The Chart of Accounts: A Deep Dive into Income Accounts

Associated Articles: The Chart of Accounts: A Deep Dive into Income Accounts

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to The Chart of Accounts: A Deep Dive into Income Accounts. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts: A Deep Dive into Income Accounts

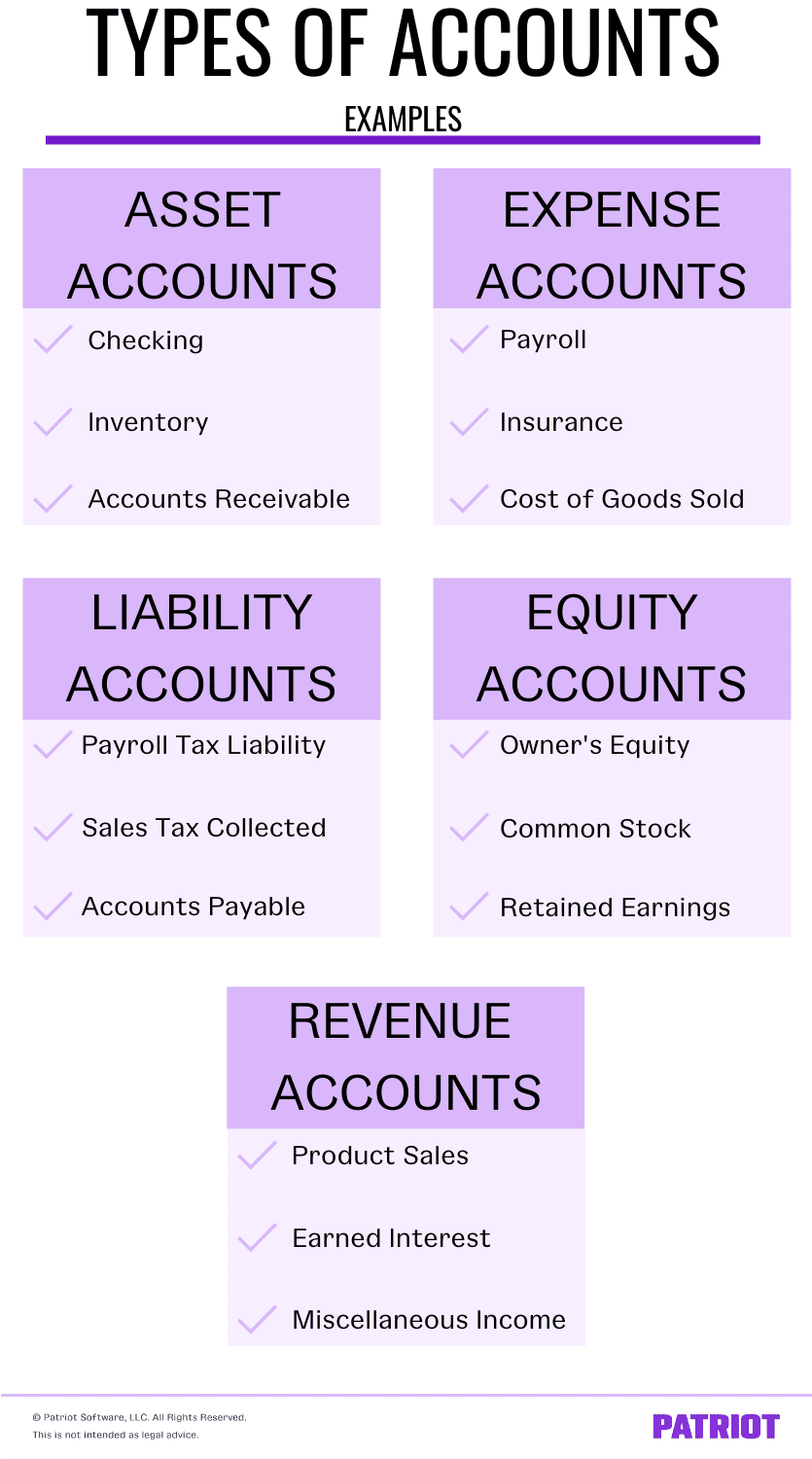

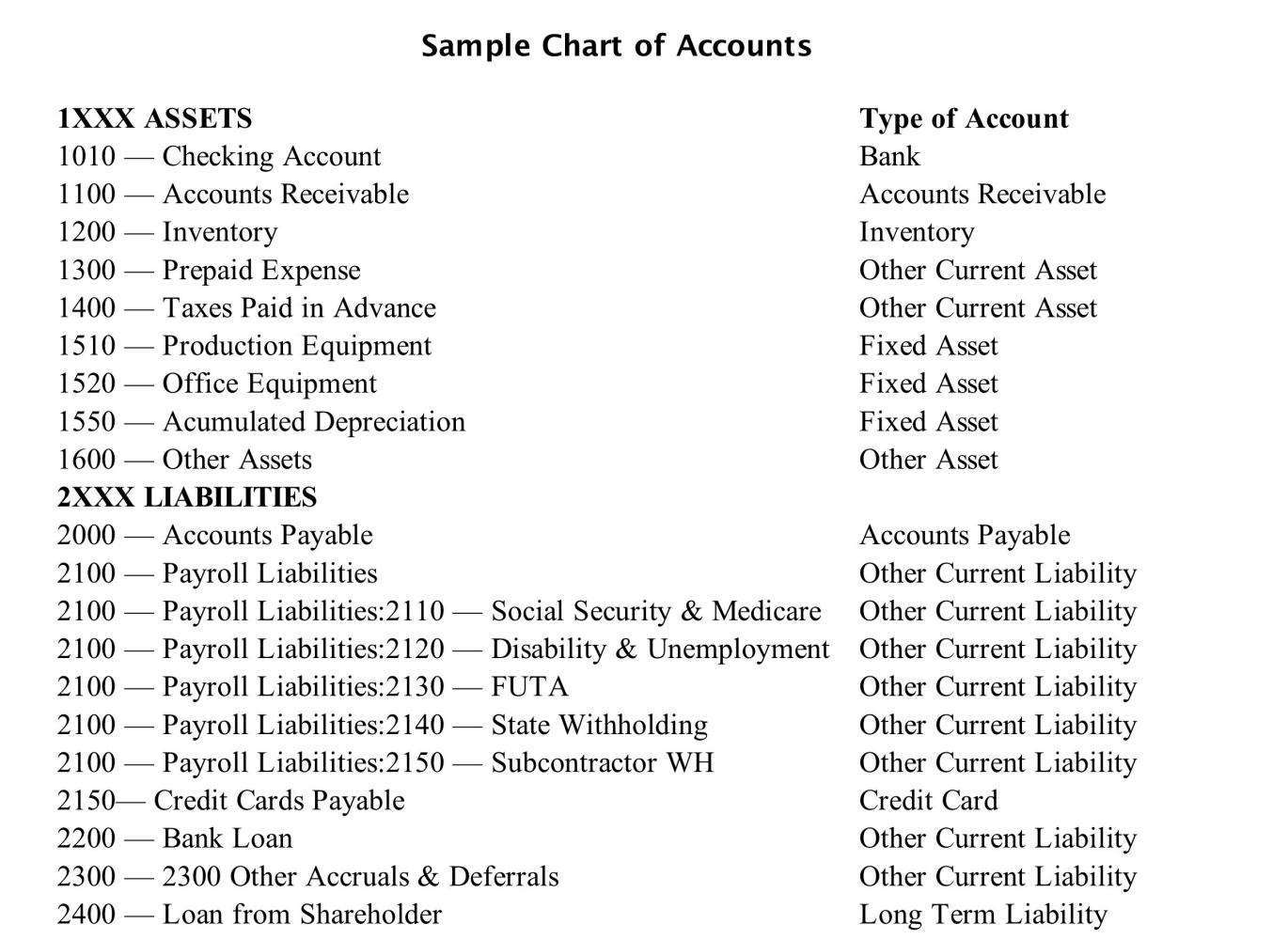

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured listing of all of the accounts used to document monetary transactions, offering a standardized framework for monitoring earnings, bills, belongings, liabilities, and fairness. Inside this important doc, income accounts maintain a place of paramount significance, as they instantly replicate the lifeblood of the enterprise – its earnings. This text will delve into the intricacies of income accounts throughout the chart of accounts, exploring their classification, construction, finest practices, and the implications of inaccurate or poorly designed income account buildings.

Understanding Income Accounts: The Basis of Earnings Recognition

Income accounts are used to document all earnings generated from the core operations of a enterprise. These accounts replicate the worth of products offered or providers rendered, representing the inflows of financial advantages ensuing from the entity’s unusual actions. Correct recording and classification of income are essential for a number of causes:

- Monetary Reporting: Income accounts are important for creating correct monetary statements, together with the earnings assertion, steadiness sheet, and money circulation assertion. These statements present essential data to stakeholders, together with buyers, collectors, and administration, enabling knowledgeable decision-making.

- Tax Compliance: Correct income recognition is paramount for complying with tax rules. Underreporting or misclassifying income can result in vital authorized and monetary penalties.

- Efficiency Analysis: Analyzing income accounts permits companies to trace gross sales efficiency, establish traits, and measure the effectiveness of selling and gross sales methods. This information is significant for strategic planning and useful resource allocation.

- Inside Management: A well-structured income account system strengthens inner controls by offering a transparent audit path of all earnings transactions. This reduces the danger of fraud and errors.

