The Final Inventory Chart Patterns Cheat Sheet: Decoding Market Indicators for Smarter Investing

Associated Articles: The Final Inventory Chart Patterns Cheat Sheet: Decoding Market Indicators for Smarter Investing

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to The Final Inventory Chart Patterns Cheat Sheet: Decoding Market Indicators for Smarter Investing. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

The Final Inventory Chart Patterns Cheat Sheet: Decoding Market Indicators for Smarter Investing

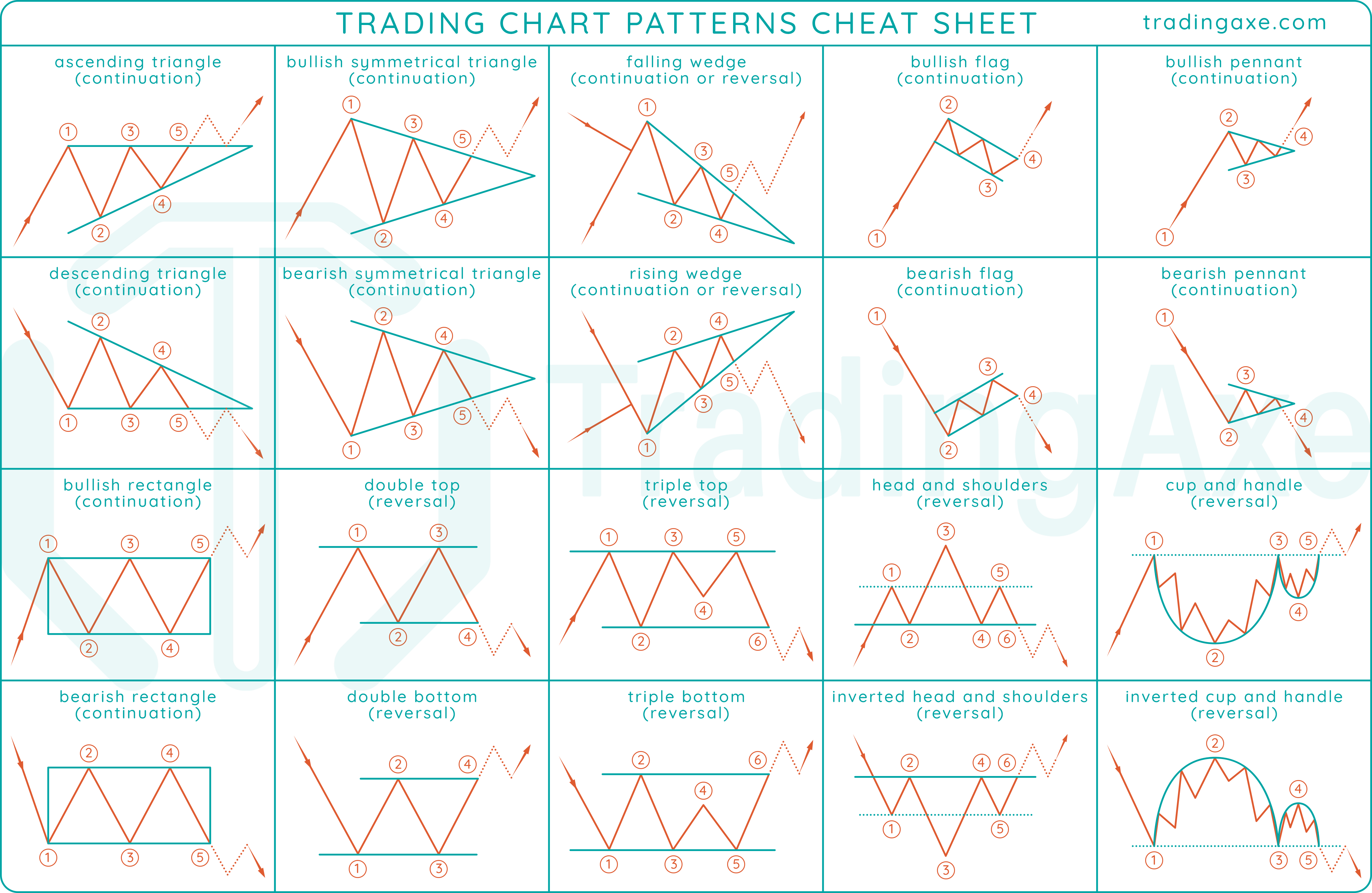

Inventory charts, at first look, can appear to be a chaotic jumble of strains and knowledge factors. Nonetheless, beneath the floor lies a wealthy tapestry of recurring patterns that skilled merchants use to foretell future value actions. These patterns, also known as chart patterns, present helpful insights into market sentiment and potential buying and selling alternatives. This complete cheat sheet will delve into among the commonest and dependable chart patterns, explaining their traits, implications, and the right way to establish them successfully.

I. Understanding Chart Patterns: The Fundamentals

Earlier than diving into particular patterns, it is essential to know the basic rules:

- Value Motion: Chart patterns are shaped by analyzing value motion – the motion of a inventory’s value over time. They mirror the interaction of provide and demand.

- Help and Resistance Ranges: These are essential components. Help is a value stage the place shopping for stress is robust sufficient to forestall additional value declines. Resistance is a value stage the place promoting stress prevents additional value will increase. Breakouts above resistance or beneath assist typically sign important value actions.

- Quantity: Quantity confirms the power of a value transfer. Excessive quantity accompanying a breakout strengthens the sign, whereas low quantity suggests a weaker transfer.

- Pattern: Patterns are often labeled as bullish (uptrend), bearish (downtrend), or impartial. Understanding the prevailing pattern is important for correct interpretation.

II. Bullish Chart Patterns (Suggesting Value Will increase):

-

Head and Shoulders Backside: This basic bullish reversal sample resembles a head and two shoulders. It varieties throughout a downtrend and alerts a possible shift to an uptrend. A breakout above the neckline confirms the sample.

