The Chart of Accounts: A Complete Information to Monetary Group

Associated Articles: The Chart of Accounts: A Complete Information to Monetary Group

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to The Chart of Accounts: A Complete Information to Monetary Group. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

The Chart of Accounts: A Complete Information to Monetary Group

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured checklist of all of the accounts utilized by a enterprise to report its monetary transactions. Consider it as an in depth roadmap of the corporate’s funds, guiding the stream of economic info and guaranteeing accuracy and consistency in bookkeeping. And not using a well-designed and maintained COA, monetary reporting turns into chaotic, unreliable, and susceptible to errors. This text will delve into the intricacies of the chart of accounts, exploring its function, construction, widespread account sorts, finest practices, and the impression of selecting the best COA.

The Goal of a Chart of Accounts:

The first function of a COA is to prepare and categorize all monetary transactions. This group is essential for a number of causes:

-

Correct Monetary Reporting: A correctly structured COA ensures that each one transactions are recorded within the appropriate accounts, resulting in correct monetary statements (revenue assertion, steadiness sheet, money stream assertion). This accuracy is significant for making knowledgeable enterprise choices.

-

Simplified Bookkeeping: A well-designed COA streamlines the bookkeeping course of. It supplies a transparent framework for recording transactions, making it simpler for accountants and bookkeepers to trace monetary information effectively.

-

Improved Monetary Evaluation: An in depth COA permits for in-depth monetary evaluation. By categorizing transactions into particular accounts, companies can analyze profitability, determine value drivers, monitor bills, and assess general monetary well being.

-

Compliance and Auditing: A well-maintained COA is important for complying with accounting requirements (like GAAP or IFRS) and facilitates the auditing course of. Auditors depend on the COA to confirm the accuracy and completeness of economic data.

-

Enhanced Determination Making: The information organized inside the COA supplies the muse for knowledgeable decision-making. Managers can use this info to evaluate the efficiency of various departments, determine areas for enchancment, and make strategic choices about useful resource allocation.

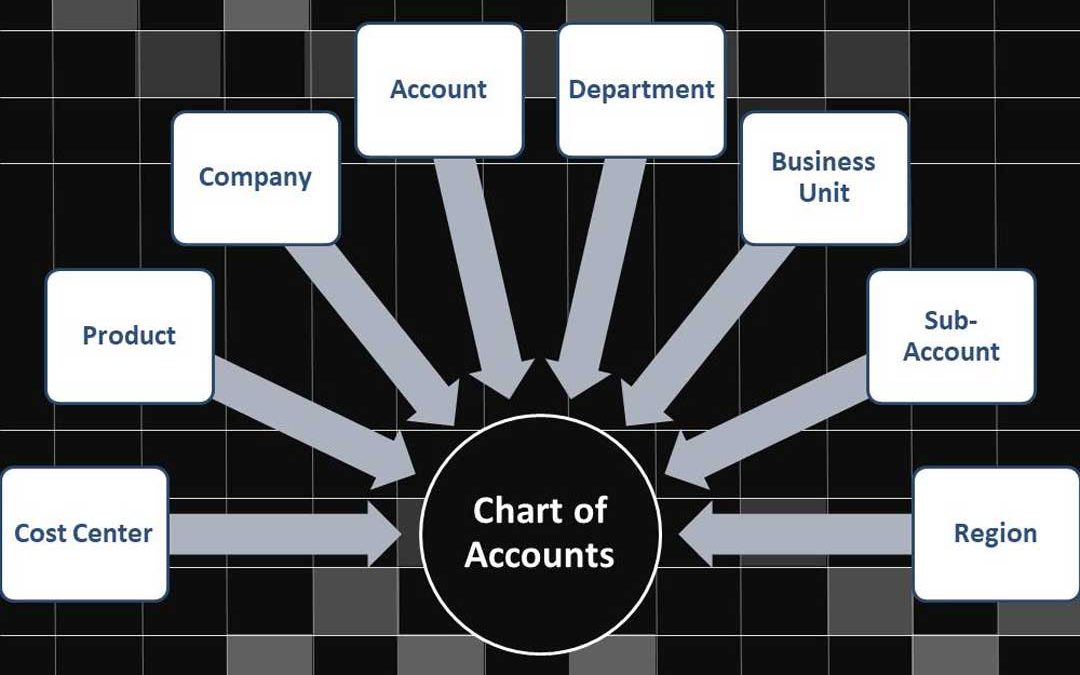

Construction and Elements of a Chart of Accounts:

A COA sometimes follows a hierarchical construction, typically utilizing a numerical or alphanumeric coding system. This technique permits for simple identification and classification of accounts. A typical construction would possibly embrace:

-

Property: These are sources owned by the enterprise, together with:

- Present Property: Property anticipated to be transformed into money inside one yr (e.g., money, accounts receivable, stock).

