Prime Chart Patterns for Technical Evaluation: A Complete Information (PDF Downloadable)

Associated Articles: Prime Chart Patterns for Technical Evaluation: A Complete Information (PDF Downloadable)

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Prime Chart Patterns for Technical Evaluation: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Prime Chart Patterns for Technical Evaluation: A Complete Information (PDF Downloadable)

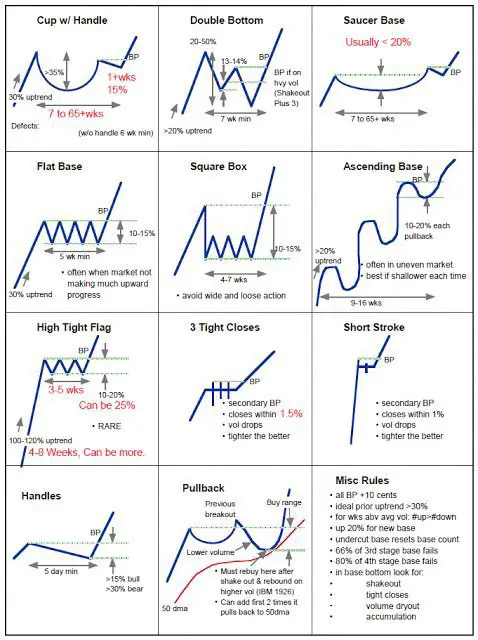

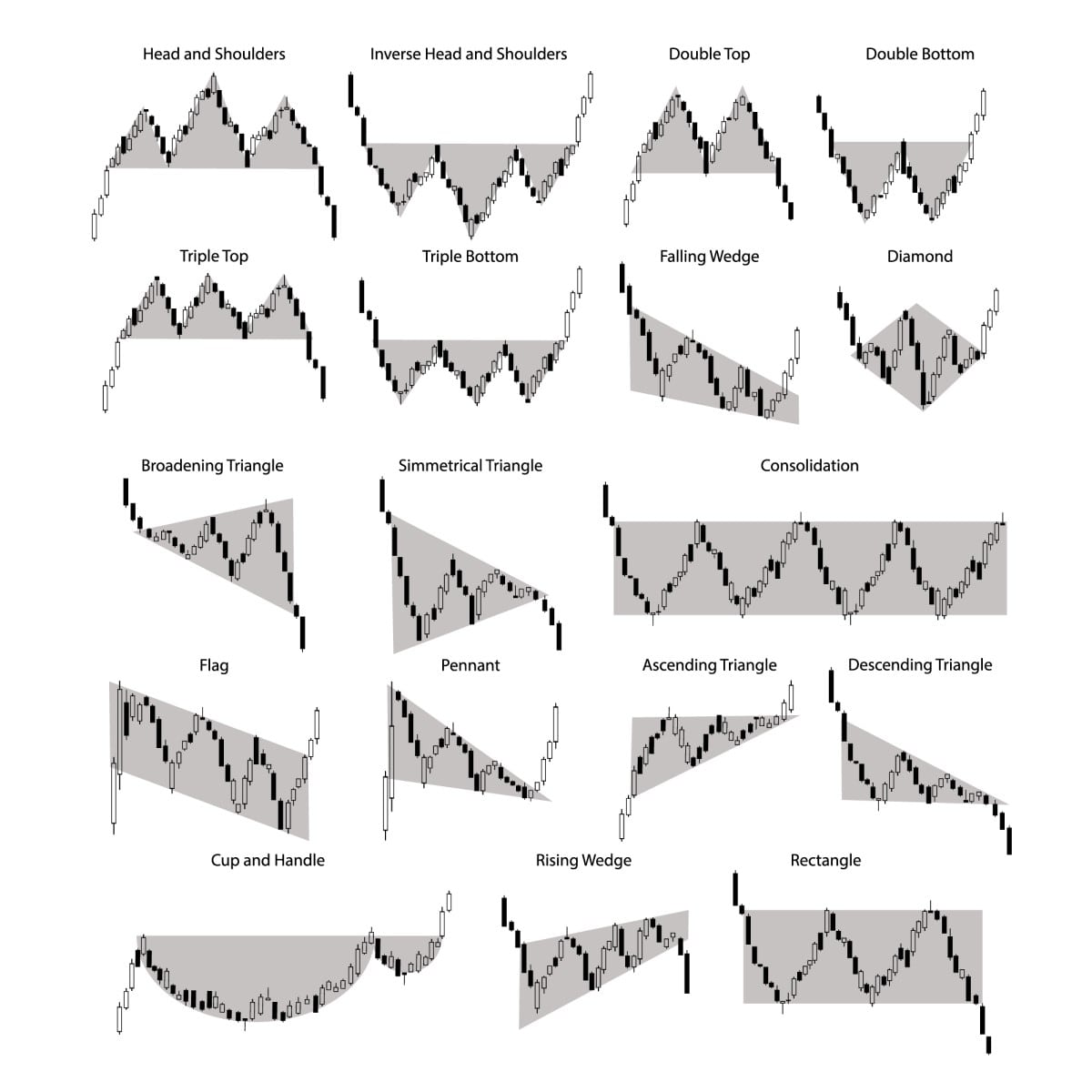

Technical evaluation, the research of market tendencies and worth motion, depends closely on figuring out recurring chart patterns. These patterns, fashioned by worth actions and quantity, supply beneficial insights into potential future worth course. Whereas no sample ensures success, understanding and accurately figuring out them considerably improves buying and selling accuracy and danger administration. This text delves into a number of the high chart patterns, explaining their traits, implications, and find out how to establish them successfully. A downloadable PDF summarizing this data is on the market on the finish.