- Traits: Three distinct troughs (left shoulder, head, proper shoulder), with the top being the bottom level. The neckline connects the troughs of the left and proper shoulders.

- Affirmation: Breakout above the neckline with elevated quantity.

- Goal: The value goal is usually calculated by measuring the gap between the top and the neckline and including it to the breakout level.

-

Double Backside: This sample reveals two consecutive lows at roughly the identical value stage, forming a "W" form. It signifies a possible reversal of a downtrend.

- Traits: Two lows at comparable value ranges, adopted by a better excessive.

- Affirmation: Breakout above the neckline (connecting the 2 lows) with elevated quantity.

- Goal: Much like the top and shoulders backside, the goal is calculated by including the gap between the low and the neckline to the breakout level.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders backside, representing a bullish continuation sample in an uptrend.

- Traits: Three distinct peaks, with the center peak being the very best. The neckline connects the peaks of the left and proper shoulders.

- Affirmation: Breakout above the neckline with elevated quantity.

- Goal: Related calculation as the top and shoulders backside.

-

Cup and Deal with: This bullish continuation sample resembles a cup with a small deal with. It suggests a interval of consolidation adopted by an extra value enhance.

- Traits: A U-shaped "cup" adopted by a brief, downward "deal with."

- Affirmation: Breakout above the deal with’s resistance stage with elevated quantity.

- Goal: The goal is commonly calculated by measuring the depth of the cup and including it to the breakout level.

-

Bullish Flag: This sample reveals a interval of speedy value enhance adopted by a consolidation interval, represented by an oblong or barely sloping flag.

- Traits: A steep upward pattern adopted by a consolidation interval inside a parallel channel.

- Affirmation: Breakout above the flag’s higher trendline with elevated quantity.

- Goal: The goal is often projected based mostly on the size of the previous flagpole (the steep upward pattern).

-

Bullish Pennant: Much like a flag, however the consolidation interval varieties a triangular form, converging to a degree.

- Traits: A robust upward pattern adopted by a triangular consolidation.

- Affirmation: Breakout above the pennant’s higher trendline with elevated quantity.

- Goal: The goal is often projected based mostly on the size of the previous flagpole.