- Non-Present Property: Property with a lifespan exceeding one yr (e.g., property, plant, and tools (PP&E), intangible property).

-

Liabilities: These are obligations owed by the enterprise to others, together with:

- Present Liabilities: Obligations due inside one yr (e.g., accounts payable, short-term loans).

- Non-Present Liabilities: Obligations due after one yr (e.g., long-term loans, bonds payable).

-

Fairness: This represents the homeowners’ stake within the enterprise, together with:

- Contributed Capital: Investments made by homeowners.

- Retained Earnings: Collected earnings that haven’t been distributed as dividends.

-

Income: Earnings generated from the enterprise’s operations (e.g., gross sales income, service income).

-

Bills: Prices incurred in producing income (e.g., value of products bought, salaries, hire, utilities).

Frequent Account Sorts and Examples:

The particular accounts inside every class will differ relying on the character of the enterprise. Nevertheless, some widespread account sorts embrace:

- Money: Data money readily available and in financial institution accounts.

- Accounts Receivable: Cash owed to the enterprise by prospects.

- Stock: Items held on the market.

- Pay as you go Bills: Bills paid upfront (e.g., insurance coverage, hire).

- Accounts Payable: Cash owed by the enterprise to suppliers.

- Salaries Expense: Wages paid to staff.

- Hire Expense: Price of renting premises.

- Utilities Expense: Price of electrical energy, water, and gasoline.

- Depreciation Expense: Allocation of the price of property over their helpful life.

- Gross sales Income: Earnings from gross sales of products or providers.

Finest Practices for Designing and Sustaining a Chart of Accounts:

-

Trade-Particular Concerns: The COA must be tailor-made to the precise business and enterprise mannequin. A producing firm may have completely different account wants than a service-based enterprise.

-

Scalability: The COA must be designed to accommodate future development and modifications within the enterprise.

-

Consistency: Keep consistency in recording transactions to make sure accuracy and reliability.

-

Common Evaluation and Updates: The COA must be reviewed and up to date periodically to mirror modifications within the enterprise’s operations and accounting requirements.

-

Detailed Documentation: Keep detailed documentation of the COA, together with account descriptions and coding conventions.

-

Use of a Chart of Accounts Software program: Accounting software program packages typically embrace built-in COA functionalities, simplifying the administration and upkeep of the chart.

Affect of Selecting the Proper Chart of Accounts:

The selection of COA considerably impacts the effectivity and accuracy of economic reporting. A poorly designed COA can result in:

-

Inaccurate Monetary Statements: Errors in recording transactions can lead to deceptive monetary studies.

-

Inefficient Bookkeeping: A disorganized COA could make bookkeeping time-consuming and error-prone.

-

Problem in Monetary Evaluation: A poorly structured COA hinders the power to carry out significant monetary evaluation.

-

Compliance Points: A non-compliant COA can result in penalties and authorized points.

Conclusion:

The chart of accounts is a elementary element of any profitable enterprise’s monetary administration system. A well-designed and maintained COA ensures correct monetary reporting, simplifies bookkeeping, facilitates monetary evaluation, and promotes compliance. By rigorously contemplating the precise wants of the enterprise and adhering to finest practices, firms can create a COA that serves as a beneficial software for managing their funds and making knowledgeable enterprise choices. Investing effort and time in creating a strong and acceptable chart of accounts is an funding within the long-term monetary well being and stability of the group. Common evaluate and adaptation of the COA will guarantee it stays a related and efficient software all through the enterprise’s lifecycle.

![Ecommerce Accounting & Bookkeeping Guide To Best Practices [2024]](https://www.ecommerceceo.com/wp-content/uploads/2020/12/image-1024x598.png)

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered beneficial insights into The Chart of Accounts: A Complete Information to Monetary Group. We recognize your consideration to our article. See you in our subsequent article!