yy inventory chart

Associated Articles: yy inventory chart

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to yy inventory chart. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Deciphering the YY Inc. (YY) Inventory Chart: A Deep Dive into the Firm’s Efficiency and Future Prospects

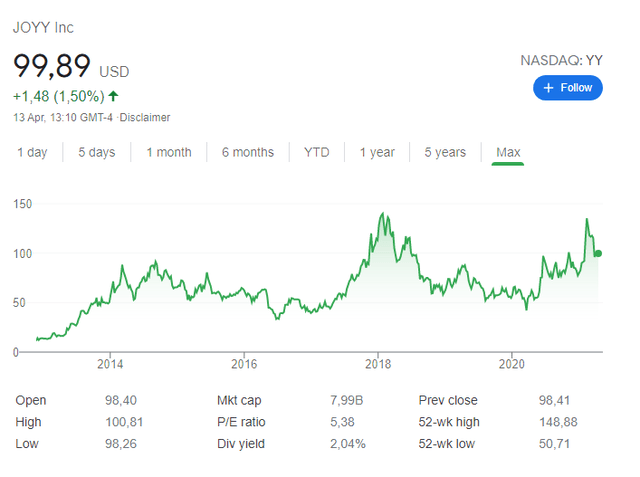

YY Inc. (now often known as JOYY Inc.), a once-dominant participant within the Chinese language live-streaming market, has skilled a turbulent journey mirrored in its inventory chart. Understanding the historic efficiency and the elements influencing its value fluctuations requires an in depth evaluation of the corporate’s enterprise mannequin, regulatory challenges, and total market dynamics. This text goals to supply a complete overview of the YY inventory chart, exploring its highs and lows, key turning factors, and potential implications for future traders.

Early Success and the Rise of Dwell Streaming:

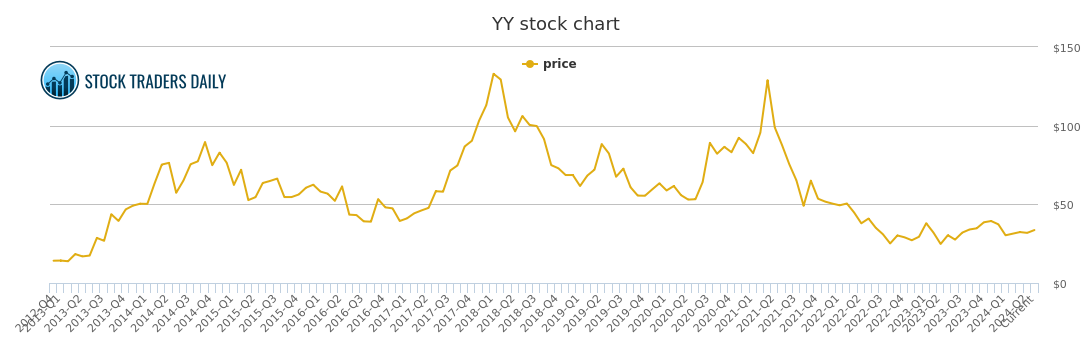

The early years of YY’s inventory chart reveal a interval of serious progress, reflecting the burgeoning recognition of its live-streaming platform in China. The corporate efficiently tapped into the demand for on-line leisure and social interplay, attracting a big person base and producing substantial income via digital presents, subscriptions, and promoting. This era is characterised by a constantly upward trending chart, punctuated by intervals of consolidation and wholesome corrections. The progressive nature of its platform and the efficient monetization technique contributed to its spectacular market capitalization. Traders had been drawn to the corporate’s robust person progress, excessive engagement charges, and the potential for additional enlargement into associated markets.

The Affect of Regulatory Scrutiny and Accounting Issues:

