The Final Chart Patterns Cheat Sheet: A Printable Information to Technical Evaluation

Associated Articles: The Final Chart Patterns Cheat Sheet: A Printable Information to Technical Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Final Chart Patterns Cheat Sheet: A Printable Information to Technical Evaluation. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

The Final Chart Patterns Cheat Sheet: A Printable Information to Technical Evaluation

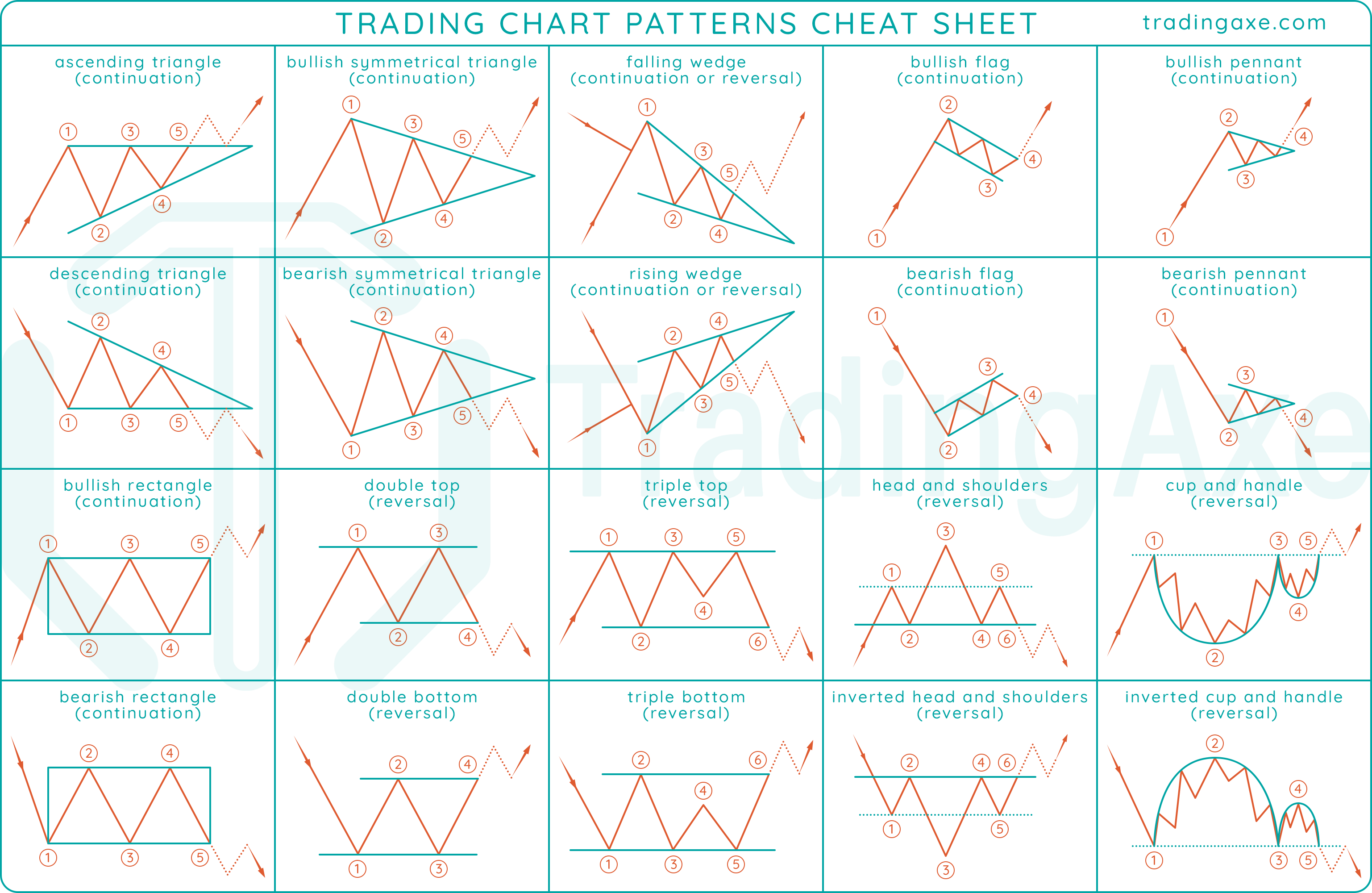

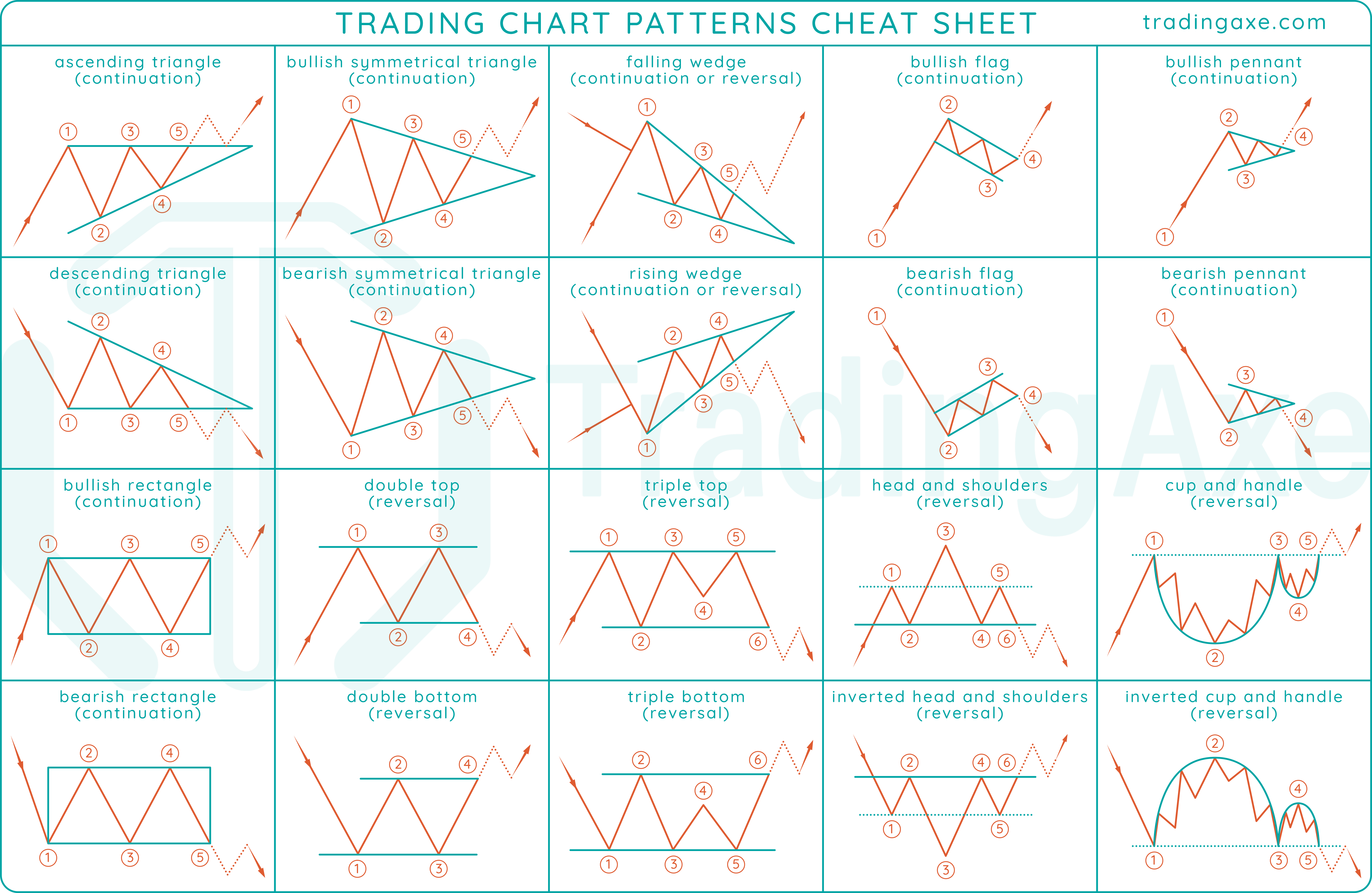

Technical evaluation, the artwork of predicting future value actions based mostly on previous market knowledge, depends closely on figuring out recurring chart patterns. These patterns, shaped by value motion and quantity, supply worthwhile insights into potential help and resistance ranges, development reversals, and continuation strikes. Whereas mastering technical evaluation takes time and observe, understanding frequent chart patterns is a vital first step. This text supplies a complete cheat sheet of prevalent patterns, full with descriptions, illustrations (think about these as being visually represented in a printable model), and buying and selling implications, empowering you to navigate the markets with better confidence.

I. Development Continuation Patterns: These patterns recommend the present development will seemingly proceed in the identical route.

A. Flag:

- Description: A flag sample resembles an oblong or pennant-shaped consolidation inside a robust uptrend or downtrend. The sample usually types after a pointy value transfer, characterised by decrease volatility and a slight pullback.