I. Continuation Patterns: These patterns recommend a brief pause in an present pattern earlier than its resumption.

A. Triangles: Triangles are characterised by converging trendlines, indicating consolidation earlier than a breakout. There are three most important sorts:

-

Symmetrical Triangles: These present converging trendlines with no clear upward or downward bias. The breakout, sometimes occurring on the apex of the triangle, will be both bullish or bearish, with the magnitude of the breakout typically just like the triangle’s peak. Quantity usually decreases through the formation of the triangle and will increase upon the breakout.

-

Ascending Triangles: These function a flat decrease trendline and an upward-sloping higher trendline. They’re thought of bullish patterns, suggesting a continuation of an uptrend. The breakout happens when costs surpass the higher trendline.

-

Descending Triangles: These show a flat higher trendline and a downward-sloping decrease trendline. They’re bearish patterns, indicating a continuation of a downtrend. The breakout occurs when costs fall beneath the decrease trendline.

B. Flags and Pennants: These patterns signify transient durations of consolidation inside a powerful pattern.

-

Flags: These are characterised by an oblong or barely sloped consolidation sample inside a powerful pattern. The flagpole represents the previous pattern, and the flag itself is a interval of momentary worth correction. Breakouts from flags typically observe the course of the previous pattern.

-

Pennants: Much like flags, pennants are characterised by a converging consolidation sample. Nonetheless, pennants have a extra symmetrical, triangular form in comparison with the oblong form of flags. Like flags, breakouts from pennants often proceed the dominant pattern.

C. Rectangles: Rectangles are horizontal consolidations between two parallel trendlines. They signify a interval of sideways buying and selling earlier than a breakout in both course. The breakout’s course will be predicted primarily based on elements like quantity and the prevailing pattern earlier than the rectangle fashioned.

II. Reversal Patterns: These patterns recommend a possible change within the prevailing pattern, indicating a shift from uptrend to downtrend or vice versa.

A. Head and Shoulders: This can be a basic reversal sample, indicating a possible finish to an uptrend. It consists of three peaks, with the center peak (the top) being considerably greater than the 2 outer peaks (the shoulders). A neckline connects the troughs between the peaks. A break beneath the neckline confirms the sample and alerts a possible downtrend.

B. Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a possible finish to a downtrend. It consists of three troughs, with the center trough (the top) being considerably decrease than the 2 outer troughs (the shoulders). A neckline connects the peaks between the troughs. A break above the neckline confirms the sample and alerts a possible uptrend.

C. Double Tops and Double Bottoms: These patterns are comparatively easy but highly effective indicators of potential pattern reversals.

-

Double Prime: This sample consists of two comparable worth highs, adopted by a decline beneath a assist degree. The assist degree is commonly used as a affirmation level for the sample’s validity. A break beneath this assist confirms the bearish reversal.

-

Double Backside: That is the mirror picture of the double high, consisting of two comparable worth lows, adopted by an increase above a resistance degree. A break above this resistance confirms the bullish reversal.

D. Triple Tops and Triple Bottoms: These are just like double tops and bottoms however contain three comparable worth highs or lows, respectively. They often sign stronger reversals than their double counterparts.

III. Different Essential Chart Patterns:

A. Gaps: Gaps are areas on a worth chart the place there is no buying and selling exercise between consecutive durations. They are often vital indicators of market sentiment and potential future worth actions. Widespread sorts embrace:

-

Breakaway Gaps: These happen at first of a powerful pattern, indicating a decisive break from a consolidation interval.

-

Exhaustion Gaps: These typically seem on the finish of a pattern, indicating a weakening of momentum and a possible reversal.

-

Widespread Gaps: These gaps are stuffed comparatively shortly, typically inside a number of buying and selling classes.

B. Island Reversals: These are highly effective reversal patterns characterised by a niche adopted by a interval of consolidation after which one other hole in the other way. They recommend a big shift in market sentiment.

IV. Components to Take into account When Figuring out Chart Patterns:

-

Quantity: Quantity affirmation is essential. Breakouts from patterns ought to ideally be accompanied by elevated quantity. Lowering quantity throughout sample formation and growing quantity through the breakout strengthens the sample’s validity.

-

Pattern: The prevailing pattern earlier than the sample formation considerably influences the interpretation. A continuation sample in a powerful uptrend is extra prone to proceed the uptrend than a reversal sample.

-

Timeframe: Chart patterns can seem on varied timeframes. Figuring out the identical sample on a number of timeframes strengthens its significance.

-

Help and Resistance: Help and resistance ranges typically play a vital position in confirming sample breakouts and figuring out potential worth targets.

-

Context: Take into account broader market circumstances and information occasions when deciphering chart patterns. A sample is perhaps much less dependable if it varieties throughout a interval of serious market volatility or surprising information.

V. Conclusion:

Chart patterns are beneficial instruments for technical evaluation, offering insights into potential future worth actions. Nonetheless, they don’t seem to be foolproof predictors, and merchants ought to at all times use them together with different types of evaluation and danger administration methods. Understanding the traits of various chart patterns, together with their implications, considerably improves buying and selling selections. Do not forget that follow and expertise are key to mastering the artwork of chart sample recognition.

(Downloadable PDF hyperlink can be inserted right here. The PDF would comprise a summarized model of the above article, probably together with illustrative charts for every sample.)

Closure

Thus, we hope this text has supplied beneficial insights into Prime Chart Patterns for Technical Evaluation: A Complete Information (PDF Downloadable). We admire your consideration to our article. See you in our subsequent article!