The Chartered Monetary Analyst (CFA) Constitution: A Path to Excellence in Finance

Associated Articles: The Chartered Monetary Analyst (CFA) Constitution: A Path to Excellence in Finance

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Chartered Monetary Analyst (CFA) Constitution: A Path to Excellence in Finance. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

The Chartered Monetary Analyst (CFA) Constitution: A Path to Excellence in Finance

The Chartered Monetary Analyst (CFA) constitution is a globally acknowledged postgraduate skilled designation awarded by the CFA Institute. It signifies a excessive stage of competence and moral conduct within the funding administration career. Reaching the CFA constitution is a demanding endeavor, requiring vital dedication, rigorous research, and a dedication to lifelong studying. This text delves into the intricacies of the CFA program, exploring its curriculum, examination course of, profession prospects, and the general worth proposition it presents to aspiring and established finance professionals.

The Rigorous Path to the CFA Constitution:

The CFA program is a three-level examination course of, every stage progressively more difficult than the final. Candidates should go all three ranges to earn the coveted CFA constitution. The exams are notoriously troublesome, with go charges sometimes starting from 35% to 50%, reflecting the excessive requirements maintained by the CFA Institute. Past the exams, candidates should additionally meet particular work expertise necessities and cling to the CFA Institute’s Code of Ethics and Requirements of Skilled Conduct.

Stage I: Constructing the Basis:

Stage I lays the groundwork for all the CFA curriculum. It focuses on the basic ideas throughout varied areas of finance, together with:

- Moral and Skilled Requirements: This significant part emphasizes the significance of moral conduct in funding administration, masking subjects like conflicts of curiosity, market manipulation, {and professional} duty. The Code of Ethics and Requirements of Skilled Conduct are central to this part.

- Quantitative Strategies: This part covers statistical ideas and strategies important for monetary evaluation, together with chance, speculation testing, and regression evaluation.

- Economics: Macroeconomics and microeconomics are explored, offering a framework for understanding the broader financial surroundings and its impression on monetary markets.

- Monetary Reporting and Evaluation: This part delves into monetary assertion evaluation, accounting ideas, and the interpretation of monetary data. It equips candidates with the talents to evaluate an organization’s monetary well being and efficiency.

- Company Finance: Candidates study capital budgeting, capital construction, dividend coverage, and different key facets of company monetary administration.

- Fairness Investments: This part introduces elementary and technical evaluation of equities, together with valuation fashions, business evaluation, and portfolio administration methods.

- Fastened Revenue: Candidates achieve an understanding of fixed-income securities, together with bond valuation, rate of interest danger, and portfolio administration strategies.

- Derivatives: This part covers varied by-product devices, resembling futures, choices, and swaps, and their functions in danger administration and funding methods.

- Various Investments: This part supplies an summary of different funding lessons, together with hedge funds, personal fairness, and actual property.

Stage I sometimes includes a major time dedication, typically requiring a number of hundred hours of research. The examination is computer-based and consists of multiple-choice questions.

Stage II: Utility and Evaluation:

Stage II builds upon the inspiration established in Stage I, specializing in the applying of ideas and analytical expertise. The format shifts to merchandise units, which current candidates with a state of affairs and require them to reply multiple-choice questions based mostly on the supplied data. This part calls for a deeper understanding and the flexibility to use theoretical information to sensible conditions. Key areas lined embrace:

- Moral and Skilled Requirements: This part continues to emphasise moral issues, making use of the Code and Requirements to particular eventualities.

- Fairness Investments: This part delves deeper into fairness valuation, portfolio building, and danger administration.

- Fastened Revenue: Candidates discover extra superior fixed-income subjects, together with credit score evaluation, mortgage-backed securities, and rate of interest fashions.

- Derivatives: This part expands on by-product pricing and hedging methods.

- Various Investments: A extra in-depth evaluation of different investments is offered.

- Portfolio Administration and Wealth Planning: This part focuses on portfolio building, danger administration, and wealth planning methods for particular person traders.

Stage III: Portfolio Administration and Wealth Planning:

Stage III is the end result of the CFA program, specializing in portfolio administration and wealth planning. The examination contains each multiple-choice questions and constructed-response questions, requiring candidates to show their analytical and communication expertise. This stage emphasizes the combination of data gained within the earlier ranges and the flexibility to develop complete funding methods. Key areas lined embrace:

- Moral and Skilled Requirements: This part continues to bolster the significance of moral conduct.

- Portfolio Administration and Wealth Planning: This part is central to Stage III, masking subjects resembling asset allocation, portfolio building, efficiency measurement, and danger administration. It emphasizes the applying of data to real-world funding eventualities.