- Illustration: (Think about a visible illustration of a flag sample right here – a steep upward development adopted by a smaller, nearly parallel, downward sloping rectangle, then a continuation of the upward development)

- Buying and selling Implications: A breakout above the flag’s higher trendline (in an uptrend) or under the decrease trendline (in a downtrend) indicators a continuation of the prevailing development. Merchants typically enter lengthy positions on a breakout from an ascending flag (uptrend) and brief positions on a breakout from a descending flag (downtrend). Cease-loss orders are usually positioned under the decrease trendline (lengthy positions) or above the higher trendline (brief positions).

B. Pennant:

- Description: Just like a flag, however the consolidation part is characterised by converging trendlines, forming a triangular form. It additionally usually follows a pointy value transfer.

- Illustration: (Think about a visible illustration of a pennant sample right here – a steep upward development adopted by a converging triangle, then a continuation of the upward development)

- Buying and selling Implications: Breakouts from pennants are additionally thought of sturdy indicators of development continuation. Merchants typically search for affirmation from quantity will increase accompanying the breakout. Cease-loss orders are positioned outdoors the pennant’s boundaries.

C. Wedge:

- Description: A wedge is a converging trendline sample that may be both ascending (bullish) or descending (bearish). An ascending wedge types inside an uptrend, whereas a descending wedge types inside a downtrend.

- Illustration: (Think about two separate visuals: one for an ascending wedge, displaying converging upward sloping traces, and one other for a descending wedge, displaying converging downward sloping traces, each inside present traits)

- Buying and selling Implications: Ascending wedges are usually thought of bearish, suggesting a possible development reversal. Descending wedges are usually thought of bullish, suggesting a possible continuation of the uptrend. Breakouts from wedges ought to be confirmed with quantity.

D. Symmetrical Triangle:

- Description: A symmetrical triangle is characterised by two converging trendlines, with neither sloping considerably extra steeply than the opposite. It types in periods of indecision available in the market.

- Illustration: (Think about a visible illustration of a symmetrical triangle – two converging trendlines, creating an isosceles triangle)

- Buying and selling Implications: Breakouts from symmetrical triangles can point out a continuation of the earlier development. The route of the breakout, coupled with quantity, determines the buying and selling technique.

II. Development Reversal Patterns: These patterns recommend a possible shift within the prevailing development.

A. Head and Shoulders (H&S):

- Description: A traditional reversal sample consisting of three peaks (the left shoulder, head, and proper shoulder), with two troughs (necklines) connecting the shoulders. The top is considerably greater than the shoulders.

- Illustration: (Think about a visible illustration of a head and shoulders sample – three peaks, with the center peak (head) considerably greater than the outer two (shoulders), linked by two roughly horizontal trendlines (necklines))

- Buying and selling Implications: A breakdown under the neckline confirms the sample and indicators a possible bearish reversal. Merchants typically enter brief positions after the neckline break, with stop-loss orders positioned above the best excessive of the sample.

B. Inverse Head and Shoulders (IH&S):

- Description: The mirror picture of the top and shoulders sample, indicating a possible bullish reversal.

- Illustration: (Think about a visible illustration of an inverse head and shoulders sample – three troughs, with the center trough (head) considerably decrease than the outer two (shoulders), linked by two roughly horizontal trendlines (necklines))

- Buying and selling Implications: A breakout above the neckline confirms the sample and indicators a possible bullish reversal. Merchants typically enter lengthy positions after the neckline break, with stop-loss orders positioned under the bottom low of the sample.

C. Double High:

- Description: Two successive peaks at roughly the identical value stage, adopted by a decline.

- Illustration: (Think about a visible illustration of a double prime sample – two peaks at roughly the identical value stage, adopted by a downward development)

- Buying and selling Implications: A breakdown under the neckline (the trough between the 2 peaks) indicators a possible bearish reversal.

