The Final TradingView Chart Setup: Mastering Your Market View for Enhanced Buying and selling

Associated Articles: The Final TradingView Chart Setup: Mastering Your Market View for Enhanced Buying and selling

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Final TradingView Chart Setup: Mastering Your Market View for Enhanced Buying and selling. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

The Final TradingView Chart Setup: Mastering Your Market View for Enhanced Buying and selling

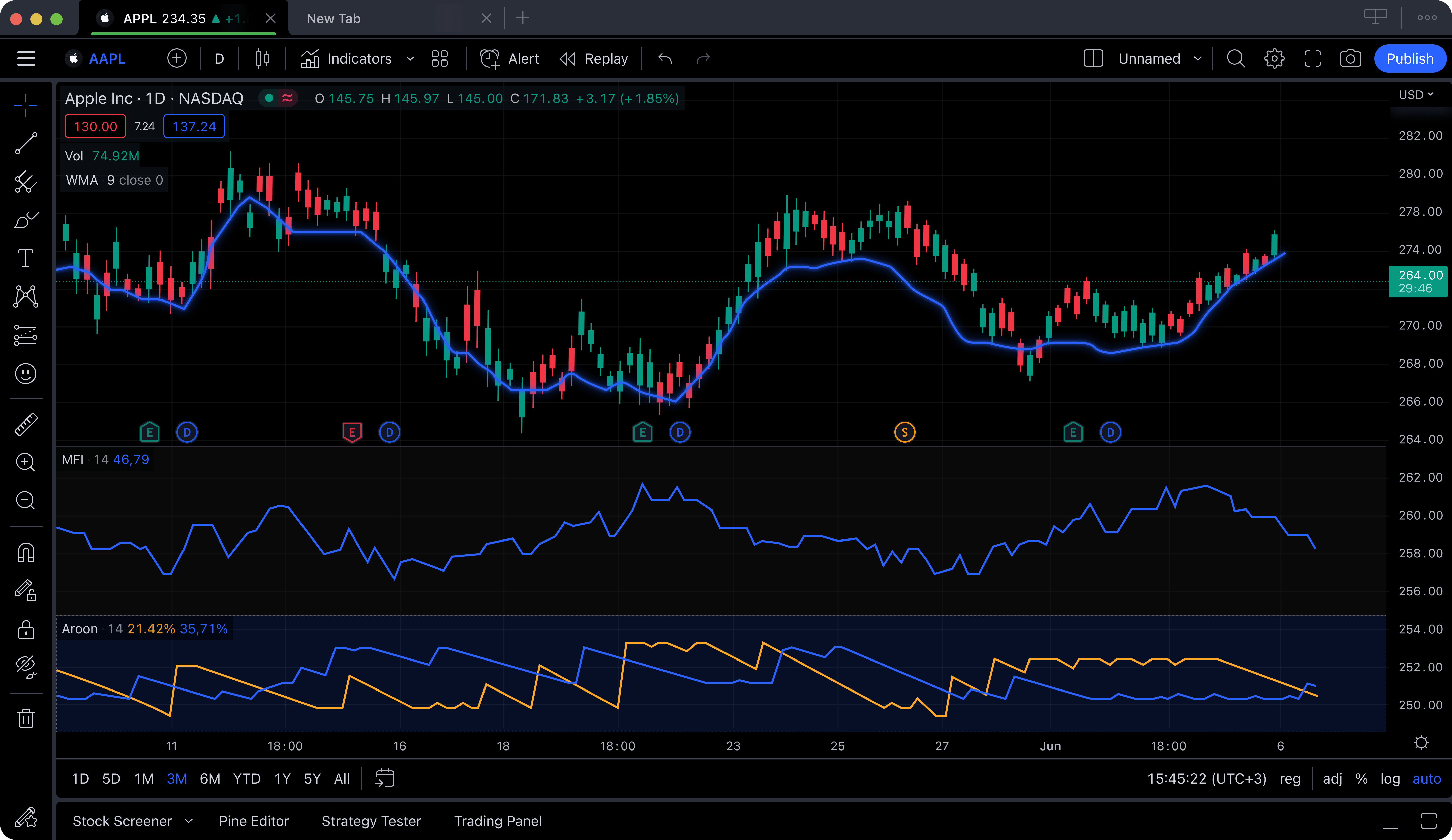

TradingView has turn into the go-to platform for hundreds of thousands of merchants worldwide, providing a robust and versatile charting surroundings. Nonetheless, the sheer variety of indicators, drawing instruments, and customization choices might be overwhelming for freshmen and even skilled merchants trying to optimize their workflow. This text delves into creating the last word TradingView chart setup, specializing in performance, readability, and in the end, improved buying and selling efficiency. We’ll discover important indicators, efficient structure methods, and customized customization to construct a chart that caters to your particular buying and selling fashion and wishes.

I. Foundational Components: Selecting the Proper Chart Sort and Timeframe

Earlier than diving into indicators and overlays, we have to set up a stable basis. The primary choice entails deciding on the suitable chart sort. Whereas candlestick charts are the preferred and supply wealthy visible info, different choices like Heikin Ashi, Renko, and Line charts can supply distinctive views.

-

Candlestick Charts: The gold customary, providing open, excessive, low, and shut value knowledge for every interval. Very best for figuring out value patterns and momentum shifts.

-

Heikin Ashi Charts: Smooths out value fluctuations, making tendencies simpler to determine, however can lag behind precise value motion. Helpful for filtering noise and specializing in the larger image.

-

Renko Charts: Primarily based on value modifications quite than time intervals, creating bricks that symbolize a predefined value motion. Glorious for figuring out tendencies and breakouts, however lacks exact timing info.