Classifying Income Accounts: A Structured Method

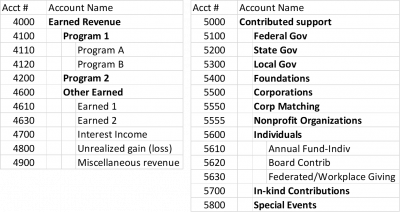

The construction and classification of income accounts differ relying on the character of the enterprise and its complexity. Nonetheless, some widespread classifications exist:

-

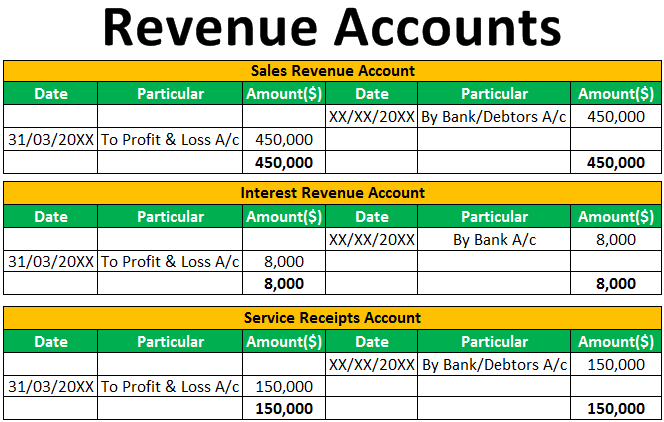

Gross sales Income: That is the commonest income account, representing the earnings generated from the sale of products or providers. For companies promoting a number of services or products, it is usually additional subdivided into extra particular accounts:

- Gross sales of Product A: Tracks income particularly from Product A.

- Gross sales of Product B: Tracks income particularly from Product B.

- Service Income: Tracks income generated from offering providers.

- Curiosity Income: This account data earnings earned from interest-bearing belongings, reminiscent of financial savings accounts, bonds, and loans.

- Rental Income: This account tracks earnings obtained from renting out properties or gear.

- Royalty Income: This account data earnings earned from licensing mental property or different belongings.

- Dividend Income: This account data earnings obtained from dividends on investments.

- Acquire on Sale of Property: Whereas not strictly working income, good points from the sale of belongings are sometimes included within the income part of the earnings assertion. These good points ought to be clearly distinguished from working income.

Structuring Income Accounts: Reaching Granularity and Management

The extent of element within the income account construction is dependent upon the enterprise’s measurement and complexity. Bigger organizations usually make the most of a extra granular construction, permitting for detailed evaluation of varied income streams. A well-structured system permits for:

- Section Reporting: Analyzing income by product line, geographic area, or buyer phase supplies beneficial insights into efficiency variations.

- Pattern Evaluation: Monitoring income over time permits companies to establish progress patterns, seasonality, and potential challenges.

- Profitability Evaluation: Combining income information with value information permits for the calculation of gross revenue margins and different profitability metrics for particular person services or products.

- Buyer Relationship Administration (CRM) Integration: Integrating the income account construction with CRM techniques permits for a extra complete understanding of buyer habits and income technology.

Greatest Practices for Income Account Administration

Implementing efficient income account administration entails a number of key practices:

- Clear and Constant Chart of Accounts: Develop a well-defined chart of accounts with clear account descriptions and numbering conventions. This ensures consistency in recording transactions.

- Common Reconciliation: Recurrently reconcile income accounts with supporting documentation, reminiscent of gross sales invoices and financial institution statements, to establish discrepancies and guarantee accuracy.

- Inside Controls: Implement robust inner controls to stop fraud and errors, reminiscent of segregation of duties and authorization procedures.

- Use of Accounting Software program: Make the most of accounting software program to automate the recording and reporting of income transactions, enhancing effectivity and accuracy.

- Common Evaluate and Updates: Recurrently assessment and replace the chart of accounts to replicate modifications within the enterprise’s operations and income streams. This ensures the COA stays related and correct.

Implications of Poor Income Account Administration

Failing to correctly handle income accounts can have vital penalties:

- Inaccurate Monetary Reporting: Inaccurate income recognition results in deceptive monetary statements, which may negatively influence funding selections and creditworthiness.

- Tax Penalties: Underreporting or misclassifying income may end up in substantial tax penalties and authorized repercussions.

- Poor Determination-Making: Inaccurate income information can result in poor enterprise selections, reminiscent of misallocation of assets and ineffective advertising methods.

- Lack of Investor Confidence: If inaccuracies in income reporting are found, it could possibly severely harm investor confidence and negatively influence the corporate’s status.

Conclusion: The Important Position of Income Accounts

Income accounts are the cornerstone of monetary reporting, offering essential details about a enterprise’s earnings technology. A well-designed and meticulously managed chart of accounts, with a strong construction for income accounts, is crucial for correct monetary reporting, efficient decision-making, and general enterprise success. Ignoring this essential side of monetary administration can have extreme and long-lasting penalties. Due to this fact, companies of all sizes ought to prioritize the event and upkeep of a complete and correct income account construction inside their general chart of accounts. Common assessment, reconciliation, and adherence to finest practices are essential for guaranteeing the reliability and integrity of monetary data, in the end contributing to the long-term sustainability and prosperity of the group.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered beneficial insights into The Chart of Accounts: A Deep Dive into Income Accounts. We recognize your consideration to our article. See you in our subsequent article!