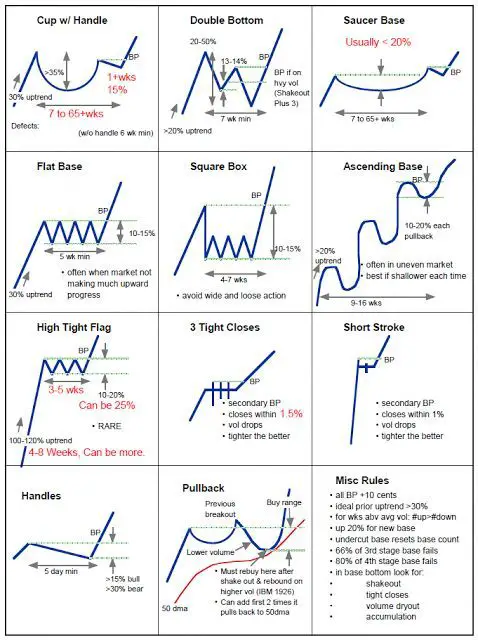

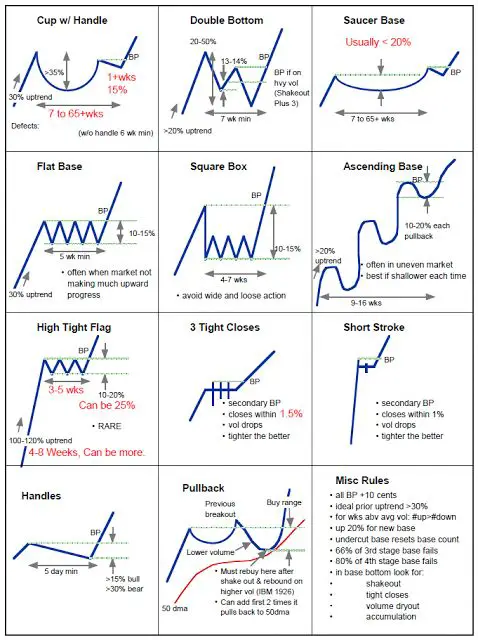

D. Double Backside:

- Description: Two successive troughs at roughly the identical value stage, adopted by an increase.

- Illustration: (Think about a visible illustration of a double backside sample – two troughs at roughly the identical value stage, adopted by an upward development)

- Buying and selling Implications: A breakout above the neckline (the height between the 2 troughs) indicators a possible bullish reversal.

E. Triple High/Backside:

- Description: Just like double tops/bottoms, however with three peaks/troughs at roughly the identical value stage.

- Illustration: (Think about visible representations of each triple prime and triple backside patterns – three peaks/troughs at roughly the identical value stage, adopted by a downward/upward development respectively)

- Buying and selling Implications: A breakdown under the neckline in a triple prime or a breakout above the neckline in a triple backside indicators a possible reversal. These patterns are usually stronger than double tops/bottoms because of the elevated affirmation.

III. Different Essential Chart Patterns:

A. Rectangle:

- Description: A value consolidation sample characterised by horizontal help and resistance ranges.

- Illustration: (Think about a visible illustration of a rectangle sample – horizontal help and resistance traces creating an oblong field)

- Buying and selling Implications: Breakouts above the resistance stage are bullish, whereas breakouts under the help stage are bearish.

B. Rounding Backside:

- Description: A U-shaped reversal sample that signifies a possible bullish reversal after a chronic downtrend.

- Illustration: (Think about a visible illustration of a rounding backside sample – a U-shaped curve on the backside of a downtrend)

- Buying and selling Implications: The breakout above the neckline confirms the sample.

C. Rounding High:

- Description: An inverted U-shaped reversal sample that signifies a possible bearish reversal after a chronic uptrend.

- Illustration: (Think about a visible illustration of a rounding prime sample – an inverted U-shaped curve on the prime of an uptrend)

- Buying and selling Implications: The breakdown under the neckline confirms the sample.

IV. Essential Issues:

- Quantity Affirmation: All the time take into account quantity when decoding chart patterns. Elevated quantity throughout breakouts strengthens the sign.

- Context is Key: Chart patterns ought to be analyzed throughout the broader market context, contemplating total traits and financial indicators.

- Danger Administration: All the time use stop-loss orders to restrict potential losses.

- Apply and Endurance: Mastering chart sample recognition requires observe and endurance. Begin by specializing in just a few key patterns and progressively develop your information.

This cheat sheet supplies a foundational understanding of frequent chart patterns. Keep in mind, this isn’t an exhaustive listing, and lots of variations exist. Constant observe, coupled with a radical understanding of market dynamics, will improve your means to successfully make the most of chart patterns in your buying and selling technique. Keep in mind to all the time conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding selections. This info is for instructional functions solely and shouldn’t be thought of monetary recommendation. (Think about this whole article formatted for straightforward printing, maybe with every sample having its personal clearly labeled part with the outline and illustration)

![Chart Patterns PDF Cheat Sheet [FREE Download]](https://howtotrade.com/wp-content/uploads/2023/02/chart-patterns-cheat-sheet-540x382.png)

Closure

Thus, we hope this text has supplied worthwhile insights into The Final Chart Patterns Cheat Sheet: A Printable Information to Technical Evaluation. We respect your consideration to our article. See you in our subsequent article!