The Chart of Accounts: A Basis for Monetary Success

Associated Articles: The Chart of Accounts: A Basis for Monetary Success

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to The Chart of Accounts: A Basis for Monetary Success. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

The Chart of Accounts: A Basis for Monetary Success

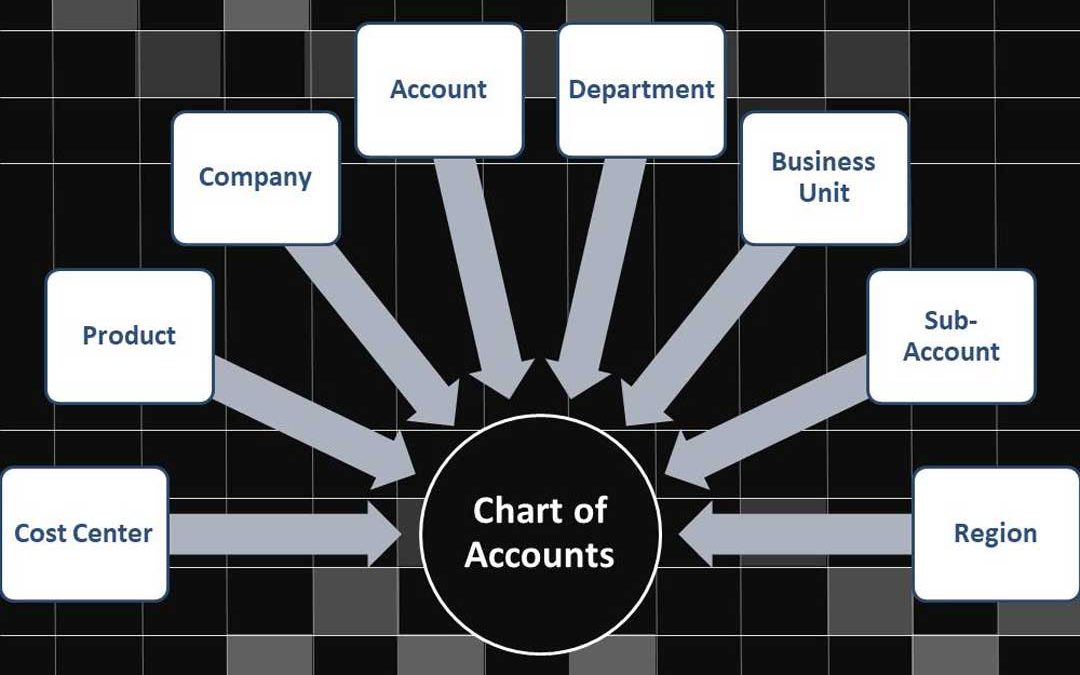

The chart of accounts (COA) is the spine of any group’s monetary reporting system. It is a structured listing of all of the accounts utilized by a enterprise to report its monetary transactions. Every account has a novel quantity, permitting for correct categorization and monitoring of each monetary occasion. With out a well-designed and meticulously maintained COA, monetary reporting turns into chaotic, inaccurate, and in the end, ineffective. This text delves into the intricacies of the chart of accounts, exploring its construction, objective, account numbering techniques, greatest practices, and the significance of sustaining its integrity.

Understanding the Function and Construction

The first objective of a chart of accounts is to supply a scientific framework for classifying and summarizing monetary transactions. This enables companies to:

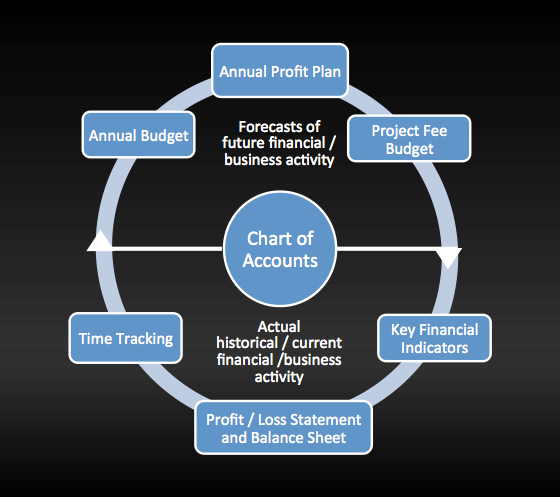

- Observe monetary efficiency: By categorizing transactions, companies can simply monitor income, bills, property, liabilities, and fairness. This info is essential for making knowledgeable enterprise choices.

- Generate monetary statements: The COA is important for getting ready correct and dependable monetary statements just like the earnings assertion, stability sheet, and money circulate assertion.

- Enhance monetary management: A well-structured COA facilitates inside controls, lowering the chance of errors and fraud.

- Simplify tax preparation: Categorized transactions streamline the method of getting ready tax returns.

- Facilitate budgeting and forecasting: The COA gives the inspiration for creating correct budgets and monetary forecasts.

The construction of a COA sometimes follows a hierarchical system, typically using a numerical coding scheme. This enables for detailed categorization and sub-categorization of accounts. A standard construction consists of:

- Property: Assets owned by the enterprise (e.g., money, accounts receivable, stock, gear).

- Liabilities: Obligations owed by the enterprise (e.g., accounts payable, loans payable, salaries payable).