-

Line Charts: Merely join closing costs, best for visualizing long-term tendencies and figuring out assist/resistance ranges. Lacks the detailed info supplied by candlestick charts.

The selection of timeframe is equally essential. Totally different timeframes reveal completely different features of the market:

-

Lengthy-term Timeframes (Every day, Weekly, Month-to-month): Very best for figuring out main tendencies and long-term funding methods.

-

Brief-term Timeframes (5-minute, 15-minute, 1-hour): Appropriate for day buying and selling and scalping, specializing in short-term value fluctuations.

The optimum timeframe is determined by your buying and selling fashion and danger tolerance. Many merchants make the most of a number of timeframes concurrently (e.g., a every day chart for total development identification and a 15-minute chart for entry/exit indicators), a method often known as multi-timeframe evaluation (MTFA).

II. Important Indicators: Filtering Noise and Figuring out Alternatives

Whereas uncooked value motion offers beneficial info, indicators can considerably improve your evaluation by highlighting key tendencies and potential buying and selling indicators. Keep away from indicator overload; concentrate on just a few high-quality indicators that complement your buying and selling technique.

-

Shifting Averages (MA): Clean out value fluctuations and determine tendencies. Common selections embrace Exponential Shifting Averages (EMA) and Easy Shifting Averages (SMA). Combining completely different MAs (e.g., 20-period EMA and 50-period SMA) can generate crossover indicators.

-

Relative Power Index (RSI): A momentum oscillator that measures the magnitude of current value modifications to guage overbought and oversold circumstances. Divergence between RSI and value can sign potential development reversals.

-

MACD (Shifting Common Convergence Divergence): One other momentum indicator that identifies modifications within the energy, path, momentum, and length of a development. Crossovers of the MACD line and sign line can generate buying and selling indicators.

-

Quantity: Important for confirming value actions. Excessive quantity throughout value will increase confirms energy, whereas excessive quantity throughout value decreases confirms weak point. Observe quantity alongside value motion for extra dependable indicators.

-

Bollinger Bands: Envelopes that plot customary deviations round a shifting common. Value bouncing off the bands can point out potential assist/resistance ranges or breakout alternatives.

III. Optimizing Your TradingView Format for Most Readability

A cluttered chart is a hindrance to efficient buying and selling. Manage your indicators and drawing instruments strategically to maximise readability and reduce visible noise.

-

Panel Group: Make the most of TradingView’s panel system to arrange your indicators logically. Group associated indicators collectively (e.g., momentum indicators in a single panel, quantity indicators in one other).

-

Coloration Coordination: Select a coloration scheme that enhances readability. Use contrasting colours for various indicators and value motion to keep away from confusion. Keep away from overly vibrant or distracting colours.

-

Indicator Settings: Customise the settings of every indicator to optimize its efficiency. Modify line thickness, coloration, and different parameters to fit your preferences.

-

Drawing Instruments: Use drawing instruments sparingly. Overuse can muddle the chart and obscure essential value motion. Deal with important instruments like Fibonacci retracements, development traces, and assist/resistance ranges.

-

Cleanliness: Commonly take away outdated drawings and indicators to keep up a clear and uncluttered chart. This prevents visible overload and lets you concentrate on probably the most related info.

IV. Personalizing Your TradingView Setup: Tailoring it to Your Technique

The last word TradingView chart setup is extremely customized. Adapt the above suggestions to your particular buying and selling fashion and technique.

-

Algorithmic Buying and selling: When you use automated buying and selling programs, combine them straight into your TradingView setup. This lets you monitor the efficiency of your algorithms in real-time.

-

Backtesting: Make the most of TradingView’s backtesting capabilities to guage the efficiency of your buying and selling methods. This helps refine your strategy and optimize your parameters.

-

Alert System: Arrange alerts for particular value ranges, indicator crossovers, or different occasions that set off buying and selling alternatives. This lets you react promptly to market modifications, even while you’re not actively monitoring the charts.

-

Information and Sentiment Integration: Combine information feeds and sentiment indicators into your chart to know the broader market context. This will present beneficial insights into value actions and potential catalysts.

V. Past the Fundamentals: Superior Strategies and Issues

-

A number of Chart Layouts: Think about using a number of chart layouts concurrently, every centered on a particular facet of your evaluation (e.g., one for long-term development evaluation, one other for short-term buying and selling indicators).

-

Customized Scripts and Indicators: For superior customers, discover creating customized scripts and indicators to tailor your evaluation to particular wants. This requires programming data however affords unparalleled customization prospects.

-

Group Sources: Leverage TradingView’s vibrant group. Share your chart setups, be taught from others, and uncover new indicators and methods.

-

Common Assessment and Refinement: Your chart setup must be a dwelling doc. Commonly assessment and refine your setup primarily based in your buying and selling efficiency and market circumstances. What works nicely in a single market surroundings may not be optimum in one other.

Conclusion:

Creating the last word TradingView chart setup is an iterative course of. Begin with the foundational parts, steadily including indicators and customization as you acquire expertise. Deal with readability, readability, and a setup that aligns completely together with your buying and selling fashion and technique. By mastering your chart view, you’ll be able to considerably improve your buying and selling efficiency and acquire a clearer understanding of the market. Keep in mind that the most effective setup is the one which works finest for you, and steady refinement is essential to long-term success.

Closure

Thus, we hope this text has supplied beneficial insights into The Final TradingView Chart Setup: Mastering Your Market View for Enhanced Buying and selling. We recognize your consideration to our article. See you in our subsequent article!