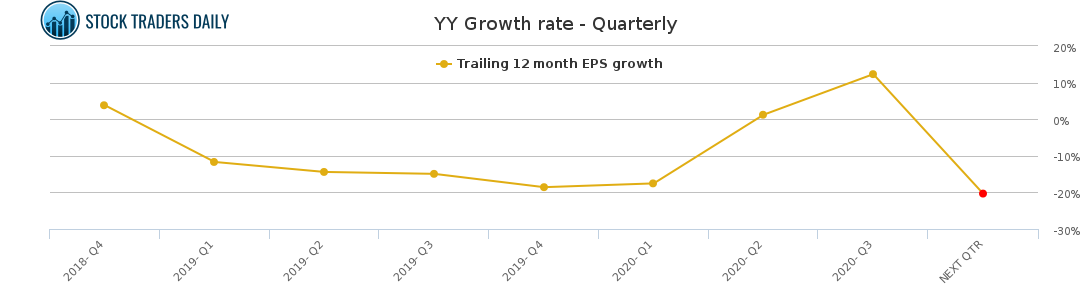

Nonetheless, the sleek upward trajectory of the YY inventory chart was disrupted by growing regulatory scrutiny from Chinese language authorities and considerations relating to the corporate’s accounting practices. These considerations, which emerged in late 2020 and early 2021, considerably impacted investor sentiment and led to a pointy decline within the inventory value. Quick-sellers focused the corporate, citing irregularities in income recognition and person numbers. The ensuing volatility is clearly seen within the chart, marked by a steep downward pattern and vital buying and selling quantity. This era highlights the significance of due diligence and the influence of regulatory dangers on even seemingly profitable corporations. The next delisting from the NASDAQ additional exacerbated the adverse sentiment.

Analyzing Key Chart Patterns and Indicators:

An in depth evaluation of the YY inventory chart requires inspecting varied technical indicators and chart patterns. For instance, figuring out help and resistance ranges can present insights into potential value reversals. Help ranges signify value factors the place shopping for stress is robust sufficient to forestall additional declines, whereas resistance ranges point out value factors the place promoting stress outweighs shopping for stress. Finding out the chart for patterns like head and shoulders, double tops, and triple bottoms also can present clues about potential future value actions. Transferring averages, such because the 50-day and 200-day shifting averages, might help to determine tendencies and potential purchase or promote alerts. The Relative Power Index (RSI) and the Transferring Common Convergence Divergence (MACD) are beneficial indicators that may assist to determine overbought or oversold situations, suggesting potential value corrections or reversals.

The Position of Macroeconomic Elements and Market Sentiment:

The YY inventory chart just isn’t solely influenced by company-specific elements. Macroeconomic situations and total market sentiment additionally play a big function. As an illustration, modifications in rates of interest, inflation, and financial progress can have an effect on investor danger urge for food, impacting the valuation of all shares, together with YY. Geopolitical occasions and regulatory modifications in China even have a big affect on the efficiency of Chinese language corporations listed on US exchanges. Durations of heightened market volatility typically coincide with sharp value swings within the YY inventory chart, reflecting the heightened uncertainty and danger aversion amongst traders.

Publish-Delisting and Present Market Place:

Following the delisting from the NASDAQ, YY’s inventory chart displays a interval of relative inactivity within the US market. Nonetheless, the corporate continues to function underneath its new identify, JOYY Inc., and its efficiency within the Chinese language market continues to influence its total valuation. Understanding the corporate’s present monetary efficiency, strategic initiatives, and aggressive panorama is essential for assessing its future prospects. Analyzing the corporate’s income streams, person progress, and profitability metrics offers insights into its long-term sustainability and potential for future progress. The aggressive panorama within the live-streaming market stays extremely dynamic, with a number of different gamers vying for market share. Due to this fact, an intensive aggressive evaluation is critical for a whole understanding of YY’s future potential.

Future Outlook and Funding Issues:

Predicting the longer term trajectory of the YY inventory chart is difficult, because it depends upon quite a few intertwined elements. Nonetheless, by rigorously analyzing the corporate’s financials, aggressive panorama, regulatory surroundings, and total market situations, traders could make extra knowledgeable selections. The potential for progress within the Chinese language live-streaming market stays vital, however traders should additionally think about the dangers related to investing in Chinese language corporations, together with regulatory uncertainty and geopolitical dangers. A diversified funding technique is essential to mitigate these dangers. Moreover, thorough due diligence is crucial earlier than making any funding selections. This consists of reviewing the corporate’s monetary statements, analyzing its aggressive benefits, and understanding the potential influence of macroeconomic elements.

Conclusion:

The YY inventory chart offers an enchanting case research of an organization’s journey via progress, challenges, and transformation. Understanding the historic efficiency, key turning factors, and influencing elements is essential for traders looking for to research its previous efficiency and assess its future prospects. Whereas the previous efficiency just isn’t indicative of future outcomes, analyzing the chart along side basic evaluation can present beneficial insights. Traders should rigorously weigh the potential rewards towards the inherent dangers earlier than making any funding selections, contemplating each the corporate’s particular circumstances and the broader macroeconomic surroundings. The journey of YY, now JOYY, showcases the complexities of the worldwide market and highlights the significance of thorough analysis and danger administration in any funding technique. The way forward for the inventory stays unsure, however by understanding the previous, traders can higher navigate the complexities of the current and make knowledgeable selections in regards to the future.

Closure

Thus, we hope this text has supplied beneficial insights into yy inventory chart. We thanks for taking the time to learn this text. See you in our subsequent article!