- Fairness: The homeowners’ stake within the enterprise (e.g., widespread inventory, retained earnings).

- Income: Revenue generated from the enterprise’s operations (e.g., gross sales income, service income).

- Bills: Prices incurred in producing income (e.g., price of products offered, salaries expense, lease expense).

Account Numbering Methods: A Key to Group

The effectiveness of a COA hinges on its account numbering system. A well-designed system ensures readability, consistency, and facilitates environment friendly knowledge retrieval. A number of widespread numbering techniques exist:

-

Easy Numerical System: This technique makes use of a easy sequence of numbers, typically growing in increments of 10 or 100. Whereas easy, it gives restricted capability for detailed categorization. For instance: 100-Money, 110-Accounts Receivable, 120-Stock.

-

Decimal System: This technique makes use of decimal factors to characterize totally different ranges of element. For instance: 100.00 – Property, 100.10 – Present Property, 100.11 – Money, 100.12 – Accounts Receivable. This enables for higher granularity and suppleness.

-

Mnemonics: This technique makes use of letters and numbers to characterize totally different account classes. For instance, “A” for Property, “L” for Liabilities, “E” for Fairness, “R” for Income, and “X” for Bills. This may enhance memorability however can change into complicated with many accounts.

-

Hybrid Methods: Many organizations use a mix of those techniques to realize optimum stability between simplicity and element. This may contain utilizing a numerical system for the principle classes and a mnemonic or decimal system for sub-accounts.

Chart of Accounts Examples with Account Numbers

Let’s illustrate with a pattern chart of accounts utilizing a modified decimal system:

1000 – Property

- 1100 – Present Property

- 1110 – Money

- 1120 – Accounts Receivable

- 1130 – Stock

- 1200 – Non-Present Property

- 1210 – Property, Plant, and Tools (PP&E)

- 1220 – Collected Depreciation

- 1230 – Intangible Property

2000 – Liabilities

- 2100 – Present Liabilities

- 2110 – Accounts Payable

- 2120 – Salaries Payable

- 2130 – Quick-Time period Loans Payable

- 2200 – Non-Present Liabilities

- 2210 – Lengthy-Time period Loans Payable

- 2220 – Mortgage Payable

3000 – Fairness

- 3100 – Widespread Inventory

- 3200 – Retained Earnings

4000 – Income

- 4100 – Gross sales Income

- 4200 – Service Income

- 4300 – Different Income

5000 – Bills

- 5100 – Value of Items Bought (COGS)

- 5200 – Salaries Expense

- 5300 – Lease Expense

- 5400 – Utilities Expense

- 5500 – Advertising Expense

- 5600 – Depreciation Expense

This instance demonstrates how a structured numbering system permits for simple identification and classification of accounts. The extent of element could be adjusted based mostly on the group’s measurement and complexity. A smaller enterprise may use a less complicated system, whereas a bigger company would probably require a extra intensive and detailed COA.

Greatest Practices for Designing and Sustaining a Chart of Accounts

- Consistency: Preserve consistency in naming conventions and account numbering all through the chart.

- Readability: Use clear and concise account names that precisely replicate the character of the account.

- Relevance: Solely embody accounts which might be related to the group’s operations. Keep away from pointless accounts.

- Flexibility: Design the COA to accommodate future progress and adjustments within the enterprise.

- Common Evaluate: Periodically assessment and replace the COA to make sure it stays related and correct. Modifications in accounting requirements or enterprise operations could necessitate changes.

- Documentation: Preserve thorough documentation of the COA, together with account descriptions and definitions.

- Inside Management: The COA ought to assist sturdy inside controls to stop errors and fraud. This consists of segregation of duties and common reconciliation of accounts.

- Business Greatest Practices: Think about industry-specific greatest practices when designing your COA. Sure industries have distinctive accounting necessities.

- Software program Integration: Select accounting software program that seamlessly integrates together with your COA. This simplifies knowledge entry and reporting.

Penalties of a Poorly Designed Chart of Accounts

A poorly designed or poorly maintained COA can result in a number of unfavourable penalties:

- Inaccurate Monetary Statements: Errors in categorization can result in inaccurate monetary statements, hindering decision-making.

- Problem in Monetary Evaluation: A disorganized COA makes it tough to research monetary efficiency and establish tendencies.

- Compliance Points: Inaccurate monetary information can result in non-compliance with tax laws and different authorized necessities.

- Inefficient Operations: Trying to find info in a disorganized COA wastes worthwhile time and assets.

- Elevated Audit Threat: A poorly designed COA will increase the chance of audit findings and potential penalties.

Conclusion

The chart of accounts is a vital element of any profitable enterprise. A well-designed and meticulously maintained COA gives the inspiration for correct monetary reporting, efficient monetary administration, and knowledgeable decision-making. By following greatest practices and frequently reviewing and updating the COA, companies can make sure the integrity of their monetary info and obtain higher monetary success. The selection of numbering system, the extent of element, and the continuing upkeep are all essential facets that require cautious consideration to make sure the COA serves its objective successfully. Investing effort and time in creating a strong COA is an funding within the long-term monetary well being of the group.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

Closure

Thus, we hope this text has offered worthwhile insights into The Chart of Accounts: A Basis for Monetary Success. We admire your consideration to our article. See you in our subsequent article!