uncertainty surrounding the expertise sector and Apple’s future prospects. Damaging information or perceived setbacks might set off sharp drops within the inventory value.

Analyzing the Chart’s Technical Facets:

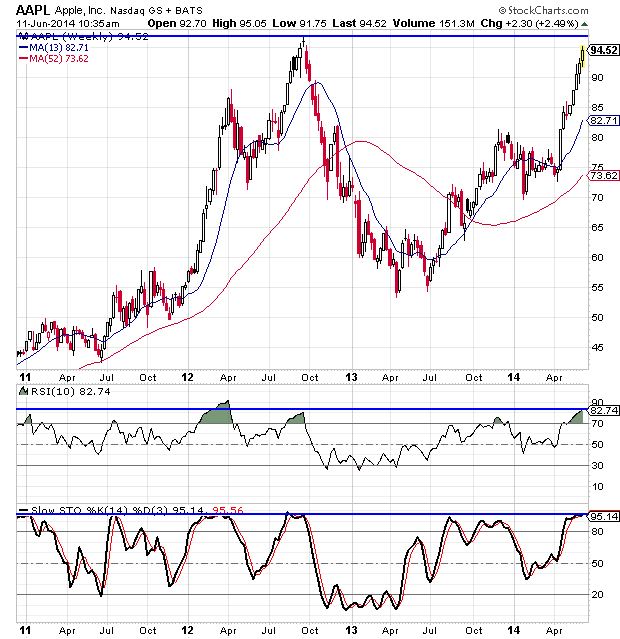

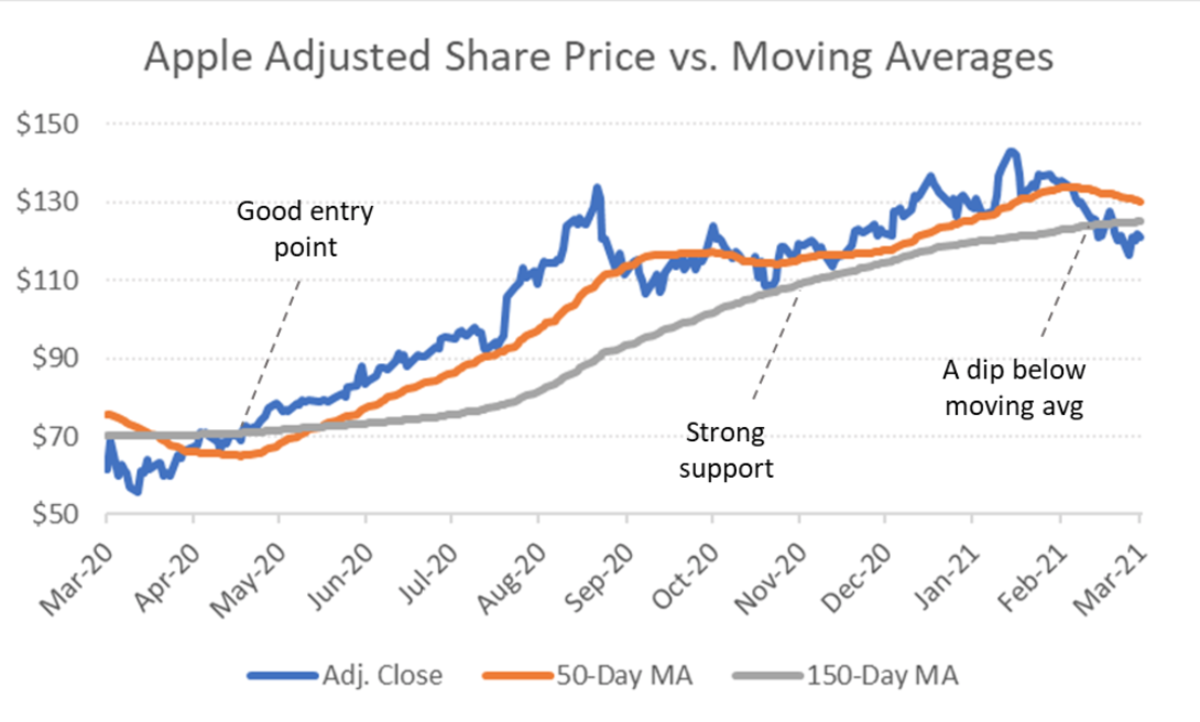

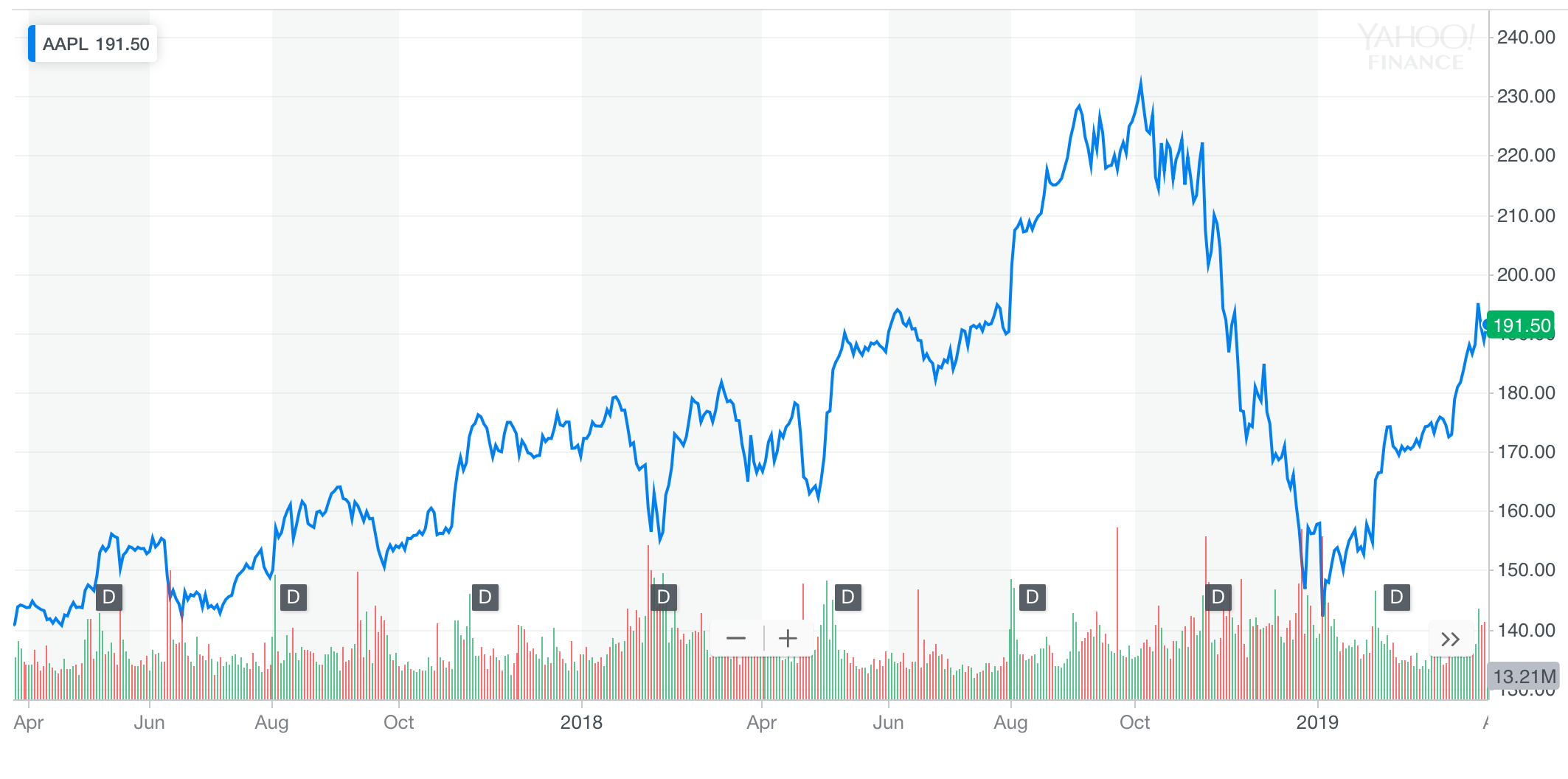

A technical evaluation of the Apple inventory chart for 2000 would reveal a number of key traits:

- Excessive Volatility: The chart shows important value fluctuations, indicating a excessive diploma of volatility. This volatility displays the uncertainty surrounding Apple’s future and the broader market circumstances.

- Lack of Clear Development: The chart would not present a transparent upward or downward development. As a substitute, it reveals a sequence of unpredictable swings, reflecting the dearth of a constant optimistic or detrimental catalyst.

- Assist and Resistance Ranges: Technical analysts might establish potential assist and resistance ranges on the chart, representing value factors the place shopping for or promoting strain was notably robust. These ranges may very well be used to foretell future value actions, though the excessive volatility of the interval makes such predictions inherently unsure.

The Lengthy-Time period Perspective:

Trying again from right now’s perspective, the Apple inventory chart of 2000 may seem as a interval of relative insignificance in comparison with the corporate’s later, explosive development. Nonetheless, it is essential to acknowledge that this era laid the groundwork for Apple’s future success. The challenges confronted in 2000 pressured the corporate to adapt, innovate, and in the end emerge stronger.

The teachings realized throughout this era of volatility have been invaluable. They emphasised the significance of product innovation, robust management, and a transparent strategic imaginative and prescient. The seeds of future triumphs, such because the iPod and the iPhone, have been already being sown in 2000, even when their affect wasn’t but obvious to many buyers.

Conclusion:

The Apple inventory market chart for 2000 is a compelling case examine within the complexities of investing in a unstable market and the challenges confronted by even probably the most iconic corporations. Whereas the 12 months itself was marked by uncertainty and important value swings, it in the end served as an important stepping stone on the trail to Apple’s unprecedented success within the years that adopted. Understanding this era requires appreciating the broader financial context, the inner struggles inside Apple, and the seeds of innovation that have been quietly being planted, setting the stage for the technological revolution that might outline the following decade. The chart serves as a strong reminder that even seemingly insurmountable challenges can pave the way in which for exceptional future development.

Closure

Thus, we hope this text has offered beneficial insights into The Apple Inventory Chart of 2000: A Case Research in Pre-iPhone Volatility. We hope you discover this text informative and useful. See you in our subsequent article!