Unveiling the Energy of Dividends Reinvested: A Deep Dive into Inventory Charts

Associated Articles: Unveiling the Energy of Dividends Reinvested: A Deep Dive into Inventory Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Unveiling the Energy of Dividends Reinvested: A Deep Dive into Inventory Charts. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Unveiling the Energy of Dividends Reinvested: A Deep Dive into Inventory Charts

Inventory charts are the visible language of the monetary markets, providing a dynamic illustration of an organization’s inventory worth over time. Nonetheless, a normal inventory chart typically overlooks a vital ingredient for long-term buyers: dividend reinvestment. Understanding how dividends, when reinvested, influence a inventory chart and in the end your funding returns, is essential to creating knowledgeable choices. This text will discover the intricacies of inventory charts with dividends reinvested, highlighting their advantages, limitations, and how you can interpret them successfully.

The Fundamentals: Dividends and Reinvestment

Dividends are funds made by an organization to its shareholders, usually from its income. These payouts will be acquired in money or reinvested instantly into extra shares of the identical firm. Dividend reinvestment plans (DRIPs) automate this course of, permitting buyers to buy extra shares with out brokerage charges, typically at a reduced worth.

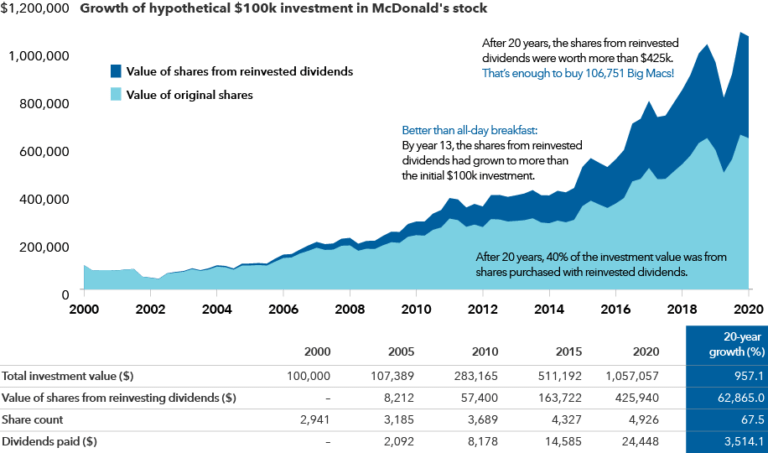

A regular inventory chart merely plots the closing worth of a share over time. Nonetheless, when dividends are reinvested, the variety of shares owned will increase, impacting the general worth of the funding. This implies a easy worth chart alone does not totally signify the expansion of your funding with DRIPs.

Visualizing Dividends Reinvested on a Inventory Chart:

To precisely signify the expansion of an funding with dividends reinvested, we have to modify the usual inventory chart. This adjusted chart accounts for the rise within the variety of shares owned via reinvestment. A number of strategies exist to visualise this:

-

Adjusted Closing Value: This technique adjusts the historic closing costs to replicate the cumulative impact of dividend reinvestment. Think about you began with 100 shares and acquired a dividend that allowed you to purchase 5 extra. The adjusted worth can be recalculated to replicate the worth of your 105 shares as should you’d purchased all of them on the preliminary worth. This creates a smoother, upward-sloping line, showcasing the compounded development.

-

Complete Return Chart: This chart shows the whole worth of the funding over time, together with each worth appreciation and dividend reinvestment. It is a extra complete illustration of your funding’s development, explicitly displaying the influence of dividends. That is typically introduced as a cumulative return share.

-

Share Rely Overlay: This strategy makes use of a normal worth chart however provides a secondary line or graph representing the variety of shares owned over time. This permits for a visible comparability of worth fluctuations and the regular improve in share depend as a result of reinvestment.

The Energy of Compounding: Why Reinvestment Issues

The fantastic thing about dividend reinvestment lies within the energy of compounding. By reinvesting dividends, you are basically shopping for extra shares on the prevailing market worth (or a reduced worth via DRIPs). These extra shares then generate their very own dividends, that are additionally reinvested, resulting in exponential development over time. This snowball impact considerably amplifies long-term returns in comparison with merely receiving dividends in money.

Take into account this instance: An investor buys 100 shares at $100 every, and the inventory pays a $5 dividend per share yearly. If the dividend is reinvested, the investor buys extra shares, rising their holdings. Over time, the variety of shares and the whole worth of their funding develop exponentially as a result of each worth appreciation and the compounding impact of reinvested dividends. This contrasts sharply with an investor who receives the dividends in money and does not reinvest them. The money dividend could also be used for different functions, thus lacking out on the compounding energy.

Deciphering Charts with Reinvested Dividends:

When deciphering charts reflecting reinvested dividends, a number of key elements ought to be thought of:

-

Time Horizon: The longer the time horizon, the extra pronounced the impact of dividend reinvestment will probably be. Brief-term fluctuations within the inventory worth will probably be much less vital in comparison with the general upward development pushed by compounding.

-

Dividend Yield: Greater dividend yields usually result in quicker compounding development, assuming the corporate maintains constant dividend payouts. Nonetheless, it is essential to judge the sustainability of the dividend payout earlier than making funding choices.

-

Inventory Value Volatility: A unstable inventory worth can influence the variety of shares bought via reinvestment. During times of low costs, extra shares are acquired, whereas greater costs end in fewer shares.

-

Comparability with Non-Reinvestment Situations: It is useful to match a chart with reinvested dividends to the same chart with out reinvestment to visually recognize the distinction in development.

Limitations and Issues:

Whereas dividend reinvestment gives vital benefits, it is important to acknowledge some limitations:

-

Dividend Cuts: Firms could cut back or eradicate dividends as a result of monetary difficulties. This could disrupt the compounding impact and influence the general return.

-

Tax Implications: Dividends are usually taxable earnings, even when reinvested. Understanding the tax implications is essential for efficient monetary planning.

-

Alternative Value: Reinvesting dividends means foregoing the chance to make use of that money for different investments or bills. This trade-off wants cautious consideration based mostly on particular person monetary targets.

-

Firm Efficiency: The success of dividend reinvestment hinges on the long-term efficiency of the underlying firm. Poorly performing firms with unsustainable dividend payouts could negate the advantages of reinvestment.

Instruments and Sources:

A number of on-line platforms and brokerage accounts supply instruments to visualise inventory charts with dividends reinvested. Many monetary web sites present historic dividend knowledge and permit for simulations of various reinvestment situations. These instruments will be invaluable in understanding the potential influence of dividend reinvestment in your funding technique.

Conclusion:

Inventory charts with dividends reinvested supply a extra full and correct image of funding development than commonplace worth charts. By understanding the ability of compounding and the varied strategies for visualizing this development, buyers could make extra knowledgeable choices. Whereas dividend reinvestment gives vital long-term advantages, it is essential to contemplate the restrictions and potential dangers related to this technique. Cautious analysis, diversification, and a long-term perspective are key to maximizing the advantages of dividend reinvestment and constructing a sturdy funding portfolio. Bear in mind to all the time seek the advice of with a monetary advisor earlier than making any funding choices to make sure your technique aligns together with your private monetary targets and threat tolerance.

Closure

Thus, we hope this text has supplied precious insights into Unveiling the Energy of Dividends Reinvested: A Deep Dive into Inventory Charts. We recognize your consideration to our article. See you in our subsequent article!