Understanding the Authorities of Canada’s Chart of Accounts (GOC COA)

Associated Articles: Understanding the Authorities of Canada’s Chart of Accounts (GOC COA)

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Understanding the Authorities of Canada’s Chart of Accounts (GOC COA). Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Understanding the Authorities of Canada’s Chart of Accounts (GOC COA)

The Authorities of Canada’s Chart of Accounts (GOC COA) is an important monetary administration device, offering a standardized framework for recording, classifying, and reporting authorities monetary transactions. Its constant software ensures transparency, accountability, and environment friendly useful resource allocation throughout all federal departments and companies. This text delves into the intricacies of the GOC COA, exploring its construction, key parts, and significance within the broader context of Canadian public finance.

The Basis of Authorities Monetary Reporting:

The GOC COA is not merely a listing of accounts; it is a subtle system designed to seize the total spectrum of presidency actions. It is the spine of the Public Accounts of Canada, the annual monetary report that particulars the federal government’s monetary efficiency and place. This standardized method permits correct comparisons throughout departments, applications, and years, facilitating knowledgeable decision-making and efficient oversight by Parliament and the general public.

Construction and Key Parts:

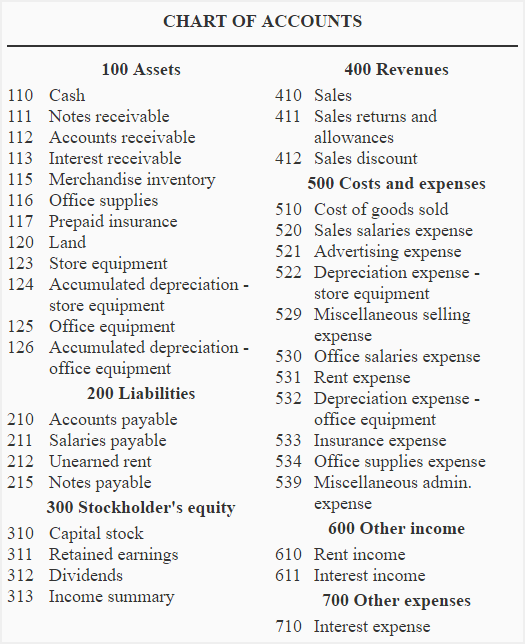

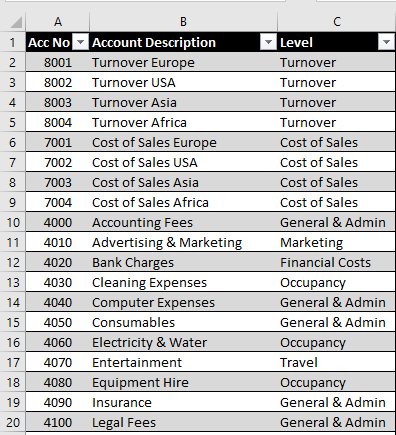

The GOC COA follows a hierarchical construction, using a multi-digit coding system to categorize transactions. This technique permits for granular element whereas sustaining a transparent overview. Key parts embody:

-

Fund: This represents the supply of funds used for a specific transaction. Totally different funds exist for varied functions, similar to working bills, capital tasks, and particular applications. Examples embody the Consolidated Income Fund, particular objective accounts, and varied belief funds. The fund code gives essential context for understanding the character of the expenditure.

-

Group: This identifies the particular division or company chargeable for the transaction. Every division and company is assigned a novel code, enabling monitoring of spending on the organizational stage. This permits for efficiency evaluation and useful resource allocation choices inside particular person departments.

-

Program Exercise: This stage categorizes transactions primarily based on the particular program or exercise they assist. That is essential for efficiency measurement and accountability, permitting for the monitoring of program effectiveness and the environment friendly allocation of sources to realize authorities goals.

-

Object: This describes the character of the expenditure, similar to salaries, hire, gear, or provides. This gives detailed perception into the kinds of sources consumed in delivering authorities applications and companies. The article code facilitates value evaluation and funds management.

-

Sub-object: This gives an additional stage of element throughout the object class. For instance, the article "Salaries" is perhaps additional subdivided into "Common Salaries," "Extra time," and "Bonuses." This elevated granularity permits for extra exact value monitoring and evaluation.

-

Monetary Yr: Each transaction is linked to the particular fiscal yr (April 1st to March thirty first) through which it occurred. That is basic for annual reporting and monetary evaluation throughout time durations.

Significance of the Chart of Accounts:

The GOC COA’s significance extends past mere monetary record-keeping. It performs a pivotal function in:

-

Budgeting and Planning: The COA varieties the idea for funds preparation and execution. Departments use the COA to develop their budgets, observe spending towards these budgets, and report on their monetary efficiency.

-

Monetary Reporting: As talked about earlier, the COA is important for producing the Public Accounts of Canada, making certain consistency and comparability in monetary reporting throughout the federal government.

-

Efficiency Measurement: This system exercise codes throughout the COA permit for monitoring the prices and outcomes of presidency applications, enabling efficiency analysis and informing future useful resource allocation choices.

-

Accountability and Transparency: The standardized nature of the COA enhances accountability by offering a transparent and constant report of presidency spending. This transparency is essential for public belief and parliamentary oversight.

-

Auditing: The COA facilitates the auditing course of by offering a structured framework for analyzing authorities transactions. This ensures the accuracy and reliability of monetary reporting.

-

Administration Management: The COA aids in inner administration management by offering a system for monitoring spending, figuring out potential inefficiencies, and making certain compliance with authorities insurance policies and laws.

Challenges and Evolution:

Whereas the GOC COA is a robust device, it faces ongoing challenges:

-

Complexity: The multi-layered construction might be complicated, requiring specialised coaching and experience for efficient use.

-

Maintaining with Change: Authorities applications and priorities evolve, requiring common updates and modifications to the COA to mirror these modifications.

-

Information Integrity: Sustaining the accuracy and integrity of information entered into the system is essential. Errors in knowledge entry can result in inaccurate reporting and flawed decision-making.

-

Integration with different techniques: Seamless integration with different authorities techniques, similar to procurement and human sources techniques, is important for environment friendly knowledge administration.

The GOC COA is frequently evolving to satisfy the altering wants of the federal government. Ongoing efforts give attention to bettering knowledge high quality, streamlining processes, and enhancing integration with different techniques. These enhancements goal to additional improve the effectiveness and effectivity of presidency monetary administration.

Conclusion:

The Authorities of Canada’s Chart of Accounts is a basic device for managing public funds. Its standardized construction, hierarchical design, and integration into varied facets of presidency operations contribute to transparency, accountability, and efficient useful resource allocation. Whereas challenges stay, ongoing efforts to enhance and adapt the COA guarantee its continued relevance and effectiveness in supporting sound monetary administration throughout the Canadian federal authorities. Understanding the GOC COA is essential for anybody concerned in Canadian public finance, from authorities officers and auditors to researchers and members of the general public looking for to know how their tax {dollars} are being spent. The system’s ongoing evolution displays a dedication to bettering transparency and accountability within the administration of public funds, a cornerstone of fine governance.

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

:max_bytes(150000):strip_icc()/chart-accounts.asp_final-438b76f8e6e444dd8f4cd8736b0baa6a.png)

Closure

Thus, we hope this text has supplied invaluable insights into Understanding the Authorities of Canada’s Chart of Accounts (GOC COA). We hope you discover this text informative and helpful. See you in our subsequent article!