Work Expertise Requirement:

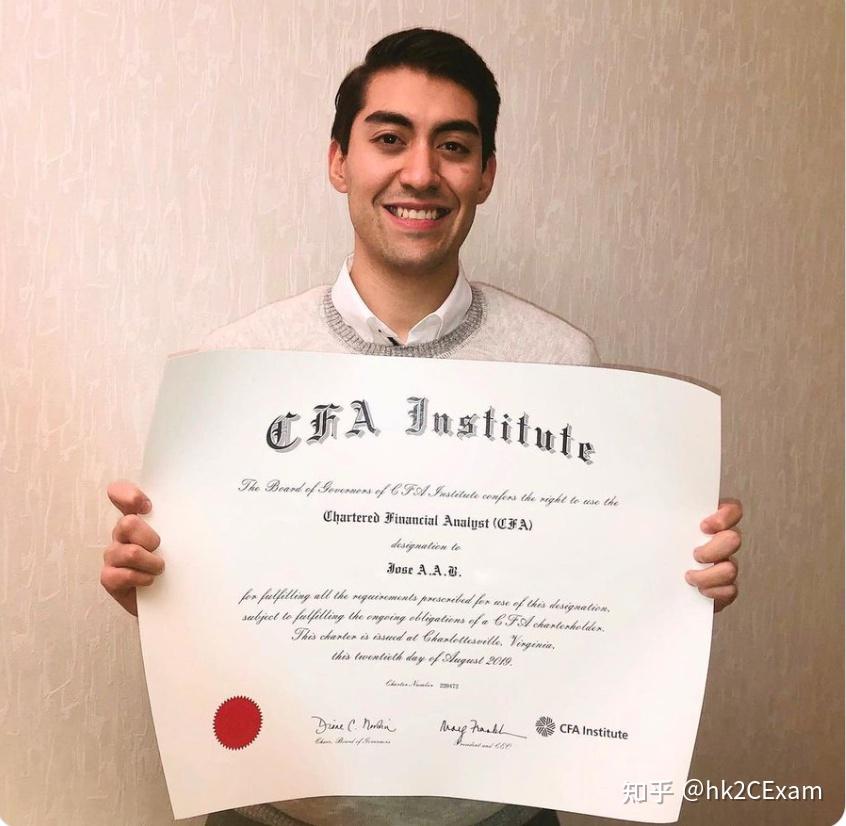

Past passing all three ranges, candidates should additionally meet the CFA Institute’s work expertise requirement of 4 years {of professional} expertise within the funding decision-making course of. This expertise should be gained after registering for the CFA program and earlier than receiving the constitution. This requirement ensures that candidates possess sensible expertise to enrich their educational information.

The Worth of the CFA Constitution:

The CFA constitution holds vital worth within the monetary business for a number of causes:

- World Recognition: The CFA constitution is acknowledged worldwide as a mark of excellence in funding administration.

- Enhanced Profession Prospects: Holding a CFA constitution considerably enhances profession prospects and opens doorways to a wider vary of alternatives.

- Elevated Incomes Potential: CFA charterholders typically command increased salaries in comparison with their friends with out the designation.

- Skilled Community: The CFA Institute supplies a robust skilled community, connecting charterholders with friends and business leaders.

- Dedication to Moral Conduct: The emphasis on ethics {and professional} requirements instills a robust sense of integrity and duty.

Profession Paths for CFA Charterholders:

The CFA constitution opens doorways to a various vary of profession paths inside the finance business, together with:

- Funding Administration: Portfolio managers, fairness analysts, fixed-income analysts, and analysis analysts are widespread roles for CFA charterholders.

- Monetary Evaluation: Company finance professionals, monetary planning analysts, and credit score analysts typically maintain the CFA constitution.

- Wealth Administration: Monetary advisors, wealth managers, and personal bankers profit from the CFA designation.

- Funding Banking: Funding banking analysts and associates typically pursue the CFA constitution to reinforce their expertise and profession prospects.

- Academia: Some CFA charterholders pursue careers in academia, educating finance and conducting analysis.

Conclusion:

The CFA constitution represents a major achievement, signifying a excessive stage of competence, moral conduct, and dedication to the funding administration career. The rigorous program calls for vital dedication and perseverance, however the rewards – enhanced profession prospects, elevated incomes potential, and a worldwide community of pros – make it a worthwhile pursuit for these aspiring to excel within the dynamic world of finance. The CFA constitution just isn’t merely a credential; it’s a testomony to a dedication to excellence and a lifelong journey of studying {and professional} progress.

_-_FI.png)

Closure

Thus, we hope this text has supplied worthwhile insights into The Chartered Monetary Analyst (CFA) Constitution: A Path to Excellence in Finance. We thanks for taking the time to learn this text. See you in our subsequent article!