III. Bearish Chart Patterns (Suggesting Value Decreases):

-

Head and Shoulders Prime: That is the bearish counterpart of the top and shoulders backside, indicating a possible reversal of an uptrend.

- Traits: Three distinct peaks, with the center peak being the very best. The neckline connects the peaks of the left and proper shoulders.

- Affirmation: Breakout beneath the neckline with elevated quantity.

- Goal: The goal is usually calculated by measuring the gap between the top and the neckline and subtracting it from the breakout level.

-

Double Prime: This sample reveals two consecutive highs at roughly the identical value stage, forming an "M" form. It suggests a possible reversal of an uptrend.

- Traits: Two highs at comparable value ranges, adopted by a decrease low.

- Affirmation: Breakout beneath the neckline (connecting the 2 highs) with elevated quantity.

- Goal: Much like the top and shoulders prime, the goal is calculated by subtracting the gap between the excessive and the neckline from the breakout level.

-

Triple Prime: Much like a double prime however with three consecutive highs at roughly the identical value stage. It strengthens the bearish sign.

- Traits: Three highs at comparable value ranges, adopted by a decrease low.

- Affirmation: Breakout beneath the neckline (connecting the three highs) with elevated quantity.

- Goal: Related calculation because the double prime.

-

Bearish Flag: This sample reveals a interval of speedy value lower adopted by a consolidation interval, represented by an oblong or barely sloping flag.

- Traits: A steep downward pattern adopted by a consolidation interval inside a parallel channel.

- Affirmation: Breakout beneath the flag’s decrease trendline with elevated quantity.

- Goal: The goal is often projected based mostly on the size of the previous flagpole (the steep downward pattern).

-

Bearish Pennant: Much like a bearish flag, however the consolidation interval varieties a triangular form, converging to a degree.

- Traits: A robust downward pattern adopted by a triangular consolidation.

- Affirmation: Breakout beneath the pennant’s decrease trendline with elevated quantity.

- Goal: The goal is often projected based mostly on the size of the previous flagpole.

IV. Impartial Chart Patterns (Suggesting Continued Consolidation or Sideways Motion):

-

Triangles: These patterns characterize a interval of consolidation the place patrons and sellers are evenly matched. They are often ascending, descending, or symmetrical.

- Traits: Converging trendlines forming a triangle form.

- Affirmation: Breakout above the higher trendline (ascending or symmetrical) or beneath the decrease trendline (descending or symmetrical) with elevated quantity.

- Goal: The goal is commonly projected based mostly on the peak of the triangle.

-

Rectangles: These patterns present a interval of sideways value motion inside a horizontal channel.

- Traits: Horizontal assist and resistance ranges.

- Affirmation: Breakout above the higher resistance stage or beneath the decrease assist stage with elevated quantity.

- Goal: The goal is commonly projected based mostly on the peak of the rectangle.

V. Necessary Issues:

- False Breakouts: It is essential to remember that chart patterns can typically produce false breakouts, the place the value briefly breaks by way of a assist or resistance stage however then reverses. Quantity evaluation and affirmation from different indicators can assist to distinguish between true and false breakouts.

- Affirmation: By no means rely solely on chart patterns. At all times affirm the alerts with different technical indicators (e.g., shifting averages, RSI, MACD) and basic evaluation.

- Timeframes: Chart patterns can seem on varied timeframes (e.g., every day, weekly, month-to-month). The timeframe chosen influences the interpretation and potential buying and selling technique.

- Observe: Mastering chart sample recognition requires apply and expertise. Begin by analyzing historic charts and step by step develop your skill to establish patterns in real-time.

This cheat sheet gives a complete overview of among the commonest inventory chart patterns. Do not forget that profitable buying and selling entails a mixture of technical evaluation, basic evaluation, threat administration, and self-discipline. Steady studying and adaptation are key to navigating the dynamic world of inventory markets. At all times conduct thorough analysis and contemplate consulting with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into The Final Inventory Chart Patterns Cheat Sheet: Decoding Market Indicators for Smarter Investing. We respect your consideration to our article. See you in our subsequent article!